Get the free RISK RETENTION GROUPS - Arkansas Insurance Department - insurance arkansas

Show details

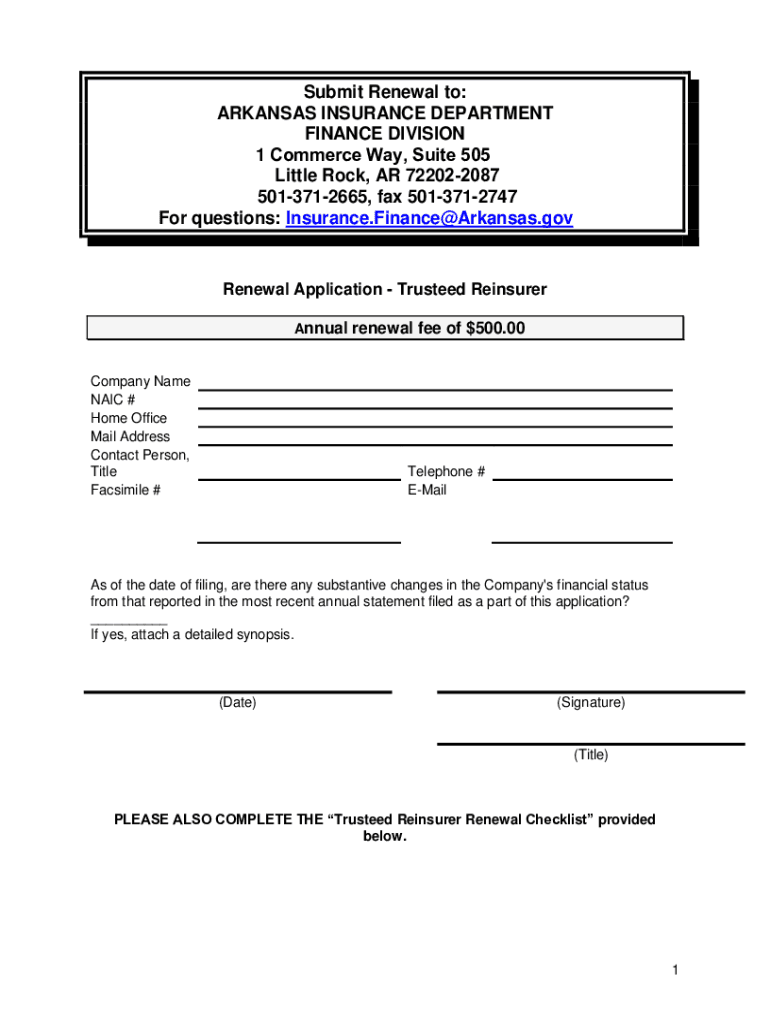

Submit Renewal to: ARKANSAS INSURANCE DEPARTMENT FINANCE DIVISION 1 Commerce Way, Suite 505 Little Rock, AR 722022087 5013712665, fax 5013712747 For questions: Insurance. Finance@Arkansas.renewal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign risk retention groups

Edit your risk retention groups form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your risk retention groups form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing risk retention groups online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit risk retention groups. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risk retention groups

How to fill out risk retention groups

01

To fill out risk retention groups, follow these steps:

02

Understand the purpose of risk retention groups (RRGs). RRGs are insurance companies owned by their policyholders that provide liability coverage to their members who are engaged in similar businesses or activities.

03

Determine if your business or activity is eligible for an RRG. RRGs are generally used by professionals, trade associations, and commercial businesses that face similar risks and want to form their own insurance company.

04

Research and select an RRG that fits your needs. Look for RRGs that have expertise in your industry and can offer the necessary coverage and services.

05

Contact the selected RRG and express your interest in joining. They will provide you with the necessary application forms and requirements.

06

Gather all the required information and documentation. This may include details about your business, financial statements, prior insurance coverage, claims history, and risk management practices.

07

Fill out the application form accurately and completely. Pay attention to the specific information requested and provide all necessary details.

08

Submit the completed application form along with any supporting documents to the RRG. Follow their instructions regarding the submission method.

09

Wait for the RRG to review your application. They may communicate with you if they require any additional information or clarification.

10

If your application is approved, you will receive a confirmation and an insurance policy from the RRG. Review the policy carefully and understand the terms and conditions.

11

Pay the required premiums according to the RRG's payment schedule. Adhere to the payment deadlines to ensure continuous coverage.

12

Maintain open communication with the RRG regarding any changes in your business or activities that may impact your coverage. Stay updated on their requirements and regulations.

13

If needed, file claims with the RRG and follow their claims process. Provide all necessary documentation and cooperate with their claims adjusters.

14

Review your coverage periodically and consider renewing with the same RRG or switching to another option based on your evolving needs and experiences.

15

Remember, it's always recommended to consult with an insurance professional or legal advisor familiar with RRGs to ensure you comply with all applicable laws and regulations.

Who needs risk retention groups?

01

Risk retention groups can be beneficial for the following entities:

02

- Professionals such as doctors, lawyers, architects, and engineers who want to have more control over their liability coverage and potentially reduce costs.

03

- Trade associations and industry groups that wish to provide tailored insurance solutions to their members.

04

- Commercial businesses operating in high-risk industries or facing unique risks that may make it difficult or expensive to obtain coverage from traditional insurance companies.

05

- Companies facing difficulties in finding coverage for specific liabilities or activities in the standard insurance market.

06

However, it's crucial for each entity to assess their specific needs and evaluate the advantages and disadvantages of joining a risk retention group compared to traditional insurance options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get risk retention groups?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific risk retention groups and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my risk retention groups in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your risk retention groups and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit risk retention groups straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing risk retention groups right away.

What is risk retention groups?

Risk retention groups are a type of insurance company that is owned by its policyholders and formed under the Federal Liability Risk Retention Act of 1986.

Who is required to file risk retention groups?

Risk retention groups are required to file with the state insurance department in each state where they operate.

How to fill out risk retention groups?

Risk retention groups need to provide detailed information about their operations, financials, and policies to the state insurance department.

What is the purpose of risk retention groups?

The purpose of risk retention groups is to provide liability insurance to its members who share similar risks.

What information must be reported on risk retention groups?

Risk retention groups must report on their financials, operations, policies, and claims history.

Fill out your risk retention groups online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Risk Retention Groups is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.