Get the free 16 Bank Reconciliation Tips and TricksTax Pro Plus

Show details

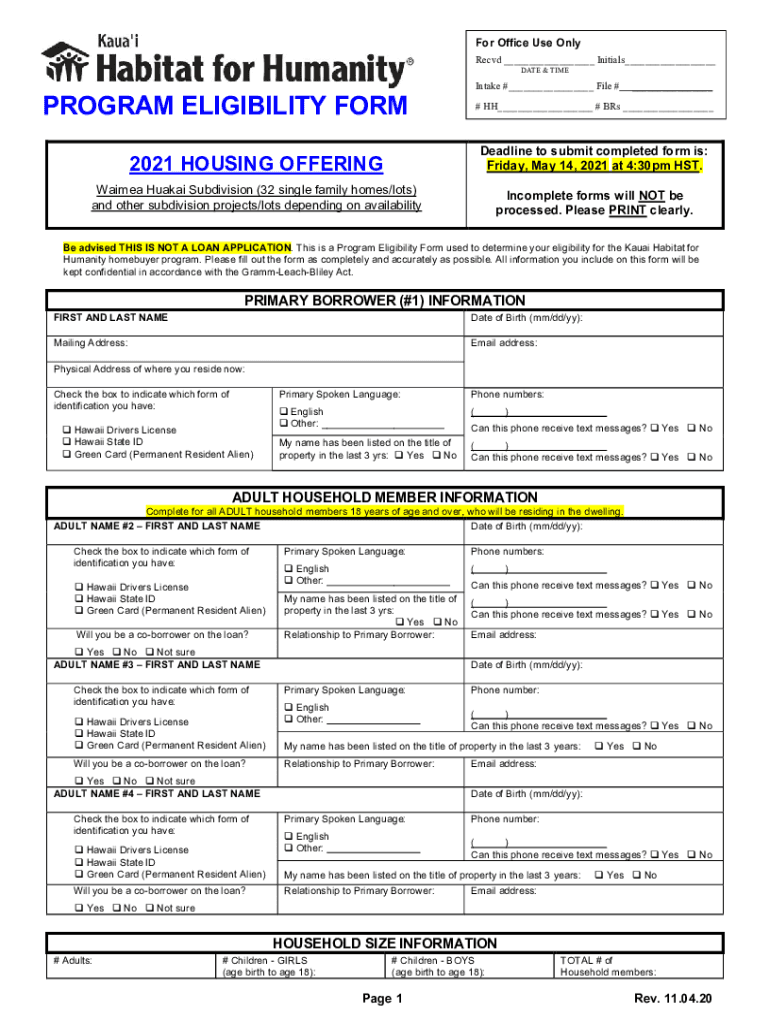

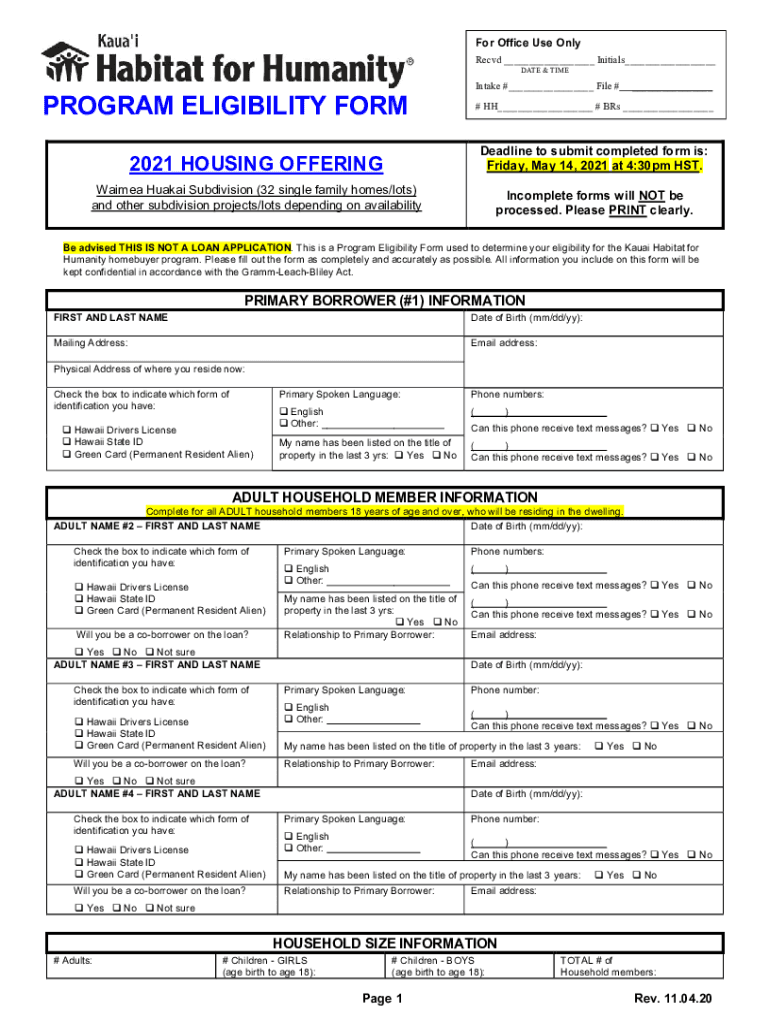

For Office Use Only Recd ___ Initials___ DATE & TIMEIntake #___ File #PROGRAM ELIGIBILITY FORM___# HH___ # BR's ___2021 HOUSING OFFERINGDeadline to submit completed form is: Friday, May 14, 2021,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 16 bank reconciliation tips

Edit your 16 bank reconciliation tips form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 16 bank reconciliation tips form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 16 bank reconciliation tips online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 16 bank reconciliation tips. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 16 bank reconciliation tips

How to fill out 16 bank reconciliation tips

01

Start by gathering all necessary bank statements and financial records.

02

Compare the ending balance on the bank statement with the ending balance in your records.

03

Look for any discrepancies such as missing transactions, duplicate entries, or incorrect amounts.

04

Make note of any outstanding checks or deposits in transit that have not been cleared by the bank.

05

Enter the adjusted bank balance by adding or subtracting outstanding items from the ending balance.

06

Repeat the process for your own records, comparing the ending balance with the adjusted bank balance.

07

Identify any differences between the two balances, known as reconciling items.

08

Investigate the reconciling items to determine the reasons behind the discrepancies.

09

Adjust your records by adding or subtracting the reconciling items to reach a new adjusted balance.

10

Update your bookkeeping system to reflect the adjusted balance.

11

Repeat the reconciliation process for any additional bank accounts or credit cards.

12

Keep accurate records of the reconciliation process for future reference.

13

Double-check all calculations and ensure accuracy in your reconciliation.

14

Consider using accounting software or online tools to simplify the bank reconciliation process.

15

Establish a regular schedule for bank reconciliations, such as monthly or quarterly.

16

Seek professional help or consult with a financial advisor if you are unsure or struggling with the bank reconciliation process.

Who needs 16 bank reconciliation tips?

01

Anyone who wants to maintain accurate financial records.

02

Business owners and entrepreneurs who handle their company's finances.

03

Accountants and bookkeepers who need to ensure the accuracy of financial statements.

04

Individuals or organizations with multiple bank accounts or credit cards.

05

Those who want to prevent errors and detect potential fraud in their financial transactions.

06

Anyone looking to improve their financial management and decision-making abilities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 16 bank reconciliation tips online?

With pdfFiller, the editing process is straightforward. Open your 16 bank reconciliation tips in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit 16 bank reconciliation tips in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your 16 bank reconciliation tips, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I sign the 16 bank reconciliation tips electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 16 bank reconciliation tips in seconds.

What is 16 bank reconciliation tips?

16 bank reconciliation tips refer to a set of guidelines and best practices designed to help individuals or businesses ensure that their financial records match their bank statements, thus facilitating accurate accounting.

Who is required to file 16 bank reconciliation tips?

Individuals and businesses that maintain bank accounts and must reconcile their financial records with bank statements are typically required to follow these tips.

How to fill out 16 bank reconciliation tips?

To fill out 16 bank reconciliation tips, one should collect bank statements, review transaction entries, identify discrepancies, and apply the tips for accuracy and completeness in the reconciliation process.

What is the purpose of 16 bank reconciliation tips?

The purpose of 16 bank reconciliation tips is to ensure accuracy in financial reporting, identify errors or fraudulent transactions, and maintain healthy financial practices.

What information must be reported on 16 bank reconciliation tips?

The information that must be reported includes bank balance, outstanding checks, deposits in transit, and any adjustments made for errors or omissions.

Fill out your 16 bank reconciliation tips online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

16 Bank Reconciliation Tips is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.