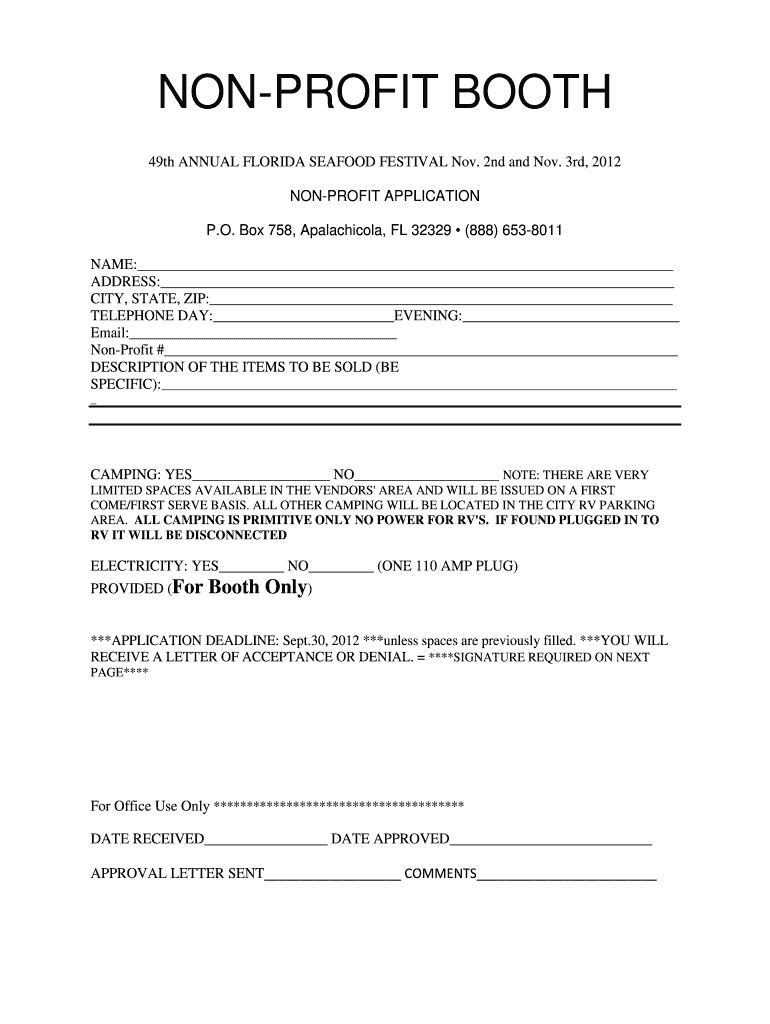

Get the free NON-PROFIT APPLICATION

Show details

Application form for non-profit vendors wishing to participate in the Florida Seafood Festival, including details on booth requirements, submission deadlines, camping options, and indemnification.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-profit application

Edit your non-profit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-profit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

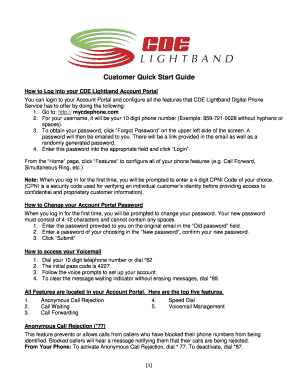

Editing non-profit application online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non-profit application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-profit application

How to fill out NON-PROFIT APPLICATION

01

Begin by downloading the non-profit application form from the relevant government website.

02

Carefully read the instructions provided with the application form.

03

Gather all necessary documents, such as your organization's bylaws, mission statement, and financial projections.

04

Fill out the application form, ensuring all fields are completed accurately.

05

Include a narrative description of your organization’s purpose, programs, and services.

06

Prepare a budget that outlines projected revenues and expenses for the next few years.

07

Review your application for accuracy and completeness before submission.

08

Submit the application form and required documents either online or via mail, as instructed.

Who needs NON-PROFIT APPLICATION?

01

Charitable organizations seeking tax-exempt status.

02

Groups aiming to provide community services or support.

03

Individuals planning to establish a foundation for philanthropic efforts.

04

Organizations wanting to apply for grants that require non-profit status.

Fill

form

: Try Risk Free

People Also Ask about

What is the English word for non profit organization?

voluntary organization. charitable institution. non-profit-making organization. not-for-profit organization. aid agency.

How much is the IRS nonprofit application fee?

The user fee for: Form 1023 is $600.

How hard is it to set up a 501c3?

How much does it cost to set up a 501c3? | Filing with the IRS for tax-exempt status Name of FeeEstimated Fees Articles of Incorporation $20-$100 Charitable Solicitation Registration $25 IRS Tax-exempt Status $275 or $600

How much does it cost to file for a 501c3?

Common mistakes in meeting the Organizational Test can lead to your application's rejection. One frequent issue is incomplete or improper language in the articles of incorporation. For instance, failing to include specific language that reflects your nonprofit's purpose or using vague terms can raise red flags.

Why would a 501c3 be denied?

How long does the 501(c)(3) application process take? For organizations using the shorter Form 1023-EZ, the application can take anywhere between three to four weeks. Applicants using the longer Form 1023 can take between three to six months to hear from the IRS.

Is it hard to apply for a 501c3?

Historically, the IRS denies a very small number of 501(c)(3) applications (less than 1%). It is much more likely that they will ask you questions that seem too hard to answer. As many as 10% of applicants simply give up on their applications for this reason.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NON-PROFIT APPLICATION?

A non-profit application is a formal request submitted to a governing body or agency to establish an organization that operates for charitable, educational, religious, or other public benefit purposes, rather than for profit.

Who is required to file NON-PROFIT APPLICATION?

Organizations seeking to obtain tax-exempt status or to formally incorporate as a non-profit entity are required to file a non-profit application.

How to fill out NON-PROFIT APPLICATION?

To fill out a non-profit application, applicants typically need to provide information about the organization's mission, structure, governance, financial information, and activities. Specific forms vary by jurisdiction.

What is the purpose of NON-PROFIT APPLICATION?

The purpose of a non-profit application is to gain recognition from the government as a non-profit organization, which allows the entity to operate tax-free and receive other benefits associated with non-profit status.

What information must be reported on NON-PROFIT APPLICATION?

The information typically required includes the organization's name, purpose, structure, board of directors, bylaws, and financial statements, as well as details about proposed activities and funding sources.

Fill out your non-profit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Profit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.