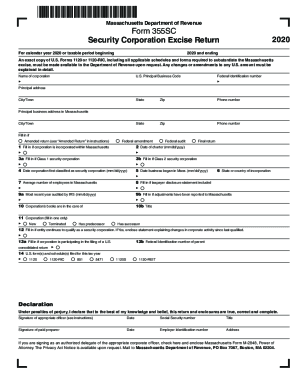

MA 355SC 2021-2025 free printable template

Show details

CAUTION: This tax return must be filed electronically. Paper versions of this return will not be accepted. If you have questions about filing electronically, contact us at 6178876367. See https://www.mass.gov/infodetails/dorefilingandpaymentrequirements

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign massachusetts domestic return form

Edit your massachusetts form domestic form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ma 355sc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 355sc online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ma form domestic. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA 355SC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out massachusetts form domestic corporation

How to fill out MA 355SC

01

Gather your personal information, including name, address, and Social Security number.

02

Obtain any necessary financial documents, such as income statements or tax returns.

03

Access the MA 355SC form from the appropriate state website or office.

04

Fill out the header section with your personal details.

05

Complete each section of the form by following the provided instructions carefully.

06

Review the form for any errors or missing information.

07

Sign and date the form as required.

08

Submit the form either electronically or by mail, ensuring you retain a copy for your records.

Who needs MA 355SC?

01

Individuals who are applying for certain state benefits or assistance programs.

02

Taxpayers who need to report specific information related to income or deductions.

03

Residents seeking to comply with state regulations or requirements.

Fill

massachusetts form foreign

: Try Risk Free

People Also Ask about massachusetts form 355sc

What is the form for a Massachusetts S Corp?

Massachusetts S corporations must annually file Form 355S or Form 63 FI. A Massachusetts S corporation that is included in a 355U also files Form 355S or 63FI but that return will generally be informational only. S corporations must also include with the annual filing: A Massachusetts Schedule S.

What is the Massachusetts minimum corporate excise tax?

Corporate Excise: Basic Structure Gross Receipts or SalesequalsMassachusetts Taxable IncomeTaxable Massachusetts Tangible Property or Net WorthApplyApplyTax Rate (9.5% or respective S-corp rates)Tax Rate of 0.26%30 more rows

What is a Massachusetts state tax form called?

Form 1: Massachusetts Resident Income Tax Return. Form 1-NR/PY: Massachusetts Nonresident or Part-Year Resident Income Tax Return.

Is Massachusetts Department of Revenue sending out checks?

Distribution of refunds will begin on November 1, 2022 – eligible taxpayers will receive their refund automatically through direct deposit or as a check sent through the mail.

What is the address for Department of Treasury Internal Revenue?

300 N. Los Angeles St. Monday through Friday, 8:30am to 4:30pm. To navigate, press the arrow keys.

What is Form 355 in Massachusetts?

Massachusetts Form 355 Excise Tax includes a tax of $2.60 per $1,000 on taxable Massachusetts tangible property or taxable net worth, whichever applies, and a tax of 8.0% on income attributable to Massachusetts.

Do I need to include a copy of my federal return with my Massachusetts state return?

You may need the following: Copies of last year's federal and state tax returns. Personal information including: Records of your earnings (W-2 forms from each employer or 1099-MISC forms if you're a contractor) Records of interest and dividends from banks (1099 forms: 1099-INT, 1099-DIV, etc.)

Who do I make check out to for Massachusetts taxes?

Complete payment voucher Form PV and attach your payment to the form. Make your check or money order payable to "Commonwealth of Massachusetts". Mail the payment to the MA mailing address with payment below.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 355sc directly from Gmail?

2021 ma security and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit massachusetts form domestic edit straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing massachusetts 355sc, you can start right away.

How do I fill out the massachusetts domestic security corporation fillable form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign ma form domestic security corporation edit and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is MA 355SC?

MA 355SC is a tax form used in Massachusetts for the reporting of the income and financial activities of a business that is classified under certain categories.

Who is required to file MA 355SC?

Businesses in Massachusetts that are subject to corporate excise and have an income requirement are required to file MA 355SC.

How to fill out MA 355SC?

To fill out MA 355SC, a taxpayer must provide information on their business income, deductions, tax credits, and other relevant financial details as specified in the form's instructions.

What is the purpose of MA 355SC?

The purpose of MA 355SC is to collect the necessary information for assessing corporate taxes owed by the business in Massachusetts.

What information must be reported on MA 355SC?

The information that must be reported on MA 355SC includes corporate income, deductions, credits, and specific financial data related to the business operations.

Fill out your ma form 355sc 2021-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ma Form Domestic Security Corporation Fill is not the form you're looking for?Search for another form here.

Keywords relevant to receivable excise subtract

Related to ma domestic security corporation fill

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.