LA LDR CIFT-620EXT-V 2021 free printable template

Show details

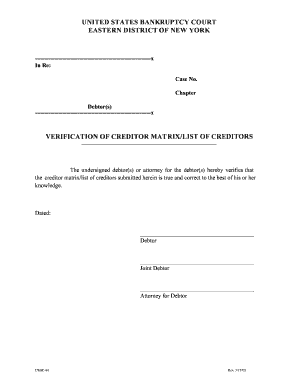

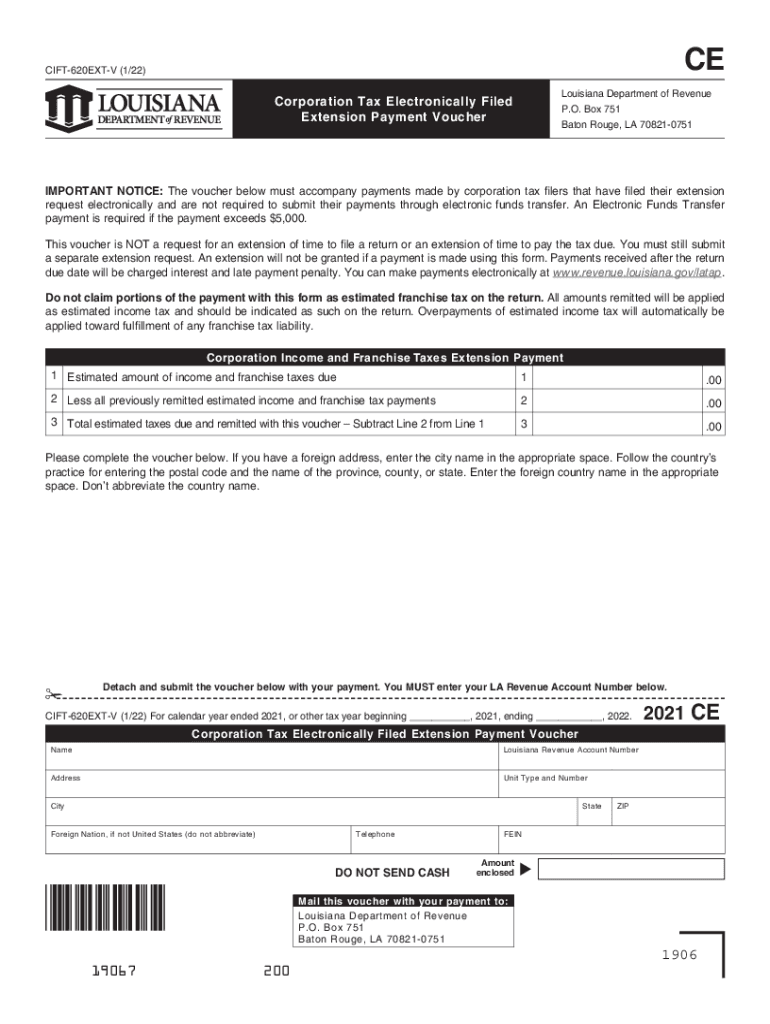

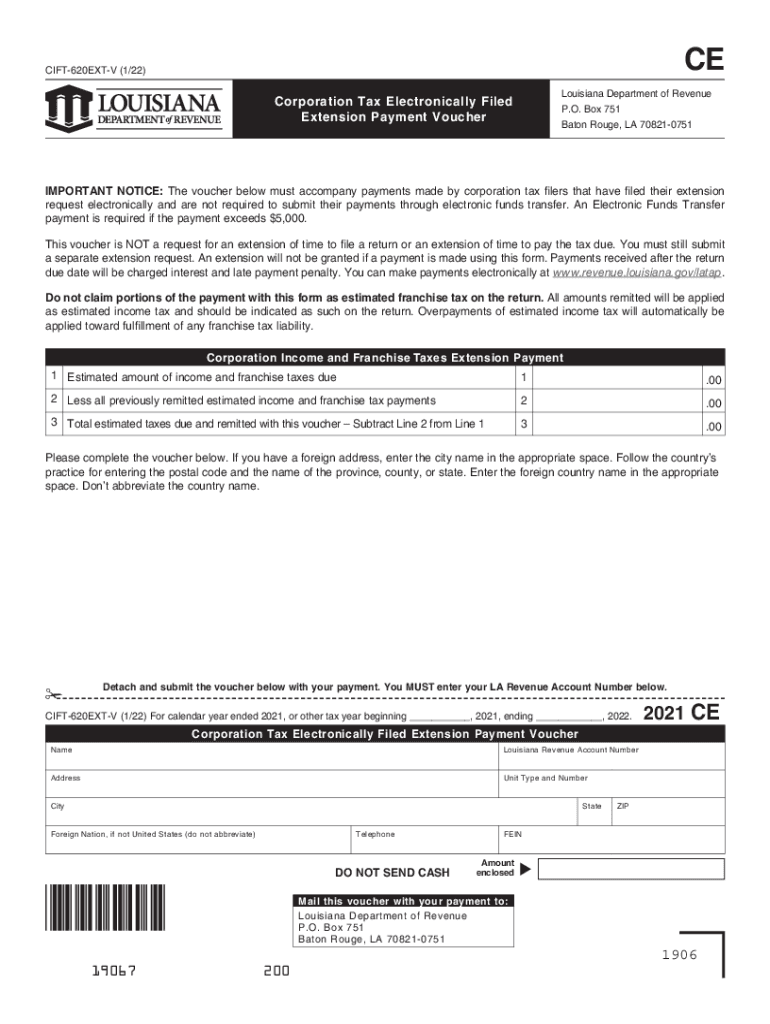

CECIFT620EXTV (1/22)Louisiana Department of Revenue P.O. Box 751 Baton Rouge, LA 708210751Corporation Tax Electronically Filed Extension Payment VoucherIMPORTANT NOTICE: The voucher below must accompany

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ce - revenuelouisianagovhome page

Edit your ce - revenuelouisianagovhome page form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ce - revenuelouisianagovhome page form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ce - revenuelouisianagovhome page online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ce - revenuelouisianagovhome page. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA LDR CIFT-620EXT-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ce - revenuelouisianagovhome page

How to fill out LA LDR CIFT-620EXT-V

01

Download the LA LDR CIFT-620EXT-V form from the official website.

02

Carefully read the instructions provided on the form.

03

Fill in your personal information in the designated fields, including your name, address, and contact details.

04

Provide any required financial information as instructed.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form either by mail or electronically, as per the instructions.

Who needs LA LDR CIFT-620EXT-V?

01

Individuals or businesses who have earned income in Louisiana and need to report certain tax information to the state.

02

Taxpayers claiming tax credits or exemptions that require additional information.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from sales tax in Louisiana?

In Louisiana, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Examples of an exception to the Louisiana sales tax are certain types of prescription medication, farm and agricultural equipment, and some types of grocery items.

How do I apply for exemption from collection of Louisiana state sales tax?

You can apply to obtain Louisiana sales tax exemption by filing form R-1048, the Application for Exemption from Collection of Louisiana State Sales Tax with the Louisiana Department of Revenue.

How do I get my Louisiana state tax forms?

Most Requested Louisiana Tax Forms Please contact the Dept. of Revenue at 1-888-829-3071 to receive a form by mail or click here to request a form. Please note that if you choose to download and print a form at the State Library or at your library, you may be charged for the cost of printing.

Who must file Louisiana franchise tax return?

All corporations and entities taxed as corporations for federal income tax purposes deriving income from Louisiana sources, whether or not they have any net income, must file an income tax return.

Who has to collect sales tax in Louisiana?

In Louisiana, sales tax is levied on the sale of tangible goods and some services. The tax is collected by the seller and remitted to state tax authorities.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ce - revenuelouisianagovhome page online?

With pdfFiller, the editing process is straightforward. Open your ce - revenuelouisianagovhome page in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit ce - revenuelouisianagovhome page straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing ce - revenuelouisianagovhome page.

How do I fill out the ce - revenuelouisianagovhome page form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign ce - revenuelouisianagovhome page and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is LA LDR CIFT-620EXT-V?

LA LDR CIFT-620EXT-V is a form used by businesses in Louisiana to request an extension of time to file their corporate income/franchise tax returns.

Who is required to file LA LDR CIFT-620EXT-V?

Taxpayers who need additional time to file their corporate income or franchise tax returns in Louisiana are required to file LA LDR CIFT-620EXT-V.

How to fill out LA LDR CIFT-620EXT-V?

To fill out LA LDR CIFT-620EXT-V, provide the necessary business information, including the taxpayer identification number, entity name, address, and the reason for the extension request.

What is the purpose of LA LDR CIFT-620EXT-V?

The purpose of LA LDR CIFT-620EXT-V is to allow businesses to formally request an extension to file their corporate income/franchise tax returns beyond the original due date.

What information must be reported on LA LDR CIFT-620EXT-V?

The information that must be reported on LA LDR CIFT-620EXT-V includes the taxpayer's name, address, taxpayer ID number, the type of return being extended, and the reason for the extension.

Fill out your ce - revenuelouisianagovhome page online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ce - Revenuelouisianagovhome Page is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.