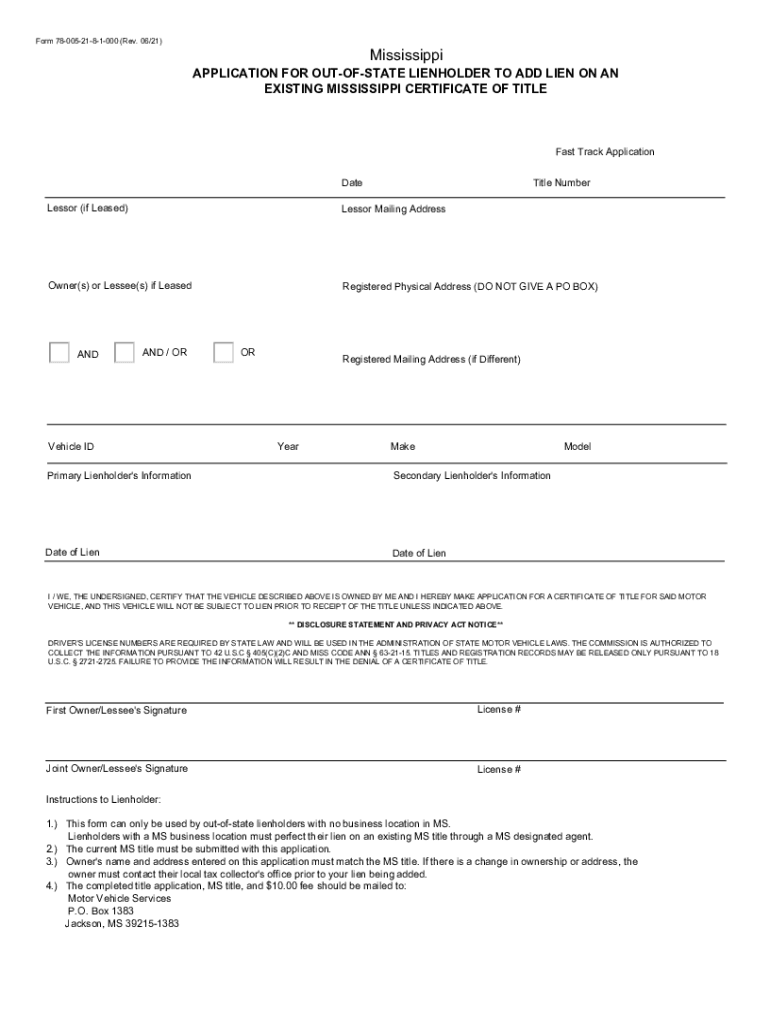

MS 78-005 2021 free printable template

Get, Create, Make and Sign MS 78-005

Editing MS 78-005 online

Uncompromising security for your PDF editing and eSignature needs

MS 78-005 Form Versions

How to fill out MS 78-005

How to fill out MS 78-005

Who needs MS 78-005?

Instructions and Help about MS 78-005

This video is for the DWC Form-005, the Employer Notice of No Coverage or Termination of Coverage. An employer who does not have workers' compensation insurance is called a “non- subscriber.” The Form-005 must be filed if you are a non- subscriber (unless your employees are exempt from coverage under the Texas Workers' Compensation Act), or if you terminate workers' compensation insurance coverage. Non-subscribers must file the DWC Form-005 each year between February 1st and April 30th, or within 30 days of hiring your first employee (if you hired them on a day outside February 1st and April 30th). You must also file the form within 10 days of receiving a request from TDI-DWC. There are several ways to file this form: You may complete the form online then print it. You may also complete the paper form. Once you have a completed hard copy, mail or fax it to the Division of Workers' Compensation. We prefer you to complete the form online through the TDI website. Go to the Division of Workers' Compensation online and select to quot;file online.” Once you have completed the required fields select the quot;submit” button. The form will be filed, and you will receive a confirmation number letting you know it has been received. The link for online filing will be repeated at the end of this video. If you are using the Form-005 to notify the Division that you have terminated coverage you must file the form within 10 days after notifying the insurance carrier of the termination of coverage unless you purchase a new policy or become a certified self-insurer. If you do not purchase a new policy you become a non-subscriber, and you must file the Form-005 each year during the February 1st to April 30th filing period. You also must notify your employees that workers' compensation insurance is not provided. Instructions for doing that are on page 2 of the form. When you file the form, you must complete all required information. Let's review how to complete a few of the boxes on the form. The first section contains required statements. Tell us why you are submitting this form. Are you telling us you do not have workers' compensation coverage? Or, are you notifying us that you have just terminated coverage? Check one of the two boxes. If you have terminated coverage you must also complete the policy information fields. Just above number 2 in section 1 there is another field you must complete. We need to know the beginning date and the ending date for the statement you are making. Enter the effective from-date and to- date in the boxes. The date you enter may not exceed a one-year period for each form submitted. For example, if you elect not to have coverage from September 15, 2014, to April 30, 2016, you will need to file two forms. The first form will use the beginning date of September 15, 2014, to April 30, 2015. The second form will use the beginning date of May 1, 2015, to April 30, 2016. The filing date ends April 30th of each year, so the beginning date...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MS 78-005 for eSignature?

How do I execute MS 78-005 online?

How do I complete MS 78-005 on an iOS device?

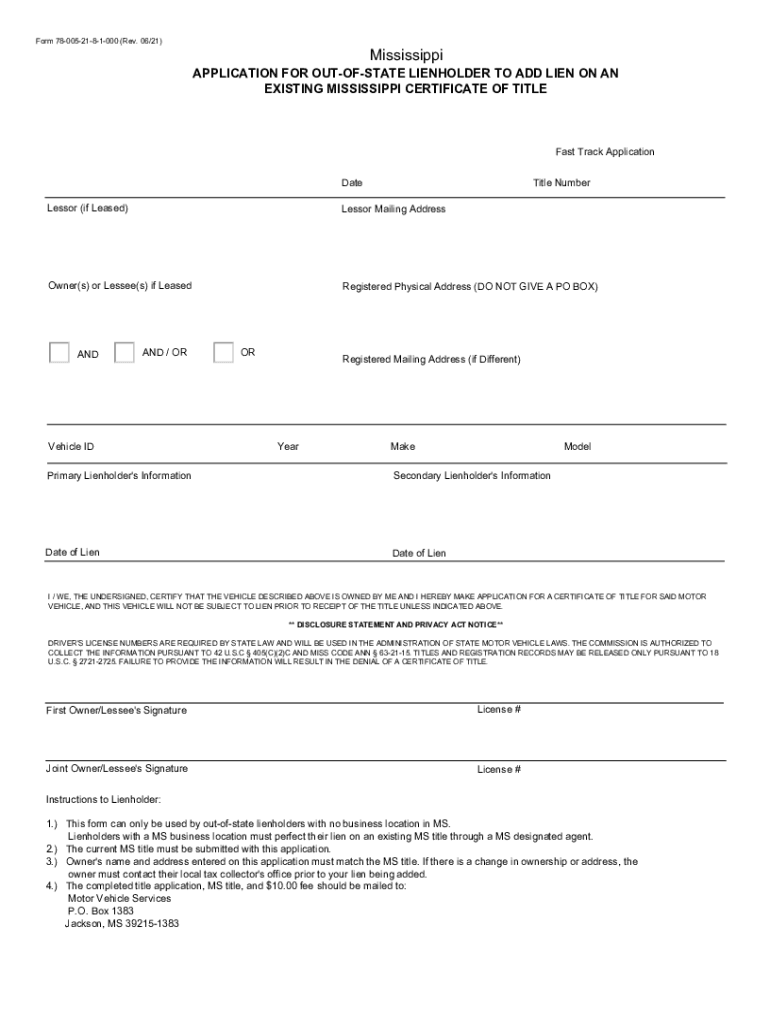

What is MS 78-005?

Who is required to file MS 78-005?

How to fill out MS 78-005?

What is the purpose of MS 78-005?

What information must be reported on MS 78-005?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.