Get the free Reciprocal CPA Certificate Application - nbpa ne

Show details

This application is for individuals seeking a CPA certificate by reciprocity in the State of Nebraska. Applicants must meet residency requirements, provide verification of CPA Examination grades,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reciprocal cpa certificate application

Edit your reciprocal cpa certificate application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reciprocal cpa certificate application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing reciprocal cpa certificate application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit reciprocal cpa certificate application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reciprocal cpa certificate application

How to fill out Reciprocal CPA Certificate Application

01

Obtain the Reciprocal CPA Certificate Application form from the relevant board website.

02

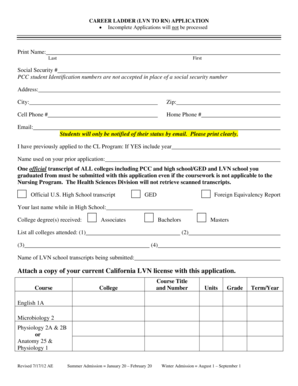

Fill out personal information, including your name, address, and contact details.

03

Provide your educational background, including degree(s) obtained and institutions attended.

04

List any CPA licenses you currently hold and provide the license numbers.

05

Complete the section regarding your professional experience, detailing relevant employment and roles.

06

Attach any required documentation, such as transcripts, proof of licensure, and any other supporting materials.

07

Review the application for accuracy and completeness.

08

Sign and date the application form.

09

Submit the application along with any required fees to the appropriate board.

Who needs Reciprocal CPA Certificate Application?

01

Individuals who are already licensed CPAs in one jurisdiction and wish to obtain a CPA license in another jurisdiction through reciprocity.

02

CPAs looking to practice in a different state or country that requires a reciprocal agreement.

03

Professionals seeking to expand their career opportunities in accounting across state lines.

Fill

form

: Try Risk Free

People Also Ask about

Can a Texas CPA practice in other states?

This means that a CPA in, say, Texas can provide tax or consulting services in any jurisdiction except Hawaii or the Commonwealth of the Northern Mariana Islands.

What states have reciprocity for CPA?

What states recognize CPA reciprocity? All states except Hawaii and New Hampshire offer instate reciprocity, though Massachusetts is limited. This reciprocity unlocks more opportunities for CPAs.

How to get a reciprocal CPA license?

Applying for a reciprocal CPA license Proof that you passed the CPA Exam. Proof of meeting the state's experience requirements. Official transcripts sent directly from your college or university. Passport-style photograph and an official copy of a driver's license or other state-issued form of identification.

Does Texas have CPA reciprocity?

If you are a CPA and were not certified in Texas, then you may apply for reciprocity in Texas. The Instructions for Completing the Reciprocal Application explains in more detail the information and fees that are required. If you would like to apply for reciprocity, all documents must be submitted for processing.

Does Colorado have CPA reciprocity?

Colorado practices CPE reciprocity with CPAs in other states. Consequently, CPAs from other jurisdictions with at least one year of licensed experience can earn Colorado licensure if they meet CPE requirements in their home state. These professionals must have also passed the AICPA ethics exam.

What is the English equivalent of a CPA?

Certified Public Accountant (CPA) is the title of qualified accountants in numerous countries in the English-speaking world. It is generally equivalent to the title of chartered accountant in other English-speaking countries.

What is the 30 month CPA rule in Texas?

(b) An applicant must pass the remaining sections within the next 30 months. Should an applicant's exam credit be invalidated due to the expiration of 30 months without earning credit on the remaining sections, the applicant remains qualified to take the examination.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Reciprocal CPA Certificate Application?

The Reciprocal CPA Certificate Application is a formal request submitted by certified public accountants (CPAs) to obtain certification in a different state or jurisdiction, recognizing their expertise and qualifications as a CPA.

Who is required to file Reciprocal CPA Certificate Application?

CPAs who are licensed in one state and wish to practice or obtain licensure in another state are required to file the Reciprocal CPA Certificate Application.

How to fill out Reciprocal CPA Certificate Application?

To fill out the Reciprocal CPA Certificate Application, applicants must provide personal information, details about their current licensure, proof of educational qualifications, employment history, and any relevant professional experience.

What is the purpose of Reciprocal CPA Certificate Application?

The purpose of the Reciprocal CPA Certificate Application is to enable CPAs to obtain reciprocal certification in different states, allowing them to practice in jurisdictions where they are not originally licensed while ensuring compliance with local regulations.

What information must be reported on Reciprocal CPA Certificate Application?

The application must report personal identification details, current state of licensure, educational background, examination history, work experience, and any disciplinary actions taken against the applicant.

Fill out your reciprocal cpa certificate application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reciprocal Cpa Certificate Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.