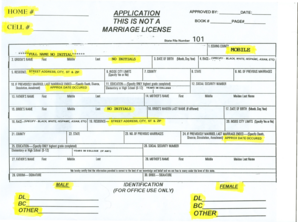

Get the free 61A500(P)(11-09)

Show details

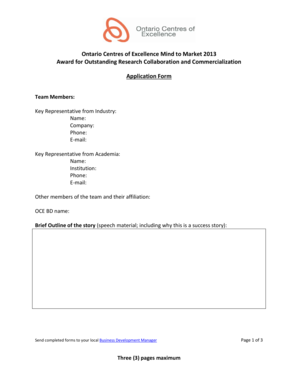

This packet contains forms and instructions for filing your 2010 personal property tax forms for communications service providers and multi-channel video programming service providers. It provides

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 61a500p11-09

Edit your 61a500p11-09 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 61a500p11-09 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 61a500p11-09 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 61a500p11-09. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 61a500p11-09

How to fill out 61A500(P)(11-09)

01

Obtain a copy of form 61A500(P)(11-09) from the relevant authority or website.

02

Fill out the personal information section, including your name, address, and contact details.

03

Provide any required identification numbers or codes as specified on the form.

04

Complete the specific sections related to your situation or purpose for filling out the form.

05

Review the form for any calculations or entries that may require additional documentation.

06

Sign and date the form where indicated.

07

Submit the completed form through the appropriate submission method outlined in the instructions.

Who needs 61A500(P)(11-09)?

01

Individuals or entities required to report specific information to the relevant authority.

02

Businesses that need to comply with regulatory reporting requirements.

03

Anyone applying for certain licenses or permits that necessitate this form.

Fill

form

: Try Risk Free

People Also Ask about

Is there a personal property tax in Kentucky?

All tangible property is taxable, except the following: personal household goods used in the home; crops grown in the year which the assessment is made and in the hands of the producer; tangible personal property owned by institutions exempted under Section 170 of the Kentucky Constitution.

At what age do seniors stop paying property taxes in Kentucky?

Homestead Exemption Section 170 of the Kentucky Constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or who have been determined to be totally disabled and are receiving payments pursuant to their disability. Find out more about the homestead exemption.

How much is personal property tax in KY?

House Bill 44 Compensating Tax Rate Calculation, given that: 2019 Total Taxable Assessment$60,000,000 2019 Tax Rate - Real Property 27.8¢ per $100 2019 Revenue Potential - Real Property $ 139,000 2019 Tax Rate - Personal Property 30¢ per $1004 more rows

Do I need to file personal property tax?

You typically have to report your property annually, providing both the fair market value and cost of the property. You can usually deduct personal property tax payments as a business expense for property used in your business.

What is considered tangible personal property in Kentucky?

Tangible personal property is physical property, usually movable, that has value and utility in and of itself (examples: trade tools, fixtures, office equipment, inventory).

What is the personal property tax deduction?

Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it's collected more than once a year or less than once a year.

What is the tax form for personal property in Kentucky?

Each individual, partnership, or corporation that has taxable personal property must file a return Form 62A500 between January 1 and May 15th with their local Property Valuation Administrator (PVA).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 61A500(P)(11-09)?

61A500(P)(11-09) is a specific form used by certain taxpayers to report particular financial information to a tax authority.

Who is required to file 61A500(P)(11-09)?

Typically, individuals or entities that meet specific financial criteria as outlined by the tax authority are required to file 61A500(P)(11-09).

How to fill out 61A500(P)(11-09)?

To fill out 61A500(P)(11-09), taxpayers must provide personal and financial information as required by the form's instructions, ensuring all sections are completed accurately.

What is the purpose of 61A500(P)(11-09)?

The purpose of 61A500(P)(11-09) is to collect essential financial data to assess tax liabilities and ensure compliance with tax regulations.

What information must be reported on 61A500(P)(11-09)?

The information that must be reported on 61A500(P)(11-09) includes income sources, deductions, credits, and any other financial data as specified in the form's guidelines.

Fill out your 61a500p11-09 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

61A500P11-09 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.