Get the free FULL REPORTING CPA LICENSE APPLICATION

Show details

Este formulario es para solicitar la licencia de CPA en el Commonwealth de Massachusetts. Incluye instrucciones detalladas sobre las tarifas, los requisitos de experiencia, las evaluaciones académicas

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign full reporting cpa license

Edit your full reporting cpa license form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your full reporting cpa license form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit full reporting cpa license online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit full reporting cpa license. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out full reporting cpa license

How to fill out FULL REPORTING CPA LICENSE APPLICATION

01

Gather required documents including your educational transcripts, proof of work experience, and identification.

02

Complete the application form, ensuring all sections are accurately filled out.

03

Calculate and include the required fees associated with the application.

04

Submit the application form along with the gathered documents and payment to the appropriate state board.

05

Wait for confirmation and further instructions from the state board regarding any additional steps needed.

Who needs FULL REPORTING CPA LICENSE APPLICATION?

01

Individuals who have completed the required education and experience in accounting.

02

Those who intend to work as Certified Public Accountants (CPAs) in states that require full reporting.

03

Accountants seeking to comply with state licensing regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the fastest path to CPA?

Pursuing a degree in Commerce or Business (with a major in accounting) is your quickest route to earning a professional accounting designation.

Are CPA requirements different in each state?

To meet your state's Certified Public Accountant requirements, you must fulfill education and experience minimums and pass the CPA Exam. Some states also have requirements related to ethics, residency, and age. Again, while every state is different, learn the minimum recommendations below.

Which US state is best for CPA?

All states require 150 credit hours, but there are nuances and other potential requirements. New York. Salary. New York offers some of the highest salaries for CPAs, with an average annual salary of around $95,000. Texas. Salary. 3. California. Salary. Florida. Salary. Illinois. Salary. Georgia. Salary.

How do you put a CPA license on a resume?

If you want to pursue a career in public accounting, such as working for a large accounting firm, then you may have to become a CPA to pursue your goals. If you plan to work as an accountant within a private company, such as a small or medium sized corporation, becoming a CPA may not be a job requirement.

Which state has the easiest CPA requirements?

In total, it takes about seven years to become a CPA. However, that includes the four years of college you're probably either close to finishing or have already finished. Here's a breakdown: You'll need 150 semester hours (225 quarter hours) which takes most people around five years.

Can I pass the CPA in 3 months?

Passing the CPA (Certified Public Accountant) exam in three months is challenging but possible, depending on several factors, including your prior knowledge, study habits, and the amount of time you can dedicate to studying each week. Here are some key points to consider:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FULL REPORTING CPA LICENSE APPLICATION?

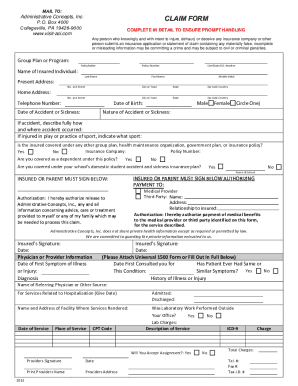

The FULL REPORTING CPA LICENSE APPLICATION is a formal document that Certified Public Accountants (CPAs) must complete to obtain or renew their CPA license. This application includes detailed information about the applicant's education, work experience, and compliance with continuing education requirements.

Who is required to file FULL REPORTING CPA LICENSE APPLICATION?

Individuals who wish to obtain or renew a CPA license are required to file the FULL REPORTING CPA LICENSE APPLICATION. This typically includes newly qualified CPAs, those seeking re-licensure after a lapse, and CPAs changing their state of practice.

How to fill out FULL REPORTING CPA LICENSE APPLICATION?

To fill out the FULL REPORTING CPA LICENSE APPLICATION, applicants need to gather their educational qualifications, work experience, and any relevant continuing professional education credits. They must accurately complete each section of the application form, ensuring that all information is current and complete before submission.

What is the purpose of FULL REPORTING CPA LICENSE APPLICATION?

The purpose of the FULL REPORTING CPA LICENSE APPLICATION is to provide regulatory bodies with the necessary information to assess an applicant's qualifications and compliance with professional standards, ensuring that only competent individuals are licensed to practice as CPAs.

What information must be reported on FULL REPORTING CPA LICENSE APPLICATION?

The FULL REPORTING CPA LICENSE APPLICATION must include information such as the applicant's personal details, educational background, professional experience, proof of continuing education, and any disciplinary actions or criminal history, if applicable.

Fill out your full reporting cpa license online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Full Reporting Cpa License is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.