Get the free Brokered CD Acknowledgement Form

Show details

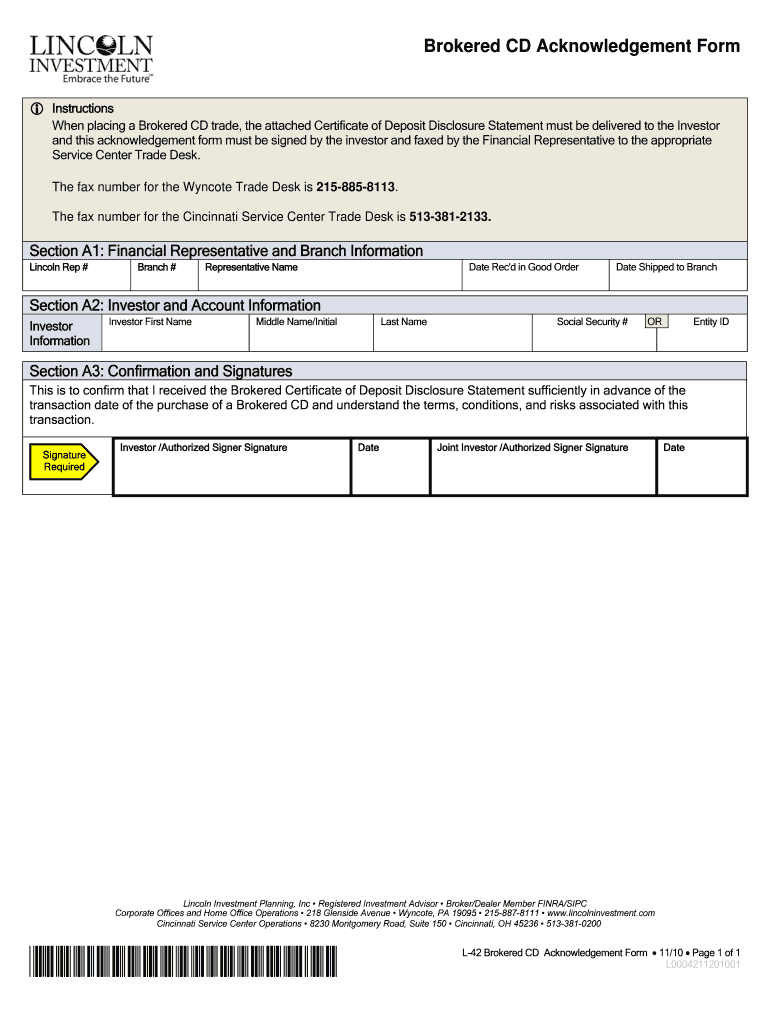

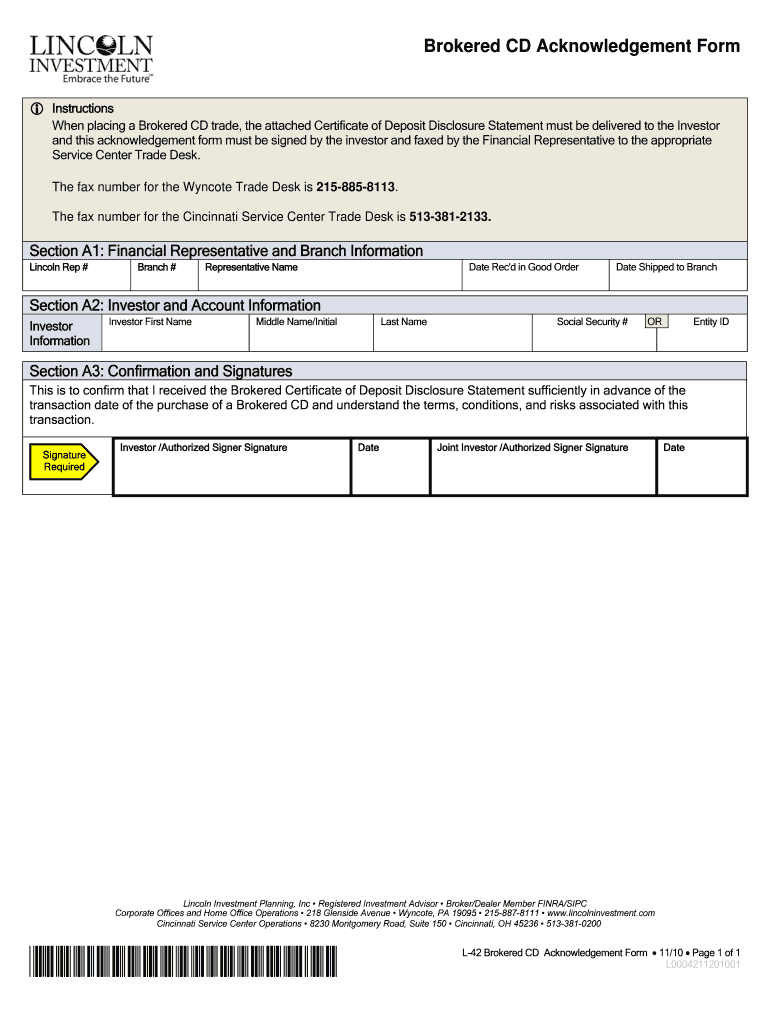

Este formulario es un reconocimiento que debe ser firmado por el inversor al realizar una transacción de Certificado de Depósito (CD) intermediado. Se requiere que el formulario de divulgación

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign brokered cd acknowledgement form

Edit your brokered cd acknowledgement form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your brokered cd acknowledgement form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing brokered cd acknowledgement form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit brokered cd acknowledgement form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out brokered cd acknowledgement form

How to fill out Brokered CD Acknowledgement Form

01

Obtain the Brokered CD Acknowledgement Form from your broker or financial institution.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide information about the brokered certificate of deposit (CD), including the name of the issuing bank and the terms of the CD.

04

Review the risks associated with brokered CDs, as outlined in the form.

05

Sign and date the form to acknowledge that you understand the terms and conditions.

06

Submit the completed form to your broker or financial institution as instructed.

Who needs Brokered CD Acknowledgement Form?

01

Investors interested in purchasing brokered certificates of deposit (CDs).

02

Individuals working with financial brokers who facilitate brokered CD transactions.

03

Financial institutions that offer brokered CDs to comply with regulatory requirements.

Fill

form

: Try Risk Free

People Also Ask about

What happens when a brokered CD reaches maturity?

When your CD matures, you can deposit the money in another account at the bank, like your savings account. You can roll it over into another CD term at the bank. You can also remove funds and spend the cash or deposit into a new, higher-rate CD at another bank.

Why does a brokered CD lose value?

All brokered CDs will fluctuate in value between purchase date and maturity date. Thus, any CD sold prior to maturity may be subject to a substantial gain or loss. A brokered CD's value can decline due to rising interest rates, and longer maturities have higher interest rate risk.

Is there a downside to brokered CDs?

Potential risks with brokered CDs Market risk: The most common risk is that you'll need your funds before the CD matures. Although there are no early redemption fees (like there are for bank-issued CDs), you may receive less than your original purchase price.

Why are brokered CDs losing value?

Certificates of Deposit (or CDs), like bonds, are valued daily. As market interest rates change, prices on bond and CD holdings can rise or fall. If interest rates rise, the market price of outstanding CDs generally declines, creating a potential loss if you decide to sell them in the secondary market.

What are the risks of a brokered CD?

Brokered CDs also come with many of the same risks as traditional CDs, including lower yields compared with higher-risk investments, the risk of changing interest rates impacting the market value of a CD, the risk that an issuer may call its CD before maturity, and more.

Can a brokered CD lose money if held to maturity?

If you stay invested until term maturity, you won't lose your principal. But if you look to get out early, you could lose money. Brokered CDs don't have early withdrawal penalties like bank CDs.

What happens to a brokered CD if the bank fails?

If the money you put into your brokered CD pushes your total deposits in an account ownership category at a bank over the $250,000 federal deposit insurance limit, you are at risk of having uninsured funds and may lose money if the insured bank fails.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Brokered CD Acknowledgement Form?

The Brokered CD Acknowledgement Form is a document that acknowledges the receipt of a certificate of deposit (CD) by a brokerage firm on behalf of its clients, ensuring that all parties are aware of the terms and conditions associated with the CD.

Who is required to file Brokered CD Acknowledgement Form?

Brokerage firms that handle the sale of brokered certificates of deposit for their clients are required to file the Brokered CD Acknowledgement Form.

How to fill out Brokered CD Acknowledgement Form?

To fill out the Brokered CD Acknowledgement Form, a brokerage firm must include pertinent details such as the client's information, the terms of the CD, including interest rate, maturity date, and any fees associated with the CD.

What is the purpose of Brokered CD Acknowledgement Form?

The purpose of the Brokered CD Acknowledgement Form is to ensure transparency and to inform clients about the terms of the brokered CD, helping them understand their investment and any associated risks.

What information must be reported on Brokered CD Acknowledgement Form?

The information that must be reported on the Brokered CD Acknowledgement Form includes the client’s name, account number, the issuing bank's details, the amount of the CD, interest rate, maturity date, and any relevant fees.

Fill out your brokered cd acknowledgement form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Brokered Cd Acknowledgement Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.