Get the free Online Foreign Transfer Duty Declaration Form ...

Show details

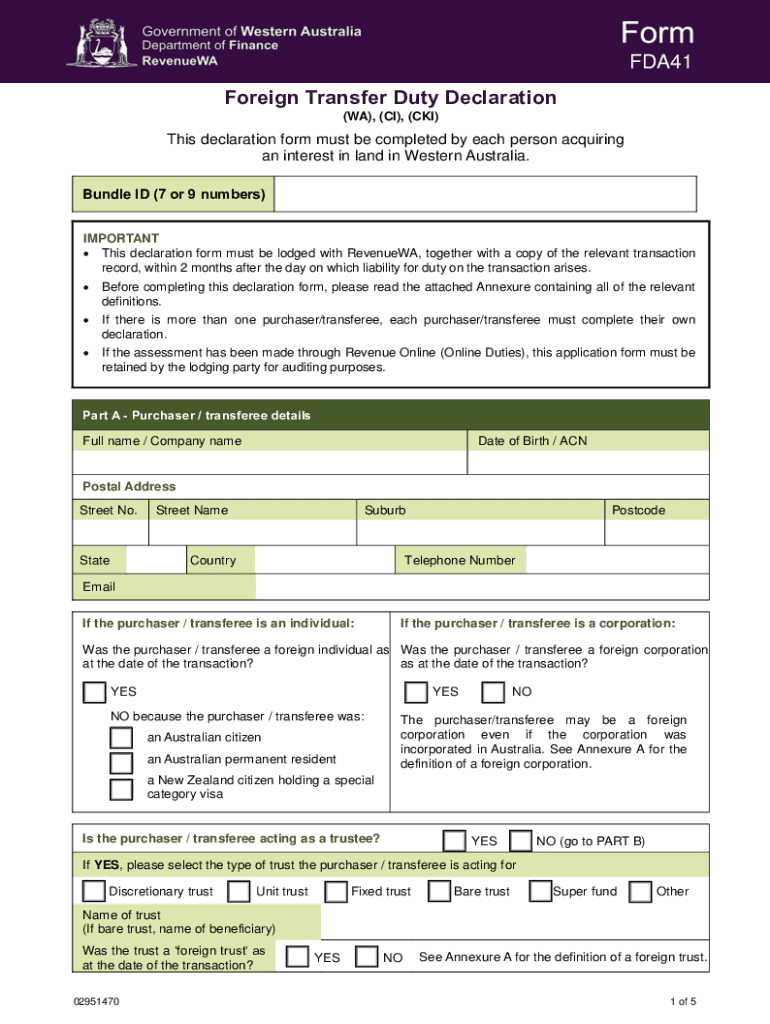

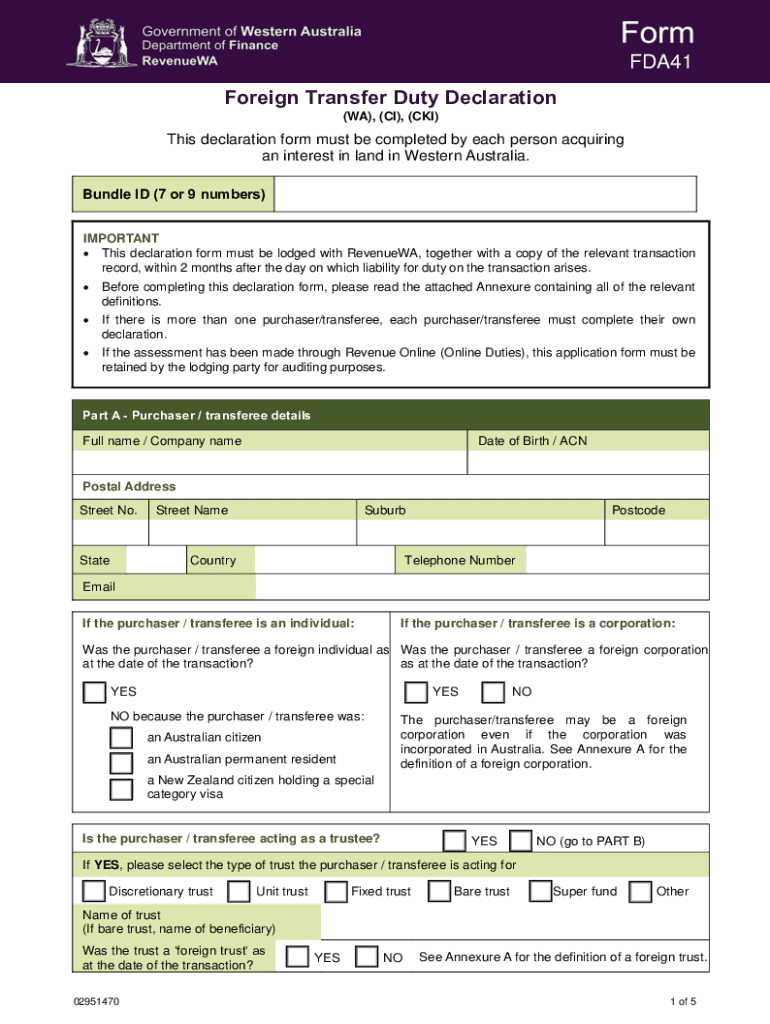

FDA41 Foreign Transfer Duty Declaration (WA), (CI), (SKI)This declaration form must be completed by each person acquiring an interest in land in Western Australia. Bundle ID (7 or 9 numbers) IMPORTANT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign online foreign transfer duty

Edit your online foreign transfer duty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your online foreign transfer duty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit online foreign transfer duty online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit online foreign transfer duty. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out online foreign transfer duty

How to fill out online foreign transfer duty

01

Step 1: Login to your online banking account.

02

Step 2: Navigate to the 'Transfer' or 'Payments' section.

03

Step 3: Select the option for 'International Transfer' or 'Foreign Transfer'.

04

Step 4: Enter the recipient's bank details, including their name, account number, and the SWIFT/BIC code of their bank.

05

Step 5: Fill in the amount you wish to transfer and select the currency.

06

Step 6: Provide any necessary additional information, such as the purpose of the transfer.

07

Step 7: Review the details entered and confirm the transfer.

08

Step 8: Verify the transaction using the OTP or second authentication method provided by your bank.

09

Step 9: Wait for the confirmation message or email from your bank regarding the successful transfer.

10

Step 10: Keep the transaction reference number for future reference.

Who needs online foreign transfer duty?

01

Individuals who need to send money to someone in a foreign country.

02

Businesses or organizations engaged in international trade or transactions.

03

People who need to pay for services or products from foreign suppliers.

04

Students or individuals studying abroad who need to transfer money for living expenses or tuition fees.

05

Expatriates or international workers who need to send money back to their home country.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find online foreign transfer duty?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific online foreign transfer duty and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out the online foreign transfer duty form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign online foreign transfer duty and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit online foreign transfer duty on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign online foreign transfer duty right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is online foreign transfer duty?

Online foreign transfer duty is a tax levied on funds transferred from one country to another through electronic means.

Who is required to file online foreign transfer duty?

Individuals or entities who transfer funds internationally via online platforms are required to file online foreign transfer duty.

How to fill out online foreign transfer duty?

Online foreign transfer duty can be filled out by providing information about the transfer amount, recipient, purpose of transfer, and any other required details on the designated online platform.

What is the purpose of online foreign transfer duty?

The purpose of online foreign transfer duty is to track and monitor funds being transferred across borders to prevent illegal activities such as money laundering and terrorism financing.

What information must be reported on online foreign transfer duty?

Information such as the transfer amount, recipient's details, purpose of transfer, and the source of funds must be reported on online foreign transfer duty.

Fill out your online foreign transfer duty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Online Foreign Transfer Duty is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.