Get the free Group Term Life Insurance Coverage - IN.gov

Show details

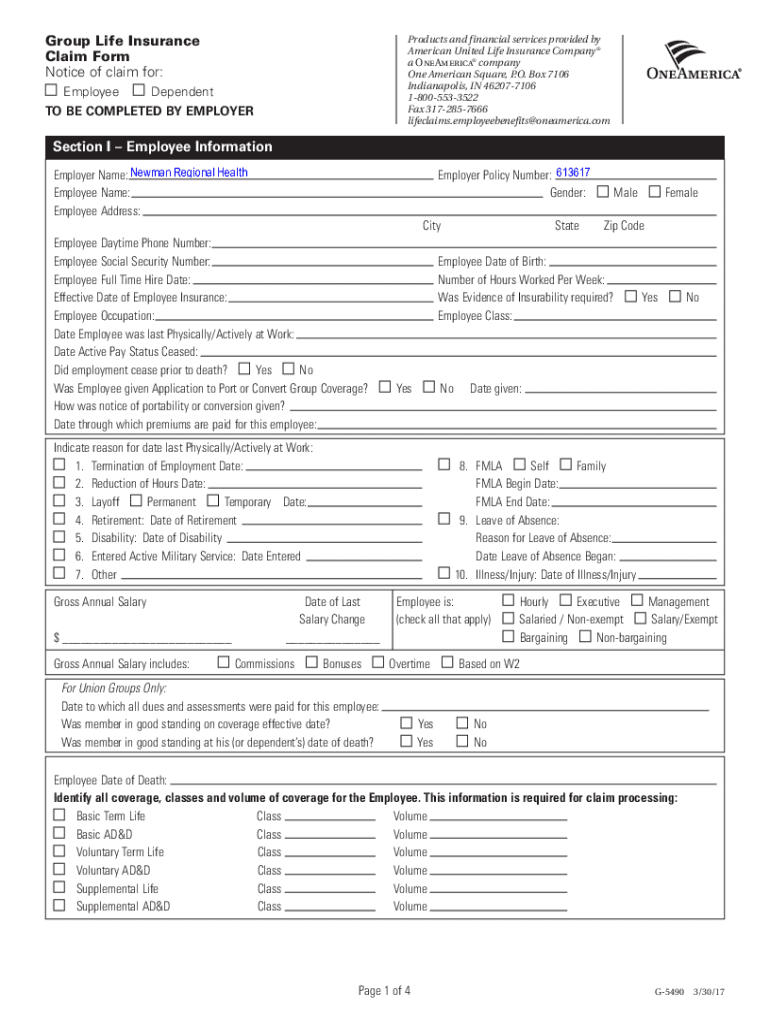

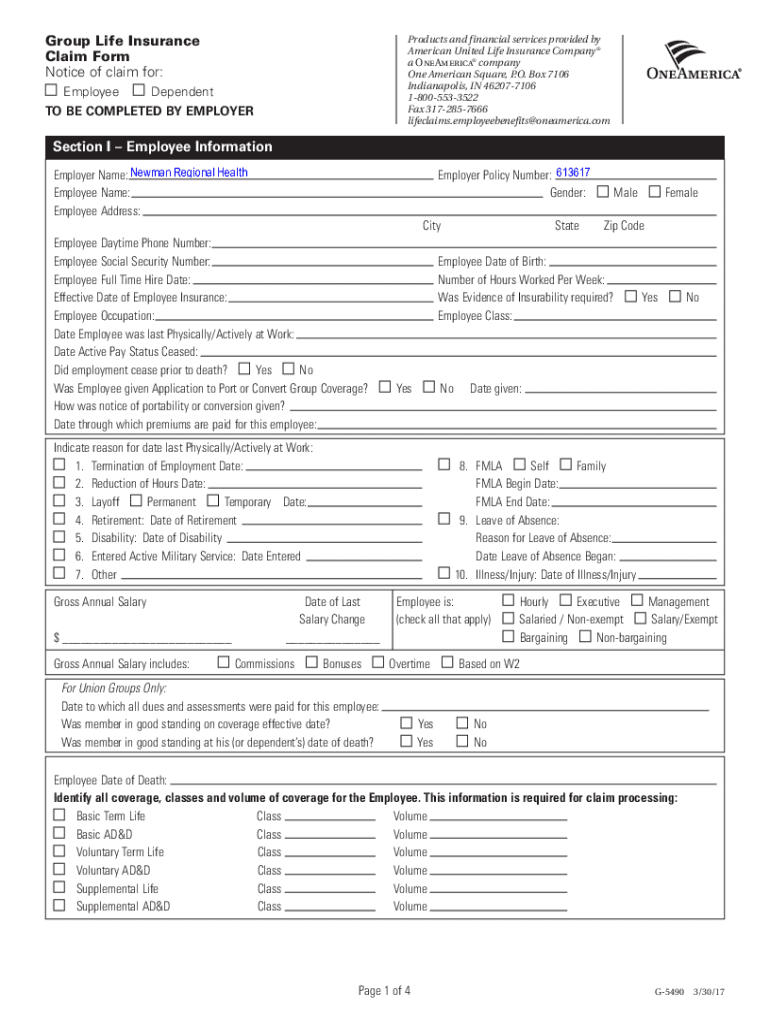

Products and financial services provided by American United Life Insurance Company a One America company One American Square, P.O. Box 7106 Indianapolis, IN 462077106 18005533522 Fax 3172857666 life

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group term life insurance

Edit your group term life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group term life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit group term life insurance online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit group term life insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group term life insurance

How to fill out group term life insurance

01

To fill out a group term life insurance policy, follow these steps:

02

Contact the insurance provider: Reach out to the insurance company that offers group term life insurance. They will guide you through the process and provide the necessary forms and documents.

03

Gather required information: Collect all the necessary details about the insured individuals and their beneficiaries. This may include personal information, such as names, dates of birth, and contact information.

04

Determine coverage amount: Discuss with the insurance provider the coverage amount required for the group term life insurance policy. This can be based on factors like salary multiples or a fixed amount per employee.

05

Complete the application forms: Fill out the application forms provided by the insurance company. Ensure that all the information is accurate and complete.

06

Submit the forms: Submit the completed forms along with any additional documents requested by the insurance provider. This may include proof of employment, medical records, or beneficiary designations.

07

Review and confirm: Review all the filled-out forms and double-check the information for accuracy. Confirm that you have provided all the necessary documents.

08

Make payment: Pay the premiums for the group term life insurance policy as per the payment terms agreed upon with the insurance provider.

09

Receive policy documents: Once the application is processed and approved, you will receive the policy documents from the insurance company. Review them carefully and keep them in a safe place.

10

Communicate policy details to employees: If you are an employer providing group term life insurance to your employees, make sure to communicate the policy details to all eligible employees. They should be aware of the coverage, beneficiary information, and any other relevant details.

11

Maintain and update the policy: Regularly review the group term life insurance policy and ensure that it remains up to date. Update any changes in employee information or beneficiary details as needed.

Who needs group term life insurance?

01

Group term life insurance is suitable for various individuals and organizations, including:

02

- Employers: Companies can offer group term life insurance as an employee benefit to attract and retain talented employees. It provides financial protection to the employees' families in case of their untimely death.

03

- Employees: Individuals who belong to an organization that provides group term life insurance can benefit from the coverage. It helps ensure their dependents are financially secure if something were to happen to them.

04

- Non-profit organizations or associations: These entities can offer group term life insurance to their members or employees, providing them with valuable life insurance coverage.

05

- Mortgage holders: Homeowners with a mortgage may consider group term life insurance to protect their family from the burden of the mortgage payments if the insured person passes away.

06

- Parents: Parents who want to secure the financial future of their dependent children can opt for group term life insurance.

07

- Business partners: Partners in a business can protect each other by obtaining group term life insurance policies that offer coverage in case of the death of one of the partners.

08

It is essential to consult with an insurance professional to determine if group term life insurance is suitable for your specific needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get group term life insurance?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the group term life insurance in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an eSignature for the group term life insurance in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your group term life insurance right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit group term life insurance on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit group term life insurance.

What is group term life insurance?

Group term life insurance is a type of life insurance coverage provided to a group of people, usually employees of a company or members of an organization.

Who is required to file group term life insurance?

Employers or organizations are typically required to file group term life insurance on behalf of their employees or members.

How to fill out group term life insurance?

To fill out group term life insurance, employers or organizations need to provide basic information about the insured individuals, such as their names, dates of birth, and coverage amounts.

What is the purpose of group term life insurance?

The purpose of group term life insurance is to provide financial protection to employees or members and their beneficiaries in the event of death.

What information must be reported on group term life insurance?

Information such as the names and ages of insured individuals, coverage amounts, beneficiaries, and premium payments must be reported on group term life insurance.

Fill out your group term life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Term Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.