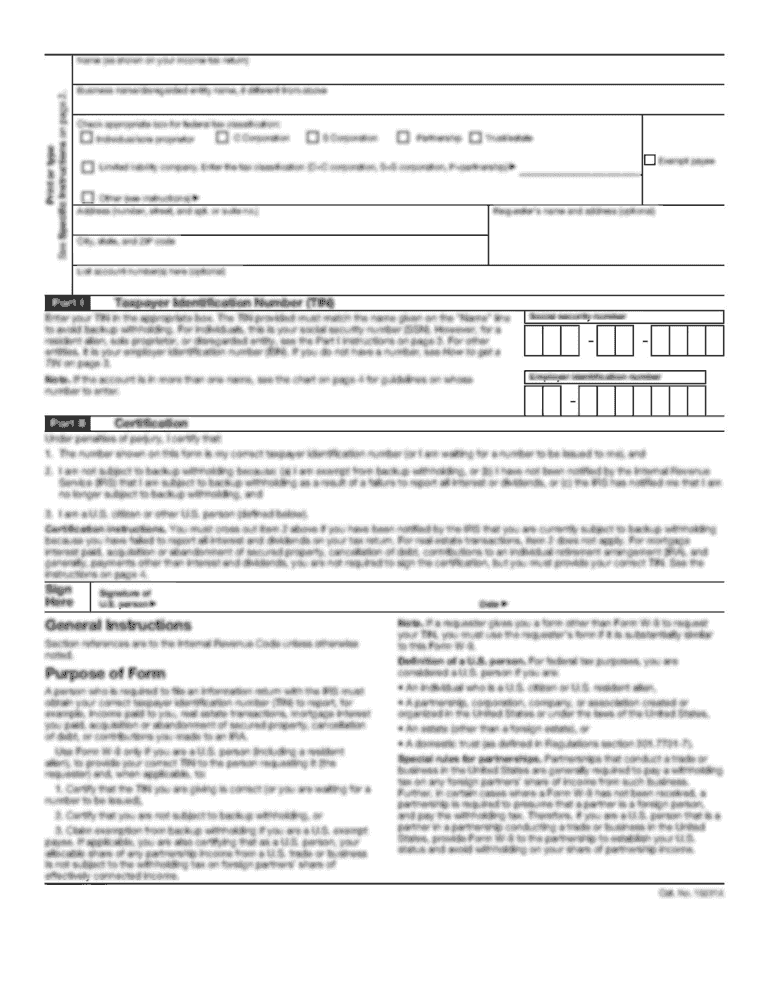

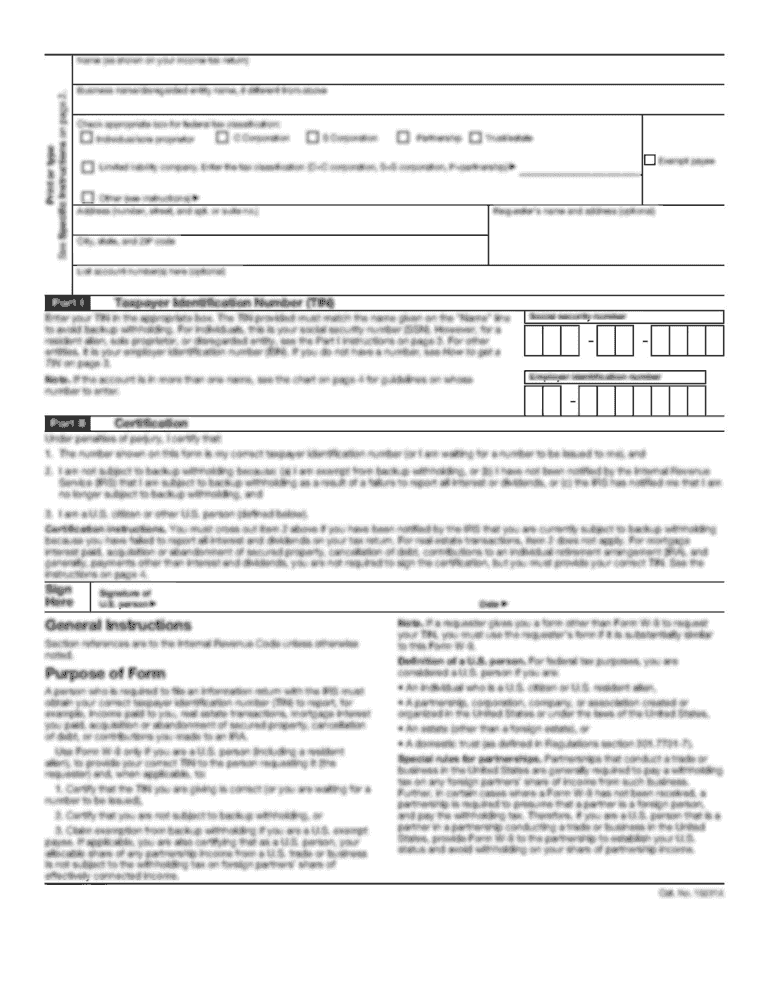

Get the free Your Retirement Plan

Show details

This handbook aims to provide essential information regarding retirement planning for members of Michigan’s Public School Employees’ Retirement System, including details on contributions, eligibility,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your retirement plan

Edit your your retirement plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your retirement plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit your retirement plan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit your retirement plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out your retirement plan

How to fill out Your Retirement Plan

01

Begin by gathering all necessary personal and financial information, including current assets, income sources, and expenses.

02

Define your retirement goals, such as desired retirement age and lifestyle expectations.

03

Estimate your future expenses during retirement, considering healthcare, housing, and leisure activities.

04

Calculate your expected income in retirement from sources like Social Security, pensions, and savings.

05

Determine the gap between your expected income and expenses, if any.

06

Develop a savings strategy to fill the gap, which may include adjusting your investment portfolio.

07

Regularly review and update your plan as your financial situation and goals change.

Who needs Your Retirement Plan?

01

Everyone planning for retirement, including those of all ages and income levels.

02

Individuals who want to ensure financial security during their retirement years.

03

People looking for a structured approach to manage savings and investments towards retirement.

04

Those wanting to align their retirement savings with their lifestyle aspirations.

Fill

form

: Try Risk Free

People Also Ask about

Is a 401k the same as a retirement plan?

Overview Voluntary Retirement. Voluntary Retirement – The most common type of retirement. Early Retirement. Disability Retirement. Deferred Retirement. Phased Retirement.

Is $600,000 enough to retire at 62?

Suppose you plan to retire at 62 with $600,000 saved. You expect to withdraw 4% each year, starting with a $24,000 withdrawal in Year One. Your money earns a 5% annual rate of return while inflation stays at 2.9%. Based on those numbers, $600,000 would be enough to last you 30 years in retirement.

What are the 4 types of retirement?

Retirement planning often involves a mix of assets like 401(k)s, IRAs, personal savings, and Social Security. Depending on individual needs and goals, it may be beneficial to diversify savings across various retirement accounts to ensure a stable financial future.

What are your retirement plan?

Retirement plans provide you with the regular payments you need to fulfil your financial goals. The amount helps you maintain your standard of living and protect your finances from inflation. Additionally, the amount helps you build an emergency fund and repay any pending debt.

What is your retirement plan?

A retirement plan is your preparation for a good life after you're done working to pay the bills or at least done working a full-time job. But it's not all about money. The non-financial aspects include lifestyle choices such as how you want to spend your time in retirement and where you'll live.

What is an example of a retirement plan?

Examples of defined contribution plans include 401(k) plans, 403(b) plans, employee stock ownership plans, and profit-sharing plans. A Simplified Employee Pension Plan (SEP) is a relatively uncomplicated retirement savings vehicle.

What is the English version of 401k?

There is a UK equivalent. In UK terms, the equivalent of a 401k is the UK workplace pension or the SIPP (self-invested personal pension).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Your Retirement Plan?

Your Retirement Plan is a financial strategy designed to provide you with income after you retire from work. It typically includes savings, investments, and potentially Social Security benefits that are organized to meet your financial needs in retirement.

Who is required to file Your Retirement Plan?

Individuals who have established a retirement account, such as a 401(k) or IRA, and need to manage their contributions, distributions, and tax implications are typically required to file their Retirement Plan. Additionally, employers who provide retirement benefits to employees may also need to file related documents.

How to fill out Your Retirement Plan?

To fill out Your Retirement Plan, you should gather relevant financial information including your income, projected retirement expenses, existing savings, and investment accounts. You may use financial planning software, consult a financial advisor, or follow specific guidelines provided by your retirement plan administrator.

What is the purpose of Your Retirement Plan?

The purpose of Your Retirement Plan is to ensure that you have sufficient funds available to maintain your desired lifestyle during retirement. It helps you to systematically save and invest in order to build a nest egg that can provide income in your retirement years.

What information must be reported on Your Retirement Plan?

Information that must be reported on Your Retirement Plan may include your current contributions, investment allocations, account balances, projected retirement income, estimated expenses in retirement, and any changes in your financial situation or goals.

Fill out your your retirement plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Retirement Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.