Get the free Deferred Forestland Tax Valuation Notice - tax idaho

Show details

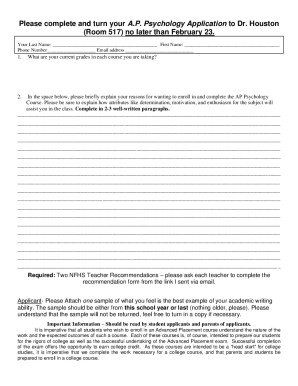

This document notifies the property owner about the assessment of deferred taxes on their property designated as Forestland, including details on tax calculation procedures based on changes in ownership,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deferred forestland tax valuation

Edit your deferred forestland tax valuation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deferred forestland tax valuation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deferred forestland tax valuation online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit deferred forestland tax valuation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deferred forestland tax valuation

How to fill out Deferred Forestland Tax Valuation Notice

01

Obtain the Deferred Forestland Tax Valuation Notice form from your local tax office or online.

02

Read the instructions thoroughly to understand the requirements.

03

Fill in your personal information in the designated fields, such as name, address, and contact details.

04

Provide information about the property, including its location and parcel number.

05

Indicate the size of the forestland and the specific use or management practices employed.

06

Attach any necessary documentation, such as maps or management plans, to support your application.

07

Review your completed form for accuracy and completeness before submission.

08

Submit the form by the specified deadline to your local tax assessor's office.

Who needs Deferred Forestland Tax Valuation Notice?

01

Landowners with forestland who wish to take advantage of deferred tax valuation for their properties.

02

Individuals or entities actively managing forests for timber production or conservation purposes.

03

Those who have received notification from their local tax office regarding eligibility for forestland valuation.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean when your taxes are deferred?

Tax-deferred refers to income or investment earnings that are not taxed until they are withdrawn, which is typically done in the future.

Is tax deferral a good thing?

Tax deductions are powerful financial tools. Making the maximum contributions to your tax-deferred accounts effectively takes a chunk of money you would have paid to the government and lets you keep it now and pay it later. The higher your tax bracket, the more you will save.

What is the purpose of deferred taxes?

Deferred tax liability is a record of taxes incurred but not yet paid. This line item on a company's balance sheet reserves money for a known future expense that reduces the cash flow a company has available to spend. The money has been earmarked for a specific purpose, i.e. paying taxes the company owes.

What is a deferred tax valuation?

Deferred taxes are hidden tax liabilities or tax benefits that arise due to differences in the recognition or measurement of assets or liabilities between the tax balance sheet and the commercial or IFRS balance sheet and that will be offset in future financial years.

What is the deferred tax program in NC?

The Land Use Program allows qualified agricultural land to be taxed based on its agricultural use value, rather than its market value. This can significantly reduce property taxes for landowners. To request an application for the Land Use Program, please call our office at (910) 592-8146.

How can I reduce my property taxes in NC?

Tax Relief Programs Elderly or Disabled Homestead Exemption. Elderly or Disabled Property Tax Deferral (Circuit Breaker) Disabled Veteran Homestead Exclusion. Present-Use Value Assessment. Builder Property Tax Exemptions. Historic Property Deferral.

Does NC give property tax breaks to seniors?

North Carolina allows property tax exclusions for senior adults and disabled individuals.

What is the property tax deferral program in NC?

North Carolina defers a portion of the property taxes 'on the appraised value of a permanent residence owned and occupied by a North Carolina resident who has owned and occupied the property at least five years, is at least 65 years of age or is totally and permanently disabled, and whose income does not exceed $56,850

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Deferred Forestland Tax Valuation Notice?

The Deferred Forestland Tax Valuation Notice is a document that property owners use to request a specific tax valuation for their forestland, often to take advantage of lower property tax rates available for land designated for forestry.

Who is required to file Deferred Forestland Tax Valuation Notice?

Property owners who wish to receive the deferred tax benefits associated with forestland management are required to file the Deferred Forestland Tax Valuation Notice.

How to fill out Deferred Forestland Tax Valuation Notice?

To fill out the Deferred Forestland Tax Valuation Notice, property owners should provide relevant information such as property details, forestland description, management practices employed, and any required signatures.

What is the purpose of Deferred Forestland Tax Valuation Notice?

The purpose of the Deferred Forestland Tax Valuation Notice is to facilitate the assessment and valuation process for forestland, allowing property owners to benefit from reduced tax rates while managing their land for forestry.

What information must be reported on Deferred Forestland Tax Valuation Notice?

The Deferred Forestland Tax Valuation Notice must include information such as the property owner’s name and address, property identification number, description of the forestland, and any applicable management plans or practices.

Fill out your deferred forestland tax valuation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deferred Forestland Tax Valuation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.