AG Financial Solutions 314/2306T 2015 free printable template

Show details

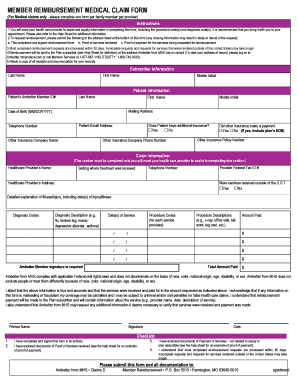

WITHDRAWAL AUTHORIZATION The term IRA will be used below to mean Traditional IRA, unless otherwise specified. Refer to pages 2 and 3 of this form for reporting and withholding notice information.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AG Financial Solutions 3142306T

Edit your AG Financial Solutions 3142306T form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AG Financial Solutions 3142306T form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AG Financial Solutions 3142306T online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AG Financial Solutions 3142306T. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AG Financial Solutions 314/2306T Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AG Financial Solutions 3142306T

How to fill out traditional IRA withdrawal authorization:

01

Obtain the withdrawal authorization form: Start by obtaining the traditional IRA withdrawal authorization form from your financial institution or the custodian of your IRA account. This form is typically available online or can be requested from the institution's customer service.

02

Provide account information: Begin by providing your personal information, such as your full name, address, and contact details. Additionally, you will need to provide your IRA account number and any other identifying information required by the form.

03

Specify withdrawal details: Next, indicate the specific details of your IRA withdrawal. This includes the amount you wish to withdraw, the reason for the withdrawal (e.g., retirement, education expenses, etc.), and the frequency of the withdrawals (one-time or recurring).

04

Choose withdrawal method: Select the preferred method of receiving the funds. This can include options like direct deposit into your bank account, a check mailed to your address, or a wire transfer. Provide the necessary details based on your chosen withdrawal method.

05

Tax withholding preferences: Indicate whether you want any taxes to be withheld from your withdrawal. Depending on your circumstances, you may choose to have a specific percentage or amount withheld to cover potential tax liabilities. Consult a tax professional if you're unsure about the appropriate withholding amount.

06

Signature and date: Before submitting the form, make sure to sign and date it. Ensure that your signature matches the one on file with your financial institution or IRA custodian. Failing to sign the form correctly may result in delays or rejection of your withdrawal request.

Who needs traditional IRA withdrawal authorization?

01

Individuals looking to withdraw funds from their traditional IRA: The traditional IRA withdrawal authorization form is necessary for individuals who hold a traditional IRA and wish to withdraw funds from their account. This form ensures that the withdrawal is carried out in accordance with the IRS regulations and guidelines.

02

Participants planning for retirement: Traditional IRAs are commonly used as retirement savings vehicles. Therefore, individuals who are nearing retirement age and intend to start accessing their IRA funds will require a withdrawal authorization form to initiate the process.

03

Those needing funds for qualified expenses: Traditional IRA funds can be withdrawn penalty-free for certain qualified expenses, such as higher education costs or first-time home purchases. In such cases, individuals will need to complete the withdrawal authorization form to demonstrate that the funds are being used for the designated purposes.

It's important to note that the specific requirements and processes for filling out the traditional IRA withdrawal authorization may vary slightly between financial institutions or IRA custodians. Therefore, it's recommended to consult the provided instructions or contact your financial institution for any additional guidance.

Fill

form

: Try Risk Free

People Also Ask about

Can you take a hardship withdrawal from a traditional IRA?

You can take an IRA hardship withdrawal to pay it down. But you can only do so if you haven't owned another home in the last two years. However, this kind of withdrawal can't exceed $10,000. That's your lifetime limit.

How can I withdraw money from my traditional IRA without penalty?

You can avoid the early withdrawal penalty by waiting until at least age 59 1/2 to start taking distributions from your IRA. Once you turn age 59 1/2, you can withdraw any amount from your IRA without having to pay the 10% penalty. However, regular income tax will still be due on each IRA distribution.

Can you withdraw all money from traditional IRA?

You can take distributions from your IRA (including your SEP-IRA or SIMPLE-IRA) at any time. There is no need to show a hardship to take a distribution. However, your distribution will be includible in your taxable income and it may be subject to a 10% additional tax if you're under age 59 1/2.

What happens if I withdraw money from my traditional IRA?

Generally, early withdrawal from an Individual Retirement Account (IRA) prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. There are exceptions to the 10 percent penalty, such as using IRA funds to pay your medical insurance premium after a job loss.

Is there a limit to what you can withdraw from traditional IRA?

For 2022, $6,000, or $7,000 if you're age 50 or older by the end of the year; or your taxable compensation for the year. For 2023, $6,500, or $7,500 if you're age 50 or older by the end of the year; or your taxable compensation for the year.

What are the rules for withdrawing from a traditional IRA?

Generally, early withdrawal from an Individual Retirement Account (IRA) prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. There are exceptions to the 10 percent penalty, such as using IRA funds to pay your medical insurance premium after a job loss.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AG Financial Solutions 3142306T to be eSigned by others?

Once your AG Financial Solutions 3142306T is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make edits in AG Financial Solutions 3142306T without leaving Chrome?

AG Financial Solutions 3142306T can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my AG Financial Solutions 3142306T in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your AG Financial Solutions 3142306T right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is traditional ira withdrawal authorization?

Traditional IRA withdrawal authorization is a form that allows individuals to request a withdrawal of funds from their traditional IRA account.

Who is required to file traditional ira withdrawal authorization?

Any individual who wants to make a withdrawal from their traditional IRA account is required to file the withdrawal authorization form.

How to fill out traditional ira withdrawal authorization?

To fill out a traditional IRA withdrawal authorization form, an individual needs to provide their personal information, details of the withdrawal amount, and any other required information requested on the form.

What is the purpose of traditional ira withdrawal authorization?

The purpose of traditional IRA withdrawal authorization is to provide authorization and instructions for the withdrawal of funds from a traditional IRA account.

What information must be reported on traditional ira withdrawal authorization?

The traditional IRA withdrawal authorization form typically requires information such as the account holder's name, account number, withdrawal amount, purpose of withdrawal, and any tax withholding preferences.

Fill out your AG Financial Solutions 3142306T online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AG Financial Solutions 3142306t is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.