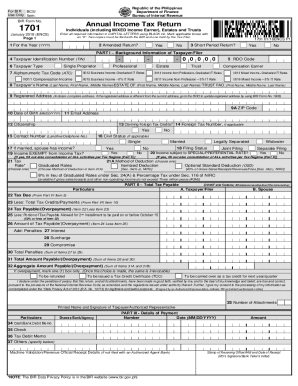

AZ DoR 140NR 2021 free printable template

Show details

DO NOT STAPLE ANY ITEMS TO THE RETURN. Check box 82F

if filing under extension82F

1

1

2

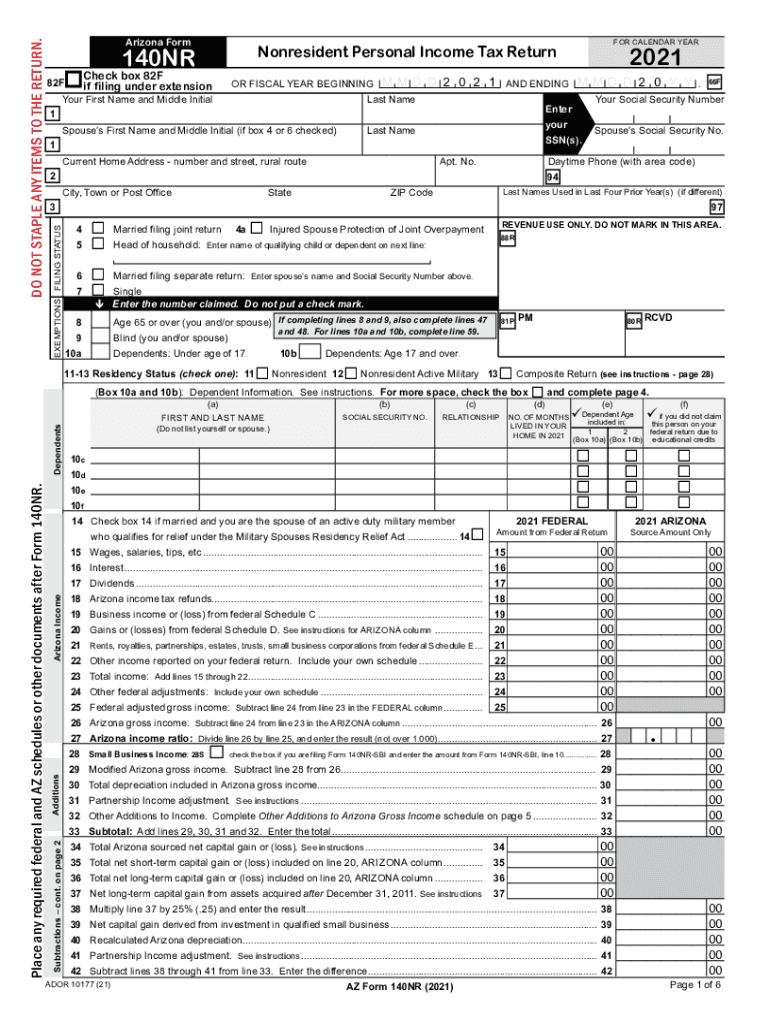

3FOR CALENDAR YEARNonresident Personal Income Tax Return140NROR FISCAL YEAR BEGINNING MM D 2 0 2 1Your First

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ DoR 140NR

How to edit AZ DoR 140NR

How to fill out AZ DoR 140NR

Instructions and Help about AZ DoR 140NR

How to edit AZ DoR 140NR

To edit the AZ DoR 140NR form, you may want to use pdfFiller's editing tools. Simply upload your completed form to the platform, where you can add or remove information easily, ensuring that all details are current and accurate before submission.

How to fill out AZ DoR 140NR

To fill out the AZ DoR 140NR, follow these steps:

01

Gather necessary personal and financial information, such as your Social Security number, income details, and tax deductions.

02

Download the AZ DoR 140NR form from the Arizona Department of Revenue website or access it through pdfFiller.

03

Fill in all required fields accurately, ensuring all entries are legible.

04

Review the completed form for any discrepancies or missing information.

05

Save a copy of the filled form for your records before submission.

About AZ DoR 140NR 2021 previous version

What is AZ DoR 140NR?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ DoR 140NR 2021 previous version

What is AZ DoR 140NR?

AZ DoR 140NR is the Arizona Department of Revenue Non-Resident Income Tax Return form. This form is specifically designed for individuals who earn income in Arizona but do not reside in the state. The form ensures that non-residents report their Arizona-source income accurately for tax purposes.

What is the purpose of this form?

The primary purpose of the AZ DoR 140NR form is to facilitate the reporting and taxation of income earned by non-residents in Arizona. By using this form, filers comply with state tax laws and ensure proper assessment of their tax obligations.

Who needs the form?

Individuals who earned income from sources within Arizona but are not legal residents of the state must file the AZ DoR 140NR. This includes non-residential workers, contractors, and individuals with Arizona-based business interests or rental income.

When am I exempt from filling out this form?

You are exempt from filing the AZ DoR 140NR if your only income from Arizona is below the threshold set by the state or if you have no taxable income related to Arizona sources. Review Arizona tax regulations or consult a tax professional for detailed exemption criteria.

Components of the form

The AZ DoR 140NR consists of various sections, including personal identification information, income details, deductions, and credits applicable to non-residents. Each section requires accurate reporting to ensure proper taxation.

What are the penalties for not issuing the form?

Failing to file the AZ DoR 140NR when required can lead to penalties imposed by the Arizona Department of Revenue. These penalties may include fines, interest on unpaid taxes, and possible legal action to recover due taxes.

What information do you need when you file the form?

When filing the AZ DoR 140NR, you will need your Social Security number, a valid form of identification, details of income earned in Arizona, and documentation for any deductions or credits you wish to claim. Accurate records are essential for proper filing.

Is the form accompanied by other forms?

Typically, the AZ DoR 140NR form may need to be filed alongside other documentation, such as federal tax returns or schedules reflecting your income. Check the instructions carefully to confirm any additional forms required for your specific situation.

Where do I send the form?

The completed AZ DoR 140NR form should be sent to the Arizona Department of Revenue at the address specified on the form's filing instructions. Ensure that you allow sufficient time for processing, considering submission deadlines.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I am currently reviewing how much I would actually have to use the PC Filler to see whether I need to subscribe. Thank you.

Very easy to use. Enjoy using this program.

See what our users say