Get the free Charitable Remainder Trust Application

Show details

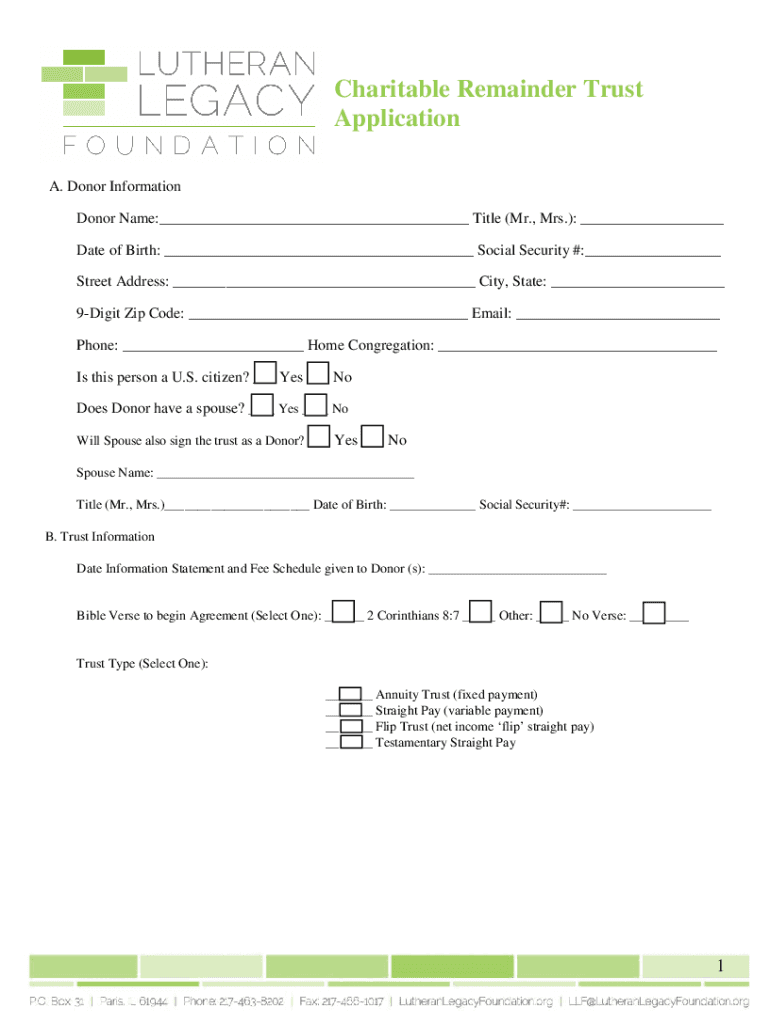

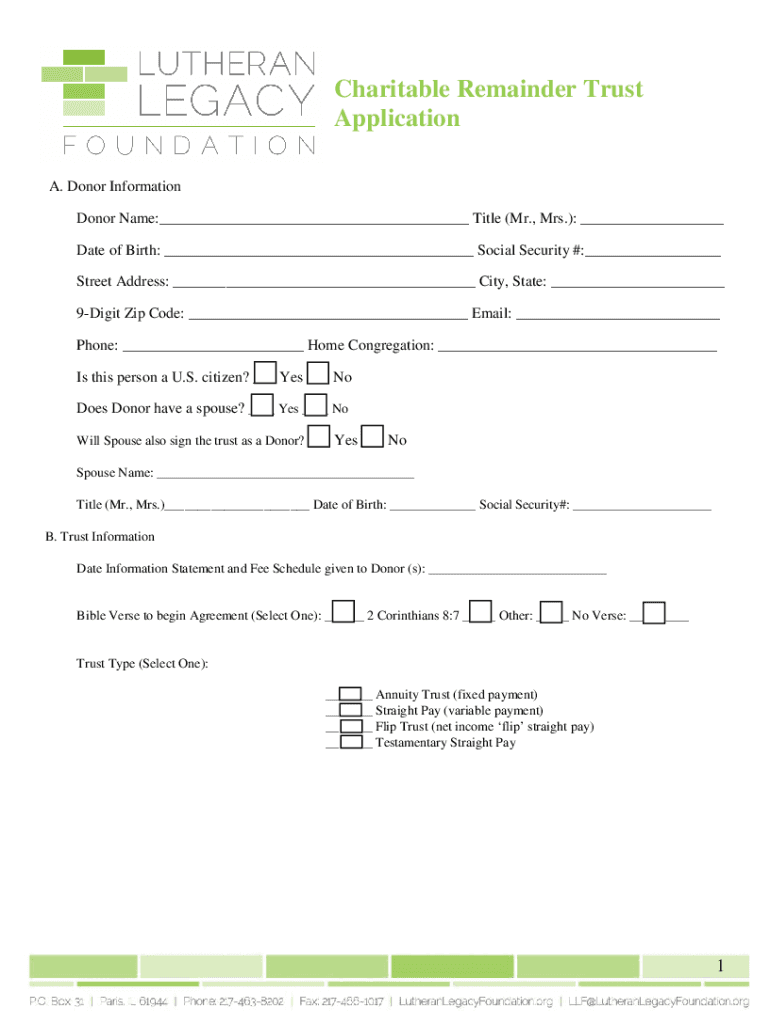

Charitable Remainder Trust Application A. Donor Information Donor Name:___ Title (Mr., Mrs.): ___ Date of Birth: ___ Social Security #:___ Street Address: ___ City, State: ___ 9Digit Zip Code: ___

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable remainder trust application

Edit your charitable remainder trust application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable remainder trust application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charitable remainder trust application online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit charitable remainder trust application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable remainder trust application

How to fill out charitable remainder trust application

01

To fill out a charitable remainder trust application, follow these steps:

02

Gather all the necessary documents and information, including your personal information, the details of the assets you plan to contribute, and the names of any charitable beneficiaries.

03

Begin by filling out the application form, providing accurate and complete information.

04

Attach any supporting documents required by the application, such as copies of trust agreements or asset appraisals.

05

If necessary, consult with an attorney or financial advisor to ensure you are accurately completing the application and maximizing the benefits of the trust.

06

Review the completed application form and attached documents for any errors or missing information before submitting.

07

Submit the application according to the instructions provided, whether it be through mail, fax, or an online submission portal.

08

Keep a copy of the submitted application for your records.

09

Follow up with the organization handling the charitable remainder trust application to ensure it has been received and is being processed.

10

If necessary, provide any additional information or documentation requested by the organization during the review process.

11

Once approved, carefully review the terms of the charitable remainder trust agreement before signing it.

12

Fulfill any funding requirements and finalize the establishment of the trust as outlined in the agreement.

13

Monitor the charitable remainder trust over time and make any necessary adjustments as your circumstances or charitable goals change.

Who needs charitable remainder trust application?

01

Anyone who wishes to support charitable causes and gain potential tax benefits may consider filling out a charitable remainder trust application.

02

Individuals who have significant assets they would like to contribute to a charitable cause but also wish to receive income from those assets during their lifetime may benefit from a charitable remainder trust.

03

People who want to create a lasting impact through philanthropy while still providing for their own financial needs or the needs of their beneficiaries may find a charitable remainder trust application useful.

04

Donors who desire flexibility in how the donated assets are invested and distributed by the charitable trust may opt to fill out a charitable remainder trust application.

05

Those who want to reduce their taxable income and potentially minimize estate taxes may also consider taking advantage of a charitable remainder trust.

06

It is advisable to consult with an attorney or financial advisor to determine if a charitable remainder trust application is suitable for your specific circumstances and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit charitable remainder trust application online?

The editing procedure is simple with pdfFiller. Open your charitable remainder trust application in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my charitable remainder trust application in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your charitable remainder trust application and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit charitable remainder trust application straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing charitable remainder trust application, you need to install and log in to the app.

What is charitable remainder trust application?

Charitable remainder trust application is a formal request submitted to establish a trust where assets are placed in a trust and income is paid to beneficiaries, with the remainder going to charity upon the death of the beneficiaries.

Who is required to file charitable remainder trust application?

Individuals or organizations looking to establish a charitable remainder trust are required to file the application.

How to fill out charitable remainder trust application?

To fill out a charitable remainder trust application, individuals must provide detailed information about the assets being placed in the trust, the beneficiaries, and the designated charity.

What is the purpose of charitable remainder trust application?

The purpose of a charitable remainder trust application is to establish a trust where beneficiaries receive income from the trust assets and the remaining assets are donated to charity upon their death.

What information must be reported on charitable remainder trust application?

Information required on a charitable remainder trust application includes details about the trust assets, beneficiaries, and the charity receiving the remainder of the assets.

Fill out your charitable remainder trust application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Remainder Trust Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.