Get the free NONProfit Organ

Show details

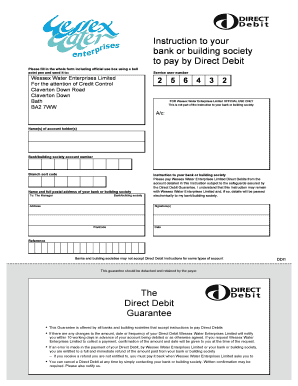

Nonprofit Organ. U.S. POSTAGE PAID Permit No. 165 Langhorne, PA Saint Andrew Alumni Newsletter April 2011 Volume 2, Issue 1 A Warm Welcome... Our Mission...to proclaim the Good News of Jesus Christ

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonprofit organ

Edit your nonprofit organ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonprofit organ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nonprofit organ online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nonprofit organ. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonprofit organ

How to fill out a nonprofit organ?

01

Start by gathering all the necessary information about your organization, including its mission statement, goals, and objectives. This will help you accurately fill out the required forms.

02

Research the specific requirements and regulations for becoming a nonprofit organ in your country or region. This may involve obtaining certain licenses, permits, or certifications.

03

Determine the appropriate legal structure for your nonprofit organ. This could be a trust, association, foundation, or charitable organization. Consult with legal experts or professionals in the field for guidance.

04

Create your organization's governing documents, such as the articles of incorporation or bylaws. These documents outline the structure, purpose, and operational guidelines of your nonprofit organ.

05

Register your nonprofit organ with the relevant government authorities. This typically involves completing an application form and providing supporting documents, such as your governing documents and a list of board members.

06

Establish a board of directors or trustees for your nonprofit organ. These individuals will be responsible for overseeing the organization's operations, making important decisions, and ensuring compliance with legal and ethical standards.

07

Develop a strategic plan for your nonprofit organ, outlining your goals, strategies, and activities. This plan will serve as a roadmap for your organization's growth and development.

08

Create a budget and financial plan to effectively manage your nonprofit organ's finances. This includes estimating income, expenses, and funding sources, as well as implementing financial controls and accountability measures.

09

Implement appropriate systems and processes for fundraising, volunteer management, program implementation, and evaluation. This will help streamline your nonprofit organ's operations and ensure its effectiveness.

10

Finally, regularly review and update your nonprofit organ's policies, procedures, and documentation to ensure compliance with changing regulations and best practices.

Who needs a nonprofit organ?

01

Nonprofit organs are needed by individuals or groups who have a social or charitable cause they want to address. These organizations aim to make a positive impact and serve the community or a specific segment of the population.

02

Nonprofit organs are often sought by activists, advocates, and individuals passionate about a certain cause, such as education, healthcare, environmental conservation, or poverty alleviation.

03

Nonprofit organs play a crucial role in addressing societal issues and providing essential services that might otherwise lack funding or support from the government or private sector.

04

Nonprofit organs can be formed by individuals, groups of people, or existing organizations looking to create a separate entity dedicated solely to charitable or socially beneficial activities.

05

Nonprofit organs can serve diverse needs and demographics, ranging from global nonprofits working on international development projects to local organizations addressing community-based issues.

In conclusion, anyone with a genuine desire to contribute to society and address specific issues can establish a nonprofit organ. By following the necessary steps to fill out the required paperwork and meeting legal and ethical standards, individuals or groups can create organizations that make a positive impact and serve the needs of the community.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nonprofit organ?

Nonprofit organization is an entity that operates without the purpose of making a profit and instead focuses on furthering a particular social cause or advocating for a particular point of view.

Who is required to file nonprofit organ?

Nonprofit organizations are required to file their financial information with the IRS, including Form 990, if they have gross receipts of $200,000 or more or total assets of $500,000 or more.

How to fill out nonprofit organ?

Nonprofit organizations can fill out Form 990 electronically or on paper, providing information about their mission, finances, and governance.

What is the purpose of nonprofit organ?

The purpose of nonprofit organizations is to serve the community or advance a charitable, educational, religious, or scientific purpose without the goal of making a profit.

What information must be reported on nonprofit organ?

Nonprofit organizations must report their revenue, expenses, program services, fundraising activities, governance structure, and executive compensation on Form 990.

How do I edit nonprofit organ in Chrome?

Install the pdfFiller Google Chrome Extension to edit nonprofit organ and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How can I edit nonprofit organ on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing nonprofit organ, you can start right away.

How do I fill out nonprofit organ using my mobile device?

Use the pdfFiller mobile app to fill out and sign nonprofit organ. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your nonprofit organ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonprofit Organ is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.