WV PTE-100EXT 2021-2025 free printable template

Show details

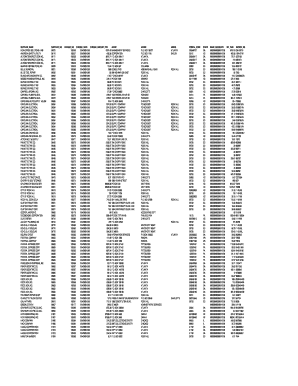

PTE100EXT Form PTE1002021Extension of Time to File Information ReturnsFEINEXTENDED DUE DATETAX YEAR BEGINNINGENDING MMDDYYYYMMDDYYYYTYPE OF BUSINESSBUSINESS NAME AND ADDRESS(CHECK ONLY ONE)Partnership

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pte 100ext 2021-2025 form

Edit your pte 100ext 2021-2025 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pte 100ext 2021-2025 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pte 100ext 2021-2025 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pte 100ext 2021-2025 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WV PTE-100EXT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pte 100ext 2021-2025 form

How to fill out WV PTE-100EXT

01

Gather necessary documentation including income statements, W-2s, and any relevant receipts.

02

Download the WV PTE-100EXT form from the West Virginia State Tax Department website.

03

Fill in your personal information at the top of the form, including your name, address, and tax identification number.

04

Enter your business or entity information if applicable.

05

Complete the income and expense sections, providing accurate figures for the tax year.

06

Calculate your total income and any deductions or adjustments.

07

Review the instructions for any additional credits or exemptions you may qualify for.

08

Sign and date the form before submitting it to the appropriate tax authority.

Who needs WV PTE-100EXT?

01

Businesses or individuals in West Virginia that are seeking an extension to file their tax returns.

02

Taxpayers who have a valid reason for needing more time beyond the standard filing deadline.

03

Individuals or entities that anticipate owing taxes and need to establish an extension to avoid late penalties.

Fill

form

: Try Risk Free

People Also Ask about

Does West Virginia have a state tax form?

The regular deadline to file a West Virginia state income tax return is April 15. Find additional information about West Virginia state tax forms, West Virginia state tax filing instructions, and government information.Efile-West-Virginia-Tax-Return. Form Name:Instructions:WV-8453Mail in WV-8453

How do I pay West Virginia state taxes?

You can use the Pay Personal Income Tax link on the MyTaxes Website. website to begin remitting payments electronically using the ACH Debit method. Credit Cards – All major credit cards accepted. You can visit the Credit Card Payments page for more information.

Can I pay my WV personal property tax online?

Welcome to the Wood County Courthouse online tools page for paying your personal property taxes online, filing your yearly personal property report online, payment for meeting rooms and park shelters, and online payments for building permits.

How do I contact the West Virginia State tax Department?

All inquiries about tax returns should be directed to one of the Regional Office Locations listed below or by calling 304-558-3333 or 800-982-8297 during regular business hours.

Does West Virginia have a personal property tax?

West Virginia residents, and non-residents, who own personal property located in West Virginia are required to pay personal property taxes, which are collected by the Office of the Sheriff. Taxes are payable semi-annually and are due on September 1 and March 1.

How do I find my personal property tax in WV?

How can I find how much I owe? Either call our office at 357-0210 or you may look your taxes up online by clicking on the 'Tax Inquiry' link.

What is West Virginia's tax ID number?

The West Virginia Tax Identification Number is your nine character ID number plus a three digit adjustment code. Personal Income Tax filers should enter '000' in this field. Business filers are defaulted to '001'.

What is the non resident withholding tax in West Virginia?

The withholding tax rate is 6.5% of distributions of West Virginia source income (whether actual or deemed distributions).

How do I pay my West Virginia state income tax?

You can use the Pay Personal Income Tax link on the MyTaxes Website. website to begin remitting payments electronically using the ACH Debit method. Credit Cards – All major credit cards accepted. You can visit the Credit Card Payments page for more information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pte 100ext 2021-2025 form to be eSigned by others?

When your pte 100ext 2021-2025 form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete pte 100ext 2021-2025 form online?

pdfFiller makes it easy to finish and sign pte 100ext 2021-2025 form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I complete pte 100ext 2021-2025 form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your pte 100ext 2021-2025 form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is WV PTE-100EXT?

WV PTE-100EXT is a form used by pass-through entities in West Virginia to request an extension of time to file their income tax returns.

Who is required to file WV PTE-100EXT?

Pass-through entities, such as partnerships and S corporations, that need additional time beyond the original due date to file their income tax returns are required to file WV PTE-100EXT.

How to fill out WV PTE-100EXT?

To fill out WV PTE-100EXT, you need to provide the entity's name, address, and Federal Employer Identification Number (FEIN), and indicate the extension period requested along with any applicable signature.

What is the purpose of WV PTE-100EXT?

The purpose of WV PTE-100EXT is to formally request an extension of time to submit tax documents for pass-through entities in West Virginia.

What information must be reported on WV PTE-100EXT?

The form must report the entity's name, address, FEIN, the period for which the extension is being requested, and any other relevant details required by the West Virginia State Tax Department.

Fill out your pte 100ext 2021-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pte 100ext 2021-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.