Get the free INSURANCE IN-DEPTH CLASSES - iiat

Show details

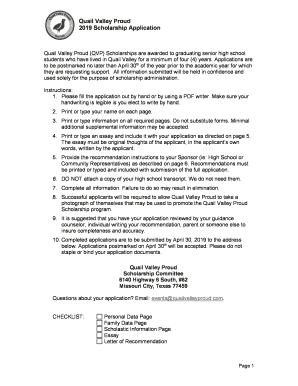

2015 Texas Commercial LINES INSURANCE IN-DEPTH CLASSES Each class: day classes/Filed for 3.5 or 4 CE credits $75 member/$100 nonmember 8 a.m. 12 p.m. Completion and Compliance: Certificates of Insurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance in-depth classes

Edit your insurance in-depth classes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance in-depth classes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance in-depth classes online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit insurance in-depth classes. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance in-depth classes

How to fill out insurance in-depth classes:

01

Start by researching and identifying reputable insurance in-depth classes offered by recognized institutions or organizations. Look for accredited programs that cover a wide range of insurance topics and are taught by experienced professionals in the industry.

02

Once you have selected a suitable insurance in-depth class, review the course syllabus and familiarize yourself with the topics that will be covered. This will help you understand the areas of insurance that the class will focus on and what you can expect to learn.

03

Prioritize your learning objectives based on your specific needs and interests within the insurance field. Whether you are interested in property and casualty insurance, health insurance, life insurance, or any other specific area, create a learning plan to ensure that you make the most out of the insurance in-depth class.

04

Attend all classes and actively participate in discussions, activities, and assignments. Engage with the instructor and fellow classmates to enhance your understanding of insurance concepts and share insights on practical applications.

05

Take diligent notes during lectures and discussions. This will help you understand and retain the information better. Review your notes regularly and organize them in a way that suits your learning style.

06

Complete any required readings or assignments promptly. These exercises are designed to reinforce your understanding of insurance principles and provide hands-on experience. Stay consistent and committed to completing all tasks to ensure maximum benefit from the insurance in-depth class.

07

Seek clarification whenever needed. If you have any doubts, questions, or need further explanation on any insurance topic, do not hesitate to ask your instructor or engage in class discussions. Remember, the purpose of the insurance in-depth class is to enhance your knowledge and understanding.

Who needs insurance in-depth classes?

01

Insurance professionals looking to expand their knowledge and enhance their skills in various insurance domains can benefit from insurance in-depth classes. These classes provide a deeper understanding of insurance principles, policies, regulations, and industry trends.

02

Individuals interested in pursuing a career in the insurance industry can benefit from insurance in-depth classes. These classes provide a comprehensive foundation in insurance concepts and equip individuals with the necessary knowledge and skills to succeed in the field.

03

Business owners and managers who handle insurance-related matters can benefit from insurance in-depth classes. Understanding various insurance policies, risk management, and regulatory requirements can help them make informed decisions and protect their businesses effectively.

04

Consumers who want to gain a deeper understanding of how insurance works and make informed choices can benefit from insurance in-depth classes. These classes provide insights into insurance policies, coverage options, and claims procedures, empowering individuals to make better decisions when purchasing insurance or navigating the insurance claims process.

In conclusion, filling out insurance in-depth classes requires thorough research, active participation, and diligent commitment. These classes can benefit insurance professionals, aspiring insurance professionals, business owners, managers, and consumers seeking a deeper understanding of insurance principles and practices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is insurance in-depth classes?

Insurance in-depth classes provide detailed information about insurance coverage and policy terms.

Who is required to file insurance in-depth classes?

Insurance companies and brokers are required to file insurance in-depth classes.

How to fill out insurance in-depth classes?

Insurance in-depth classes can be filled out online through a designated portal or submitted in paper form.

What is the purpose of insurance in-depth classes?

The purpose of insurance in-depth classes is to ensure transparency and provide consumers with detailed information about their insurance policies.

What information must be reported on insurance in-depth classes?

Insurance in-depth classes must include information about coverage limits, deductibles, premiums, and policy exclusions.

How can I get insurance in-depth classes?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific insurance in-depth classes and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make edits in insurance in-depth classes without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your insurance in-depth classes, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my insurance in-depth classes in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your insurance in-depth classes and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your insurance in-depth classes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance In-Depth Classes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.