Get the free Form 8955-SSA

Show details

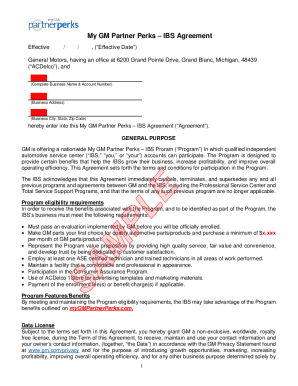

This document provides information about the release of Form 8955-SSA, which is used to report information about separated participants with deferred vested benefits under retirement plans. It discusses

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8955-ssa

Edit your form 8955-ssa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8955-ssa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 8955-ssa online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 8955-ssa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8955-ssa

How to fill out Form 8955-SSA

01

Obtain Form 8955-SSA from the IRS website or your tax professional.

02

Provide your name and address at the top of the form.

03

Enter your EIN (Employer Identification Number) in the designated section.

04

Fill in the information for each plan participant, including their name, Social Security number, and the amount of their accrued benefit.

05

Indicate the type of plan (e.g., defined benefit or defined contribution) as required.

06

Complete the signature section with your name and title, confirming the information is accurate.

07

Submit the form electronically or by mail to the appropriate IRS address by the deadline.

Who needs Form 8955-SSA?

01

Employers who maintain a retirement plan and have participants who have separated from service.

02

Plan sponsors required to report certain information regarding the plan participants.

03

Employers needing to report accrued benefits for participants who are not currently enrolled in the plan.

Fill

form

: Try Risk Free

People Also Ask about

Can form 8955-SSA be filed electronically?

Use the IRS's FIRE (Filing Information Returns Electronically) to electronically file Form 8955-SSA. Effective for plan years beginning after 2019, electronic filing is available for Form 5500-EZ using the DOL EFAST2 filing system.

What is the 8955-SSA plan termination?

Use Form 8955-SSA to report information relating to each participant who separated from service covered by the plan and is entitled to a deferred vested benefit under the plan but is not paid this retirement benefit.

What is the penalty for failing to file 8955-SSA?

The penalty has been increased to $10 from $1 for each participant not reported and for each day multiplied by the number of days the failure continues, up to a maximum of $50,000 from $5,000 applied to returns, registration statements, and notifications required to be filed after December 31, 2019, as amended by

When to file 8955-SSA?

In general, if a Form 8955-SSA must be filed for a plan year, it must be filed by the last day of the seventh month following the last day of that plan year (plus extensions). This due date may be extended under some circumstances.

What is the 8955-SSA form for?

About Form 8955-SSA, Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits | Internal Revenue Service.

Does the 8955-SSA need to be signed?

Electronic signatures are not required for electronically filed Forms 8955-SSA. The name of the administrator or sponsor should be typed into the signature line. Administrators and sponsors are not required to have their own FIRE Transmitter Control Code, User ID or PIN.

Can a 8955-SSA be filed electronically?

You can file Form 8955-SSA electronically with Form 5500 or separately.

Does Form 5500 have to be filed electronically?

For the Form 5500, the Form 5500-SF, and the Form PR: You must electronically file the Form 5500, the Form 5500-SF, and the Form PR (Pooled Plan Provider Registration).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 8955-SSA?

Form 8955-SSA is a tax form used by employers to report information about plan participants in retirement plans that are not subject to the Employee Retirement Income Security Act (ERISA).

Who is required to file Form 8955-SSA?

Employers who maintain pension plans that are not covered by ERISA must file Form 8955-SSA to report information about participants in the plan.

How to fill out Form 8955-SSA?

To fill out Form 8955-SSA, employers must provide details about the pension plan, including identifying information, the name of the plan, and the information regarding participants who have separated from service or are receiving benefits.

What is the purpose of Form 8955-SSA?

The purpose of Form 8955-SSA is to provide the IRS with information about individuals who are entitled to pension benefits, ensuring that the participants' data is accurately reported for pension records.

What information must be reported on Form 8955-SSA?

The information that must be reported on Form 8955-SSA includes the name and identification number of the plan, participant names, social security numbers, and any other relevant details about the retirement benefits due to the participants.

Fill out your form 8955-ssa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8955-Ssa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.