Get the free Salary Reduction Agreement Tax Sheltered Annuity Plans 403 ...

Show details

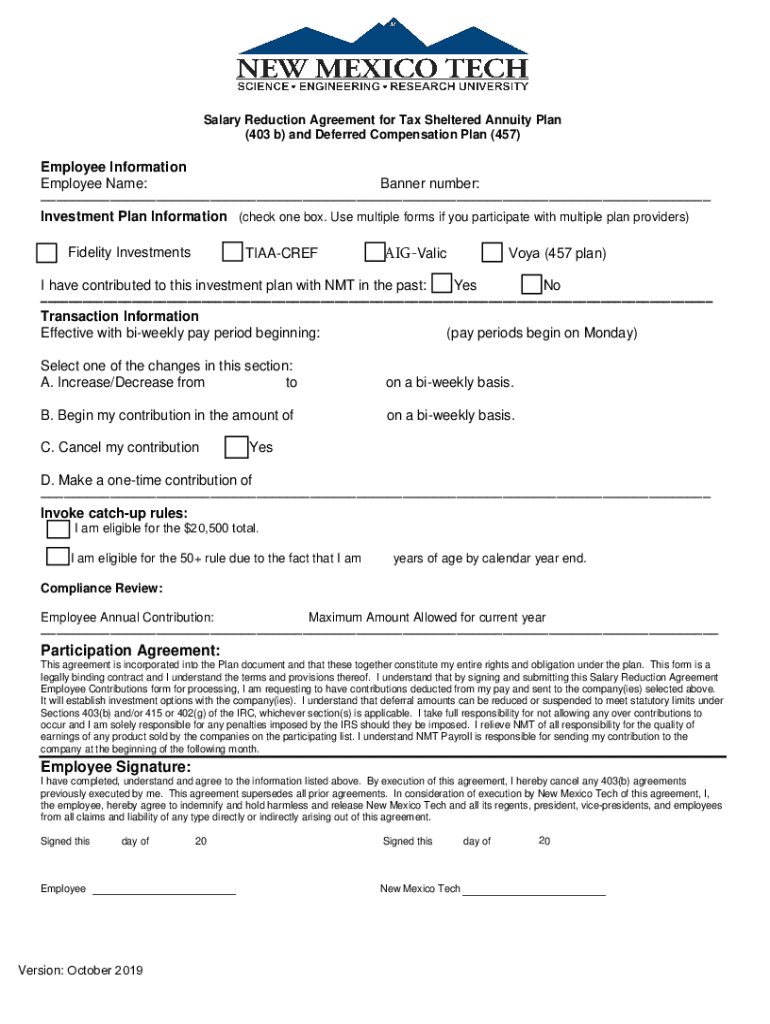

Salary Reduction Agreement for Tax Sheltered Annuity Plan (403 b) and Deferred Compensation Plan (457)Employee Information Banner number: Employee Name: Investment Plan Information (check one box.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign salary reduction agreement tax

Edit your salary reduction agreement tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your salary reduction agreement tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit salary reduction agreement tax online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit salary reduction agreement tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out salary reduction agreement tax

How to fill out salary reduction agreement tax

01

Gather all necessary information and documents such as the employer's Tax ID, employee's Social Security Number, and the existing employment contract.

02

Consult with a tax professional or an employment lawyer to ensure compliance with all relevant laws and regulations.

03

Draft a salary reduction agreement tax, specifying the terms of the reduction, the effective date, and the reason for the reduction.

04

Include provisions regarding any temporary or permanent changes to the employee's benefits or compensation.

05

Have both the employer and the employee review and sign the agreement to indicate their understanding and acceptance of the terms.

06

Retain a copy of the signed agreement for both parties' records.

07

Implement the agreed-upon salary reduction and ensure that all necessary adjustments are made to the employee's payroll and tax withholdings.

08

Monitor and track any changes in applicable tax laws or regulations that may affect the salary reduction agreement and make adjustments as necessary.

09

Periodically review the salary reduction agreement to assess its effectiveness and make any required updates or modifications.

Who needs salary reduction agreement tax?

01

Employers who are facing financial difficulties and need to reduce their labor costs may use a salary reduction agreement tax.

02

Employees who agree to a salary reduction to help their employer maintain operations or mitigate financial hardship may also be involved in the agreement.

03

Consulting with a tax professional or an employment lawyer is advisable for both employers and employees to understand the legal and tax implications of a salary reduction agreement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send salary reduction agreement tax to be eSigned by others?

When you're ready to share your salary reduction agreement tax, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for the salary reduction agreement tax in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your salary reduction agreement tax in seconds.

How do I fill out the salary reduction agreement tax form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign salary reduction agreement tax and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is salary reduction agreement tax?

Salary reduction agreement tax is a tax on the reduction in an employee's salary due to an agreement with the employer to reduce compensation in exchange for certain benefits or perks.

Who is required to file salary reduction agreement tax?

Employers are required to file salary reduction agreement tax on behalf of their employees who have entered into such agreements.

How to fill out salary reduction agreement tax?

To fill out salary reduction agreement tax, employers must accurately report the reduction in salary for each employee and any corresponding benefits or perks received.

What is the purpose of salary reduction agreement tax?

The purpose of salary reduction agreement tax is to ensure that the reduction in an employee's salary is properly documented and taxed according to the relevant regulations.

What information must be reported on salary reduction agreement tax?

On salary reduction agreement tax, employers must report the employee's name, social security number, the amount of salary reduction, and any benefits or perks received in exchange for the reduction.

Fill out your salary reduction agreement tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Salary Reduction Agreement Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.