Get the free BLANKET CERTIFICATE OF RESALE (TEXAS)

Show details

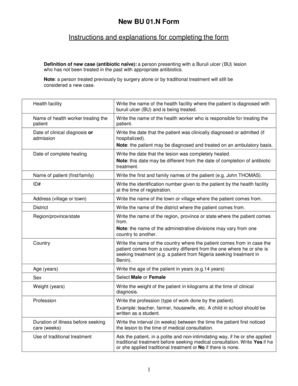

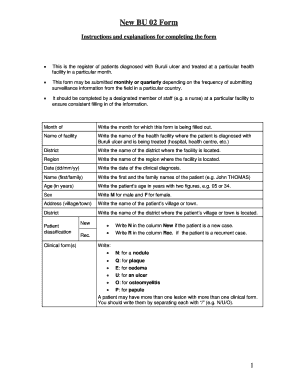

This document serves as a certificate for purchasers in Texas to certify that they are buying materials or goods for resale purposes, thereby exempting them from sales tax. It includes necessary fields

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign blanket certificate of resale

Edit your blanket certificate of resale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your blanket certificate of resale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing blanket certificate of resale online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit blanket certificate of resale. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out blanket certificate of resale

How to fill out BLANKET CERTIFICATE OF RESALE (TEXAS)

01

Begin by obtaining the Blanket Certificate of Resale form from the Texas Comptroller’s website or an authorized source.

02

Fill out the name and address of the purchaser at the top of the form.

03

Indicate the seller's name and address where the goods will be purchased.

04

Provide the type of business the purchaser operates and specify if it's eligible for resale.

05

Include the purchaser's Texas Sales and Use Tax Permit number.

06

Specify the items that will be purchased for resale, or indicate 'all goods' if applicable.

07

Sign and date the form to certify that the information provided is accurate and that the purchaser is eligible to make tax-free purchases for resale.

Who needs BLANKET CERTIFICATE OF RESALE (TEXAS)?

01

Businesses in Texas that purchase goods for resale rather than for personal use.

02

Retailers, wholesalers, or service providers who buy items to sell them to customers.

03

Businesses that wish to avoid paying sales tax at the time of purchase on items they intend to resell.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to get a resale certificate in Texas?

There is no fee for the permit, but you may be required to post a security bond.

Who orders the resale certificate in Texas?

In Texas, the seller is typically responsible for ordering the HOA resale certificate.

What is a suggested blanket resale certificate?

This is to certify that all tangible personal property or taxable services purchased from: are intended for resale as tangible personal property or for use or incorporation as a material or part of other tangible personal property to be produced for sale.

How to apply for a reseller certificate in Texas?

HOW TO GET A RESALE CERTIFICATE IN TEXAS ✔ STEP 1 : Complete the Texas Sales Tax Form. ✔ STEP 2 : Fill out the Texas resale certificate form. ✔ STEP 3 : Present a copy of this certificate to suppliers when you wish to purchase items for resale.

Who pays for a resale certificate in Texas?

The cost for obtaining a resale certificate in Texas is capped at $375. Since it is the seller's responsibility to provide it, the seller typically pays this expense at the time it is ordered. HOA management companies usually expect payment upfront before they will process an order.

How to get a resale certificate in Texas?

A Resale Certificate allows you to avoid paying sales tax when you purchase goods from a wholesaler intending to resell them to your customers, who then pay you the sales and use tax. You get a Resale Certificate by completing Form 01-339 (Texas Sales and Use Tax Resale Certificate).

What is a blanket resale certificate in Texas?

Resale certificates are usually provided in a “blanket” form. This means that the resale certificate applies to all items purchased from the vendor. States that allow for resale exemptions either accept a state-issued resale certificate or, in some cases, a multi-state certificate.

How much does a resale certificate cost in Texas?

Resale certificates are free in Texas.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BLANKET CERTIFICATE OF RESALE (TEXAS)?

A Blanket Certificate of Resale in Texas is a document used by retailers to purchase items intended for resale without paying sales tax at the point of purchase. It allows the buyer to make multiple purchases under one certificate.

Who is required to file BLANKET CERTIFICATE OF RESALE (TEXAS)?

Retailers or businesses that buy items for resale in Texas are required to file the Blanket Certificate of Resale. This includes those who engage in selling tangible personal property or taxable services.

How to fill out BLANKET CERTIFICATE OF RESALE (TEXAS)?

To fill out the Blanket Certificate of Resale, provide the buyer's name, address, seller's name, date, type of property being purchased, and include a declaration that these purchases will be for resale. Ensure to sign the document.

What is the purpose of BLANKET CERTIFICATE OF RESALE (TEXAS)?

The purpose of the Blanket Certificate of Resale is to exempt retailers from paying sales tax on products they intend to resell, streamlining the purchasing process for businesses.

What information must be reported on BLANKET CERTIFICATE OF RESALE (TEXAS)?

The information that must be reported on the Blanket Certificate of Resale includes the buyer's name, address, seller's name, a description of the type of items being purchased, the date of the transaction, and a statement of intent to resell.

Fill out your blanket certificate of resale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Blanket Certificate Of Resale is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.