Get the free www.irs.govprivacy-disclosureirs-surveysIRS SurveysInternal Revenue Service

Show details

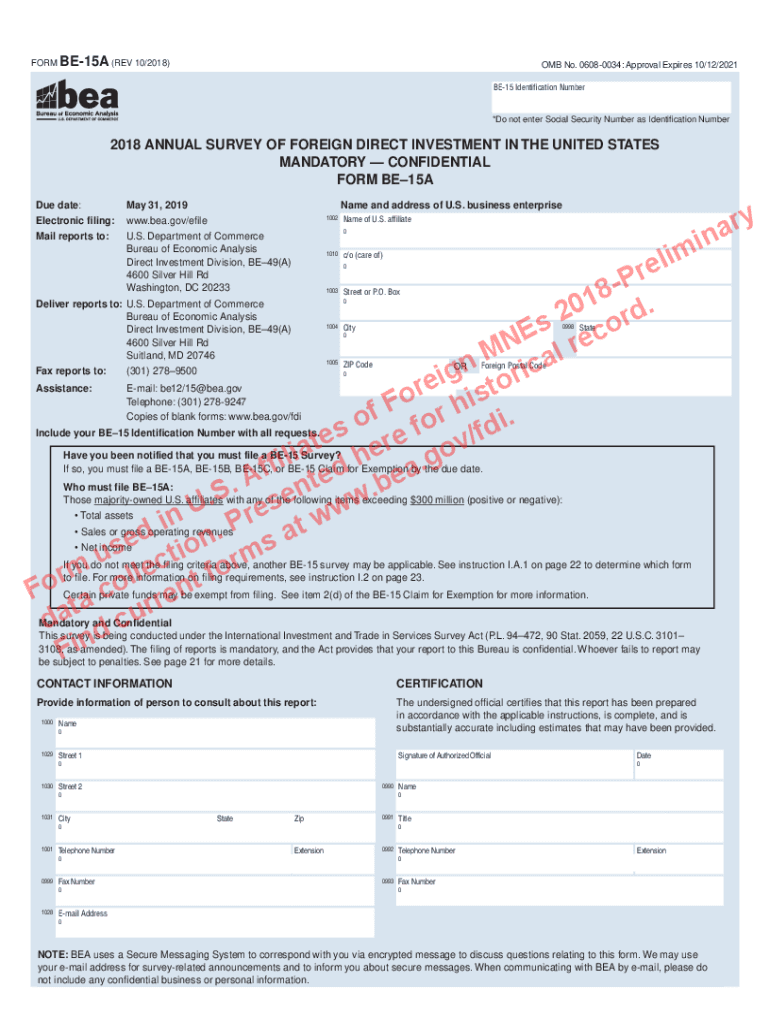

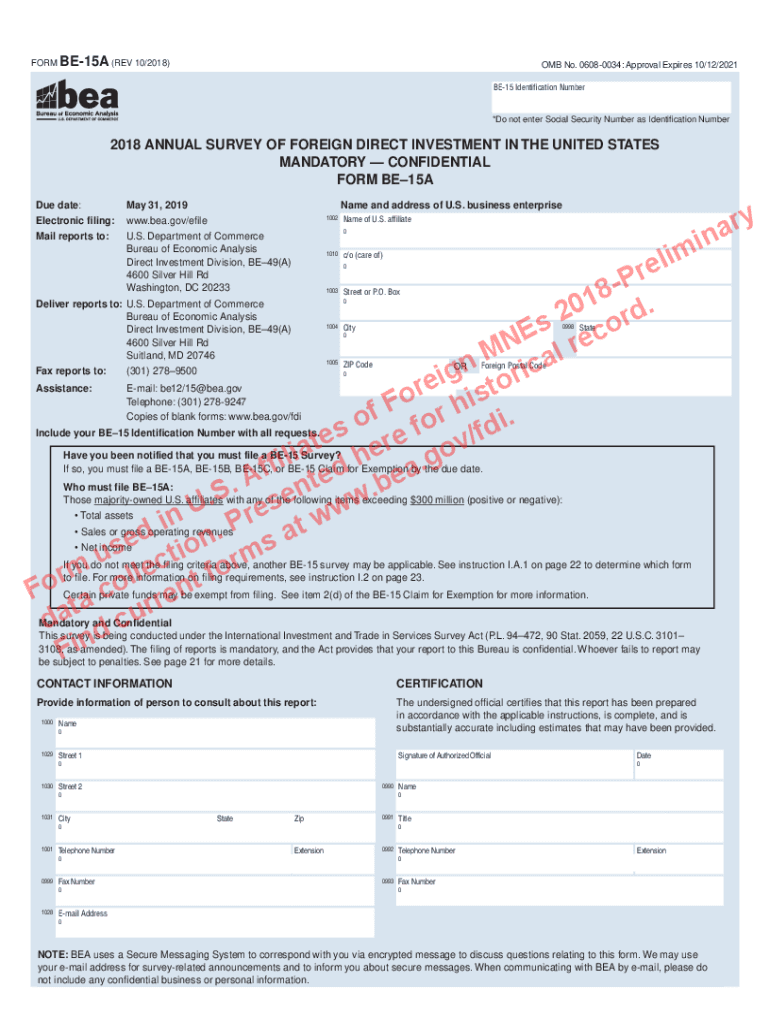

FORM BE15A (REV 10/2018)OMB No. 06080034: Approval Expires 10/12/2021 BEA12Identication IdenticationNumber Number BE15×Do not enter Social Security Number as Identification Number2018 ANNUAL SURVEY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service

Edit your wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service online

To use the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service

How to fill out wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service

01

To fill out wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service, follow these steps:

02

Access the official website of the Internal Revenue Service (IRS), which is www.irs.gov.

03

Look for the 'Privacy Disclosure' section on the IRS website. It is usually located at the bottom of the page.

04

Click on the 'Disclosure Surveys' link within the 'Privacy Disclosure' section.

05

You will be redirected to the IRS surveys page. Read the instructions and information provided on the page.

06

Choose the specific survey you want to fill out by clicking on its title or corresponding link.

07

Carefully read the survey questions and provide accurate and honest responses.

08

Fill out all the required fields and answer the optional questions if you wish.

09

Review your answers before submitting the survey to ensure they are correct.

10

Click on the 'Submit' or 'Finish' button to submit your survey electronically.

11

Once submitted, you may receive a confirmation message or notification.

12

Remember to provide truthful information and follow any additional instructions or guidelines provided by the IRS.

Who needs wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service?

01

Various individuals and entities may need to fill out wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service. These include:

02

- Taxpayers who have been selected for IRS surveys as part of random sampling or targeted research.

03

- Individuals or businesses who have specific knowledge or experiences related to the survey's subject matter.

04

- Researchers, economists, or statisticians who collaborate with the IRS and contribute to data analysis and policymaking.

05

- Professionals in the tax or financial industry who are involved in IRS-related activities and seek to provide feedback or suggestions.

06

- Individuals or organizations interested in improving IRS services, policies, or procedures by sharing their experiences or opinions.

07

It is important to note that not everyone is required to fill out IRS surveys. The need to fill out a survey depends on specific circumstances and purposes determined by the IRS.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service and other forms. Find the template you need and change it using powerful tools.

How do I complete wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service online?

pdfFiller has made filling out and eSigning wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service?

The wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service is a survey conducted by the Internal Revenue Service to gather information related to privacy and disclosure policies.

Who is required to file wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service?

Taxpayers and businesses may be required to file the wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service depending on their specific circumstances.

How to fill out wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service?

The wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service can typically be filled out online on the IRS website or through other designated channels.

What is the purpose of wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service?

The purpose of the wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service is to collect important data related to privacy and disclosure practices for compliance purposes.

What information must be reported on wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service?

The wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service may require information such as personal identification details, specific privacy policies, and disclosure practices.

Fill out your wwwirsgovprivacy-disclosureirs-surveysirs surveysinternal revenue service online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wwwirsgovprivacy-Disclosureirs-Surveysirs Surveysinternal Revenue Service is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.