Get the free Fiscal Note Tracking System Authorization Form. Fiscal Note Tracking System User Aut...

Show details

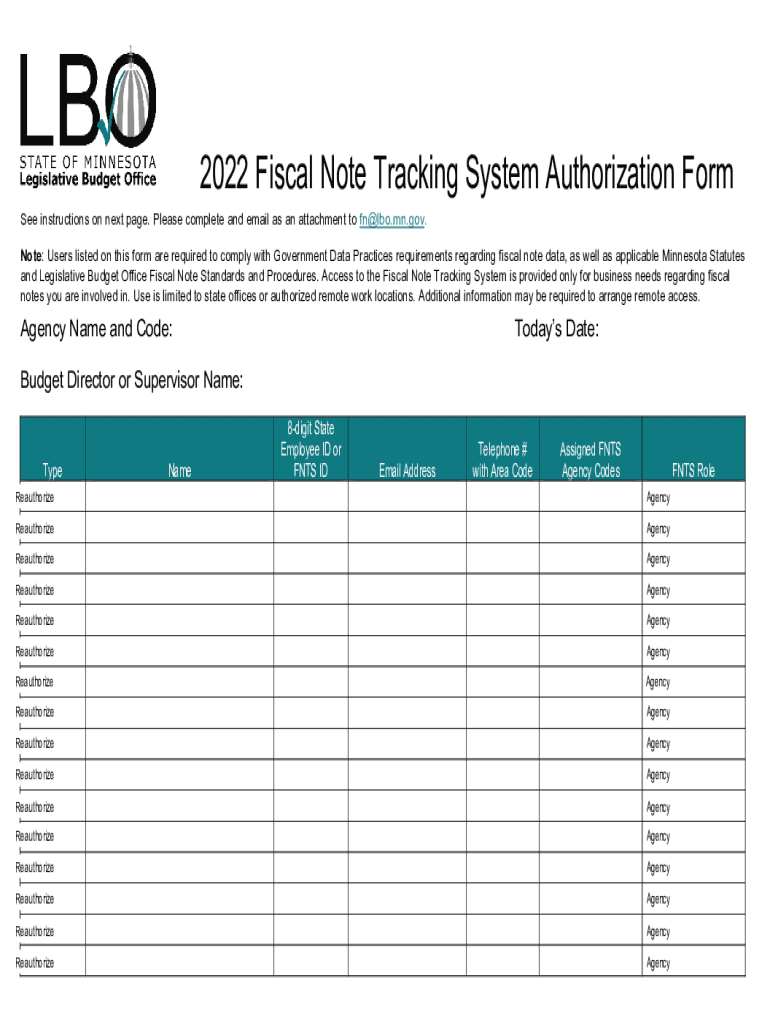

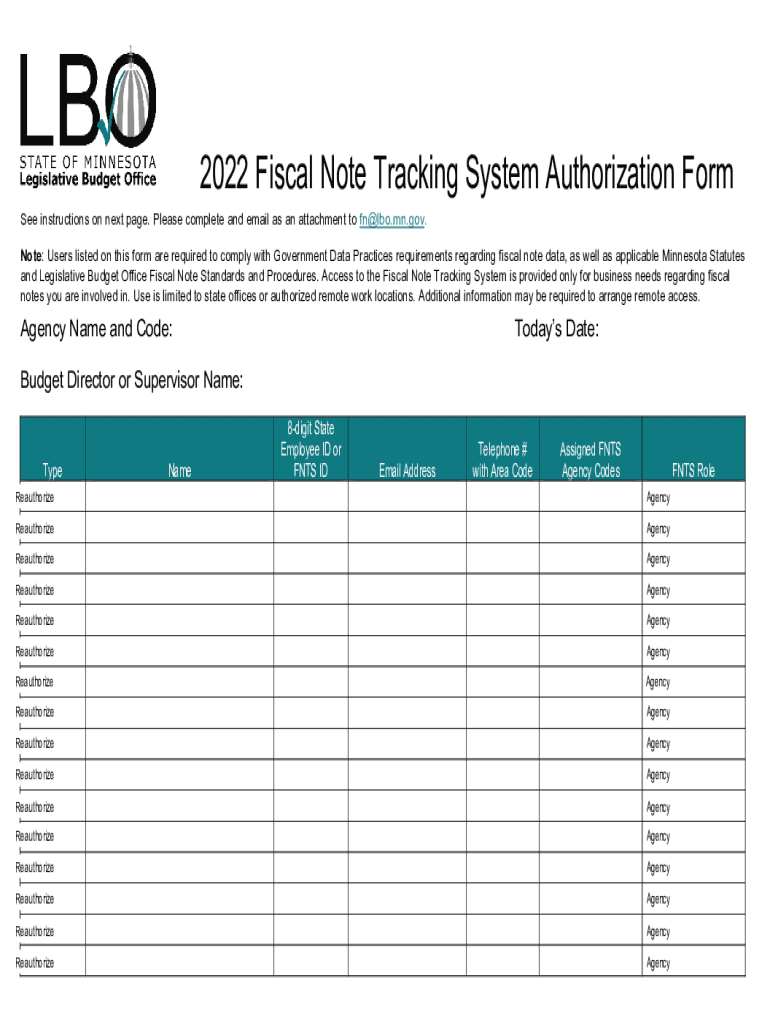

2022 Fiscal Note Tracking System Authorization Form See instructions on next page. Please complete and email as an attachment to FN×LBO.MN.gov. Note: Users listed on this form are required to comply

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal note tracking system

Edit your fiscal note tracking system form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal note tracking system form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fiscal note tracking system online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fiscal note tracking system. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal note tracking system

How to fill out fiscal note tracking system

01

To fill out the fiscal note tracking system, follow these steps:

02

Access the fiscal note tracking system by logging into the designated platform.

03

Click on the 'New Note' or equivalent button to start a new fiscal note.

04

Fill in the required information such as the title of the fiscal note, the date, and the responsible department.

05

Provide a detailed description of the proposed legislation or policy change that the fiscal note is related to.

06

Specify the estimated fiscal impact of the proposed legislation or policy change, including any potential costs or savings.

07

Indicate any other relevant details or considerations that should be taken into account.

08

Save and submit the completed fiscal note for review and approval.

09

Monitor and update the fiscal note as necessary, based on any changes or developments.

10

Ensure proper documentation and record keeping of the fiscal notes for future reference and audits.

11

Train and educate relevant staff members on how to navigate and use the fiscal note tracking system for efficient and accurate data entry.

Who needs fiscal note tracking system?

01

A fiscal note tracking system is beneficial for various entities including:

02

- Government agencies and departments responsible for assessing the financial impacts of proposed legislation or policy changes.

03

- Legislative bodies such as state or federal assemblies that require comprehensive fiscal analysis of proposed bills.

04

- Policy analysts and researchers who need to track and document the fiscal implications of different policy proposals.

05

- Financial and budgeting offices tasked with budget planning and forecasting based on the fiscal notes.

06

- Auditors and oversight agencies involved in reviewing the accuracy and completeness of fiscal notes.

07

- Advocacy organizations and lobbyists who aim to understand the potential economic consequences of proposed policies.

08

- Any organization or individual involved in the legislative process and concerned about the financial effects of proposed measures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fiscal note tracking system in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your fiscal note tracking system and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send fiscal note tracking system to be eSigned by others?

When you're ready to share your fiscal note tracking system, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out the fiscal note tracking system form on my smartphone?

Use the pdfFiller mobile app to fill out and sign fiscal note tracking system. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is fiscal note tracking system?

Fiscal note tracking system is a system used to track and monitor the financial impact of proposed legislation.

Who is required to file fiscal note tracking system?

Government agencies and departments responsible for analyzing the fiscal impact of proposed legislation are required to file fiscal note tracking system.

How to fill out fiscal note tracking system?

Fiscal note tracking system can be filled out by entering relevant financial information related to proposed legislation into the system.

What is the purpose of fiscal note tracking system?

The purpose of fiscal note tracking system is to provide transparency and accountability in the legislative process by documenting the financial implications of proposed legislation.

What information must be reported on fiscal note tracking system?

Information such as projected costs, revenue impacts, and economic analysis related to proposed legislation must be reported on fiscal note tracking system.

Fill out your fiscal note tracking system online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Note Tracking System is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.