Get the free Substantially Equal Periodic PaymentsInternal Revenue ...

Show details

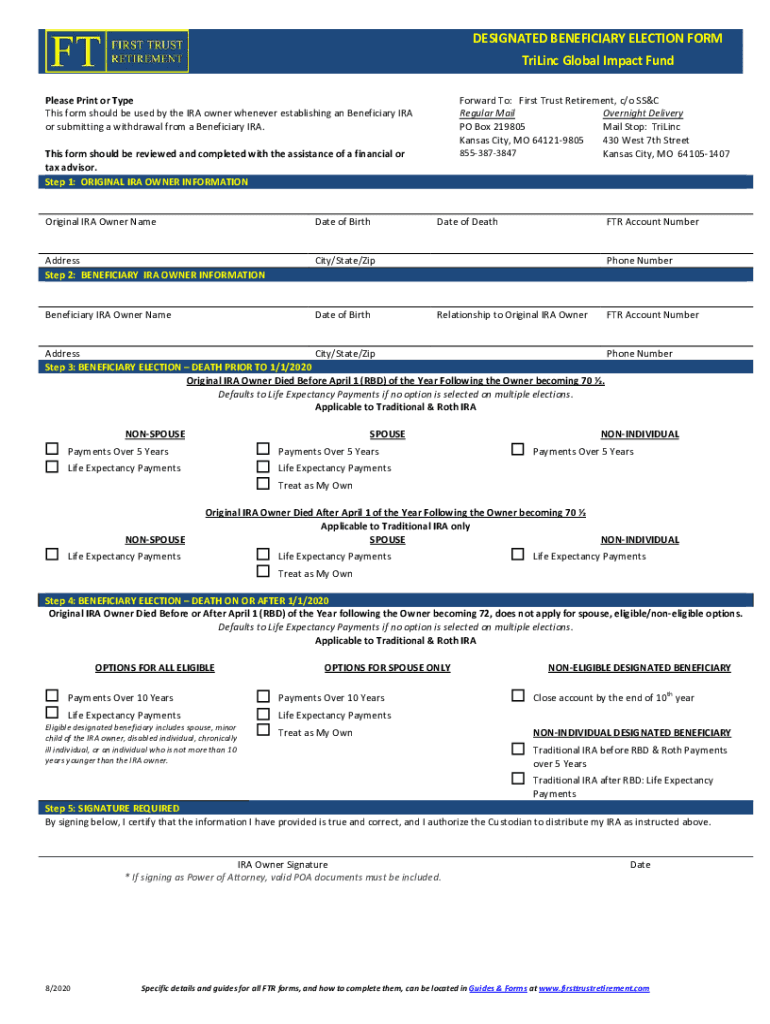

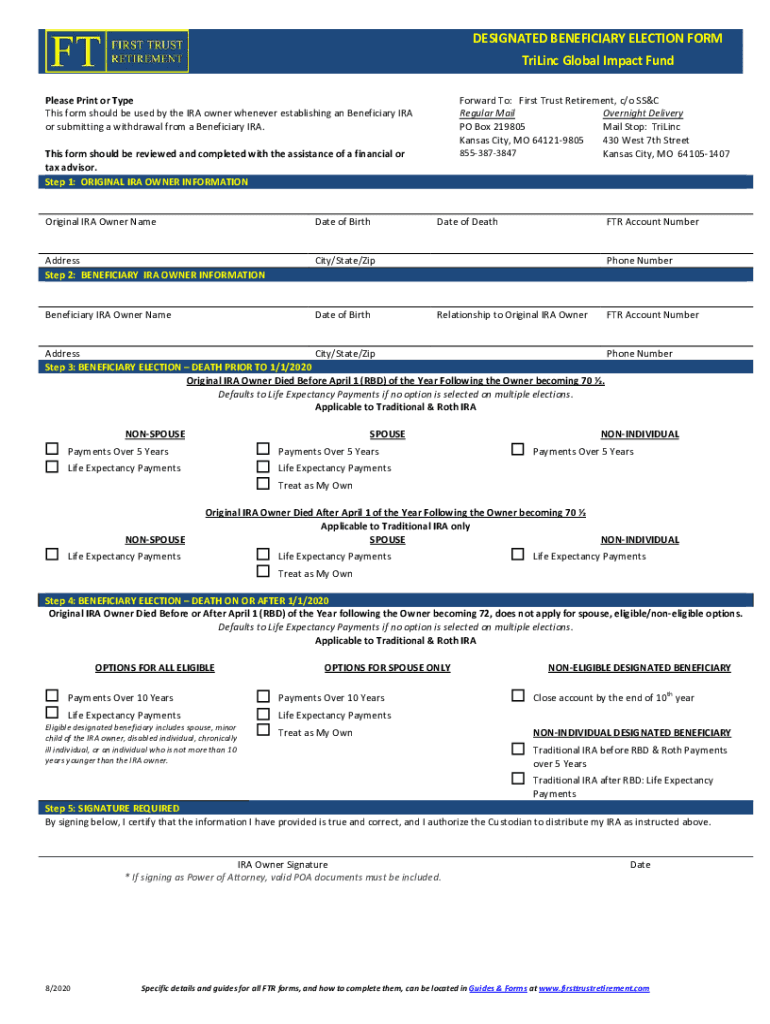

DESIGNATED BENEFICIARY ELECTION FORM Trailing Global Impact Fund Please Print or Type This form should be used by the IRA owner whenever establishing a Beneficiary IRA or submitting a withdrawal from

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign substantially equal periodic paymentsinternal

Edit your substantially equal periodic paymentsinternal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your substantially equal periodic paymentsinternal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit substantially equal periodic paymentsinternal online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit substantially equal periodic paymentsinternal. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out substantially equal periodic paymentsinternal

How to fill out substantially equal periodic paymentsinternal

01

Step 1: Determine if you are eligible for substantially equal periodic payments (SEPP). You must be below the age of 59 ½ and have a qualified retirement plan or an IRA.

02

Step 2: Calculate the amount of SEPP using one of the allowed methods. The three common methods are the Required Minimum Distribution (RMD) method, the Fixed Amortization method, and the Fixed Annuitization method. Each method has its own calculation formula.

03

Step 3: Complete the necessary paperwork. This usually involves filling out a distribution request form provided by your retirement plan administrator or IRA custodian. Make sure to include the specific details of your SEPP calculations.

04

Step 4: Submit the paperwork to your retirement plan administrator or IRA custodian. They will review and process your request.

05

Step 5: Start receiving the SEPP distributions. It's important to note that once you start the SEPP, you must continue taking distributions for at least five years or until you reach the age of 59 ½, whichever is longer. Failure to do so may result in penalties and taxes.

Who needs substantially equal periodic paymentsinternal?

01

Individuals who need substantially equal periodic payments (SEPP) are usually those who want to access their retirement savings before reaching the age of 59 ½ without incurring the usual early withdrawal penalties.

02

Common reasons for needing SEPP include early retirement, financial emergencies, or major life events where access to retirement funds is necessary.

03

It's important to consult with a financial advisor or tax professional to determine if SEPP is the right option for your specific financial situation and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the substantially equal periodic paymentsinternal electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your substantially equal periodic paymentsinternal in seconds.

How can I edit substantially equal periodic paymentsinternal on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing substantially equal periodic paymentsinternal.

Can I edit substantially equal periodic paymentsinternal on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute substantially equal periodic paymentsinternal from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is substantially equal periodic paymentsinternal?

Substantially equal periodic paymentsinternal, also known as SEPP or 72(t) payments, are a series of substantially equal periodic payments made from an individual retirement account (IRA) or other qualified retirement plan that meets the requirements of the Internal Revenue Code.

Who is required to file substantially equal periodic paymentsinternal?

Individuals who wish to take substantially equal periodic payments from their retirement accounts to avoid early withdrawal penalties are required to file SEPP.

How to fill out substantially equal periodic paymentsinternal?

To fill out substantially equal periodic paymentsinternal, individuals must calculate the annual distribution amount based on IRS-approved methods and submit a written request to their retirement account custodian.

What is the purpose of substantially equal periodic paymentsinternal?

The purpose of substantially equal periodic paymentsinternal is to allow individuals to access their retirement funds before reaching retirement age without incurring early withdrawal penalties.

What information must be reported on substantially equal periodic paymentsinternal?

The annual distribution amount, calculation method used, and other relevant details must be reported on substantially equal periodic paymentsinternal.

Fill out your substantially equal periodic paymentsinternal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Substantially Equal Periodic Paymentsinternal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.