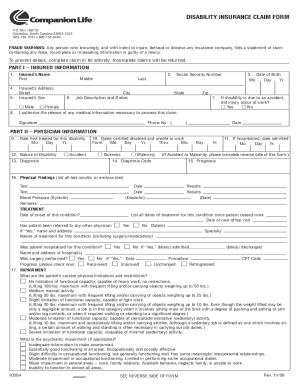

Get the free How to Report Vested Benefits on Your Income Taxes ...

Show details

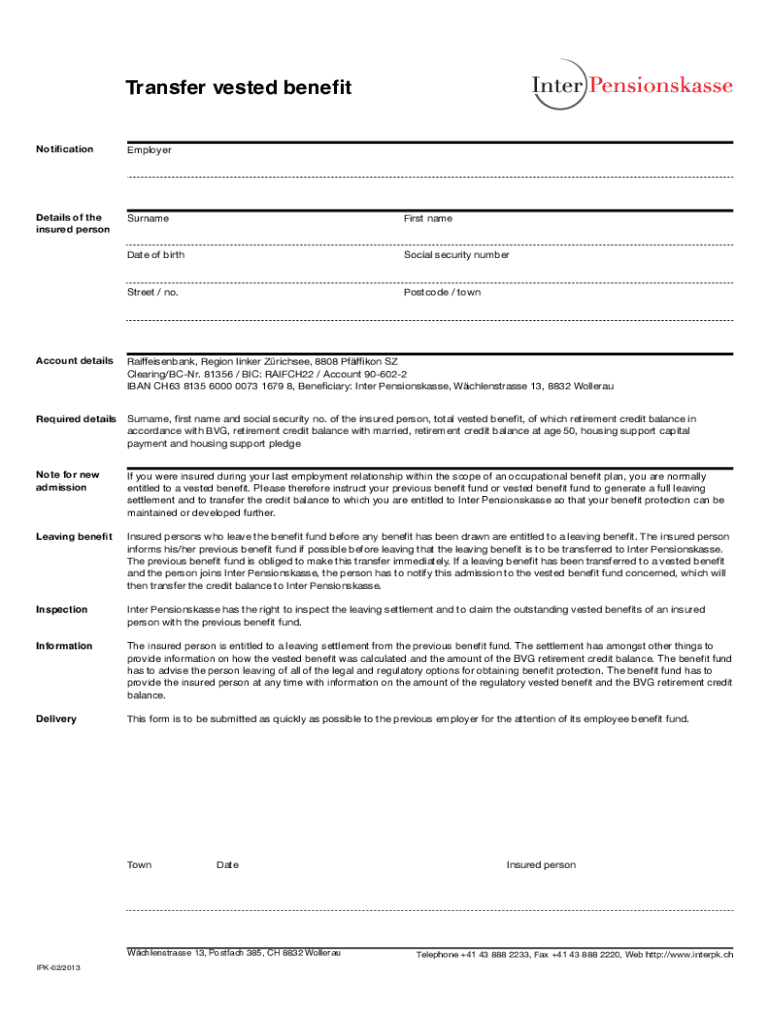

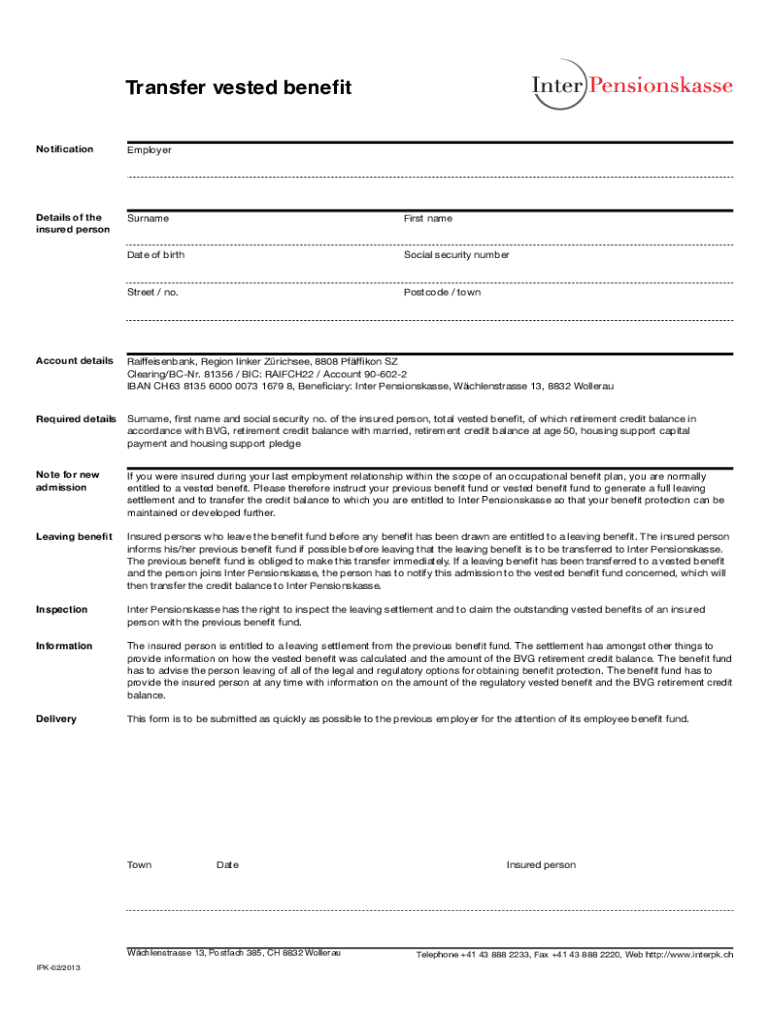

! Transfer vested benefit

NotificationEmployerDetails of the

insured personSurnameFirst namesake of biosocial security numberStreet / no. Postcode / townAccount detailsRaieisenbank, Region linker

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how to report vested

Edit your how to report vested form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to report vested form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how to report vested online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit how to report vested. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to report vested

How to fill out how to report vested:

01

Gather necessary information: Before filling out the report, make sure you have all the required information related to the vested assets. This may include details such as the type of asset, its value, the date it vested, and any relevant transaction details.

02

Verify reporting requirements: Different jurisdictions and organizations may have specific reporting requirements for vested assets. Check with the appropriate authorities or consult your organization's guidelines to ensure you understand the specific reporting obligations.

03

Use the designated form: Many organizations provide specific forms for reporting vested assets. Locate the appropriate form and ensure you have a copy of it. If there is no designated form, use a general reporting template or create a document that includes all the required information.

04

Fill out personal information: In the report, include your personal details such as your full name, contact information, and any other identification numbers required by the reporting entity.

05

Provide details of the vested assets: In the report, provide the necessary details of the vested assets, such as their type, value, and any other relevant information requested. Be as accurate and thorough as possible to ensure proper reporting.

06

Include transaction details: If there have been any transactions related to the vested assets, such as buying or selling, include the details of these transactions. This helps provide a comprehensive overview of the assets and their history.

07

Attach supporting documents: If there are any supporting documents required or available, such as proof of ownership or transaction records, attach them to the report. This helps validate the information provided and ensures transparency.

08

Review and double-check: Before submitting the report, review all the entered information to ensure accuracy and completeness. Double-check for any errors or missing details that may affect the report's integrity.

Who needs to report vested assets:

01

Individuals receiving vested assets: If you have received vested assets as part of a compensation package or any other arrangement, you may need to report them as per the relevant tax or regulatory requirements. This typically applies to employees or individuals involved in equity-based compensation plans.

02

Employers and organizations: Employers or organizations that offer equity-based compensation plans to their employees need to ensure proper reporting of vested assets. This ensures compliance with tax and regulatory obligations and contributes to transparent financial practices.

03

Tax authorities or regulatory bodies: Tax authorities and regulatory bodies require reporting of vested assets to track the movement and value of such assets. This helps ensure compliance and maintain accurate records for taxation purposes.

By following the steps to fill out and report vested assets, individuals and organizations can fulfill their reporting obligations and maintain transparency in their financial activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is how to report vested?

Reporting vested stock is a process where an individual reports their ownership of shares in a company that have fully vested.

Who is required to file how to report vested?

Employees or individuals who have received stock options or other forms of equity compensation and have had those shares fully vest are required to file how to report vested.

How to fill out how to report vested?

To fill out how to report vested, individuals need to provide details on the number of shares vested, the date of vesting, the fair market value of the shares at the time of vesting, and any taxes withheld.

What is the purpose of how to report vested?

The purpose of how to report vested is to ensure that individuals accurately report their vested shares to the relevant tax authorities and comply with tax regulations.

What information must be reported on how to report vested?

On how to report vested, individuals must report the number of shares vested, the date of vesting, the fair market value of the shares at the time of vesting, and any taxes withheld.

How do I modify my how to report vested in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your how to report vested as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Where do I find how to report vested?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the how to report vested in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit how to report vested online?

With pdfFiller, it's easy to make changes. Open your how to report vested in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Fill out your how to report vested online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Report Vested is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.