Get the free 990-T - cff

Show details

This form is used by exempt organizations to report unrelated business income and to calculate the tax owed on that income. It includes various sections for income, deductions, and taxes applicable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 990-t - cff

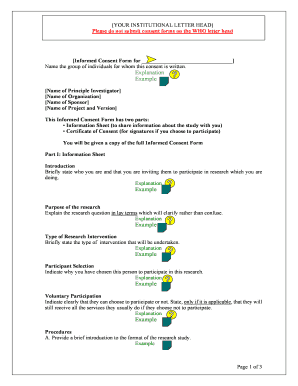

Edit your 990-t - cff form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 990-t - cff form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 990-t - cff online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 990-t - cff. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

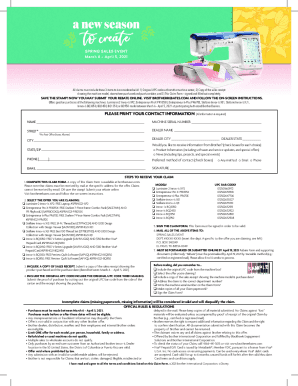

How to fill out 990-t - cff

How to fill out 990-T

01

Gather all relevant financial documents related to the unrelated business income.

02

Complete the header section of Form 990-T, including the organization’s name, address, and EIN.

03

Identify and report the unrelated business income and expenses in Part I of Form 990-T.

04

Calculate the net unrelated business taxable income (UBTI) by subtracting expenses from income.

05

Complete the applicable sections of Part II to account for any applicable deductions.

06

If necessary, apply any specific tax credits in Part III.

07

Sign and date the form, ensuring accuracy and completeness before submission.

08

File Form 990-T by the due date, typically on the 15th day of the 5th month after the end of the organization's tax year.

Who needs 990-T?

01

Non-profit organizations that have income from unrelated business activities.

02

Tax-exempt organizations that generate $1,000 or more in unrelated business taxable income.

03

Organizations that want to report activities that are not related to their exempt purpose.

Fill

form

: Try Risk Free

People Also Ask about

How do I report an IRA on my tax return?

IRA contributions will be reported on Form 5498: IRA contribution information is reported for each person for whom any IRA was maintained, including SEP or SIMPLE IRAs. An IRA includes all investments under one IRA plan.

What's the difference between a 990 and a 990 T?

Unlike Form 990 (link to B6) which is NOT used to calculate taxes owed by the organization, IRS Form 990-T is a separate tax form that must be filed by tax-exempt organizations that have certain types of unrelated business income and is used to calculate and report tax owed.

What are the different types of 990?

Annual information returns include Form 990, Form 990-EZ and Form 990-PF. Form 990-N (e-Postcard) is an annual notice. Form 990 is the IRS' primary tool for gathering information about tax-exempt organizations, educating organizations about tax law requirements and promoting compliance.

Can IRS Form 990-T be filed electronically?

Should Form 990-T be filed electronically? Yes! Form 990-T must be filed electronically for tax years ending on or after December 2020. Get Started with Tax990 and file your Form 990-T electronically with the IRS.

Does an IRA need to file a 990 T?

Tax considerations UBTI is subject to taxation in all varieties of retirement accounts, such as IRAs, retirement plans like Keoghs, and health savings accounts (HSA). When total positive UBTI across all applicable investments held in a retirement account equals $1,000 or more, then Form 990-T must be filed.

What is a 990 T form for an IRA?

What is Form 990-T? Understanding Unrelated Business Income Tax (UBIT) You may have recently received a notice indicating that your IRA may have incurred unrelated business income tax, or UBIT for short. UBIT applies to certain investments within an IRA and needs to be accounted for by filing Form 990-T.

What is the difference between 990 and 990T?

Unlike Form 990 (link to B6) which is NOT used to calculate taxes owed by the organization, IRS Form 990-T is a separate tax form that must be filed by tax-exempt organizations that have certain types of unrelated business income and is used to calculate and report tax owed.

Who is exempt from filing a Form 990?

Some organizations, such as political organizations, churches and other religious organizations, are exempt from filing an annual Form 990.

What is the threshold for not reporting income?

The minimum income amount to file taxes depends on your filing status and age. For 2024, the minimum income for Single filing status for filers under age 65 is $14,600 . If your income is below that threshold, you generally do not need to file a federal tax return.

Can I file form 990T electronically?

Required e-filing of Forms 990, 990-EZ, 990-PF, 990-T, and 4720 for tax years beginning after July 1, 2019. The Taxpayer First Act, enacted July 1, 2019, requires tax-exempt organizations to electronically file information returns and related forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 990-T?

Form 990-T is a tax form used by exempt organizations to report unrelated business income (UBI) and calculate the tax owed on that income.

Who is required to file 990-T?

Organizations that are exempt from federal income tax under Internal Revenue Code section 501(c) must file Form 990-T if they have $1,000 or more of gross unrelated business income.

How to fill out 990-T?

To fill out Form 990-T, organizations need to provide specific information about their unrelated business activities, calculate their UBI, list allowable deductions, and ultimately determine the taxable income and tax due.

What is the purpose of 990-T?

The purpose of Form 990-T is to ensure that tax-exempt organizations pay taxes on their unrelated business income, thus promoting fairness in the tax system.

What information must be reported on 990-T?

Form 990-T requires reporting of details such as gross unrelated business income, specific expenses related to that income, net income or loss, and any applicable tax calculated based on that income.

Fill out your 990-t - cff online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

990-T - Cff is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.