Get the free Multifamily Underwriting Standards - mnhousing.gov

Show details

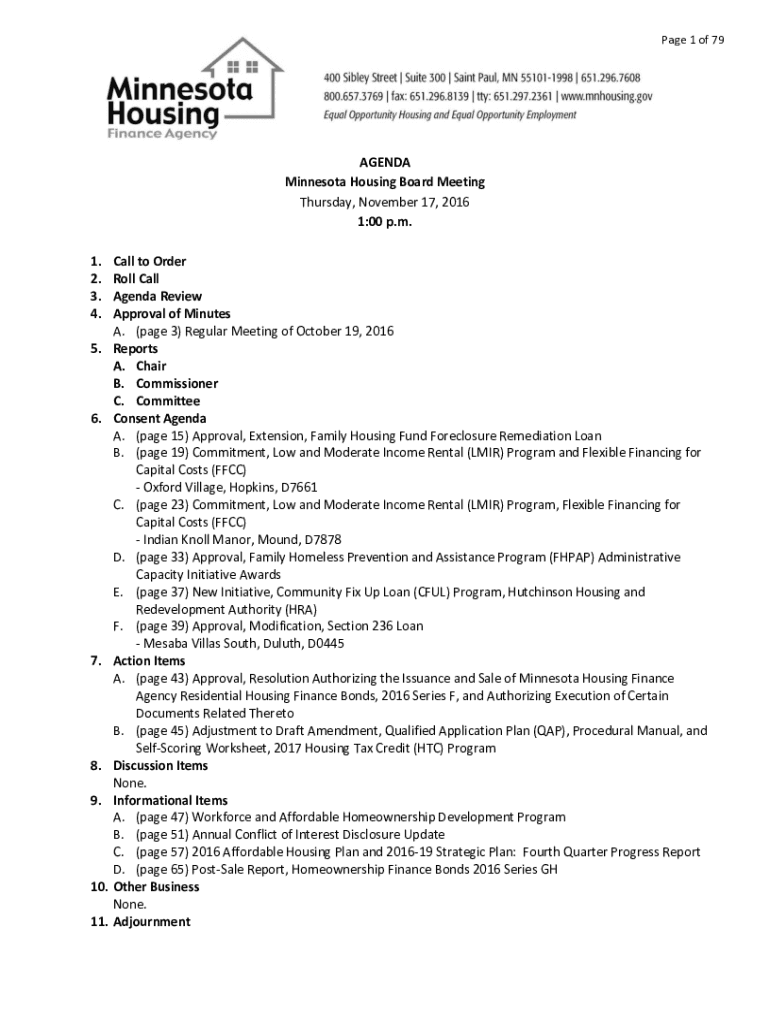

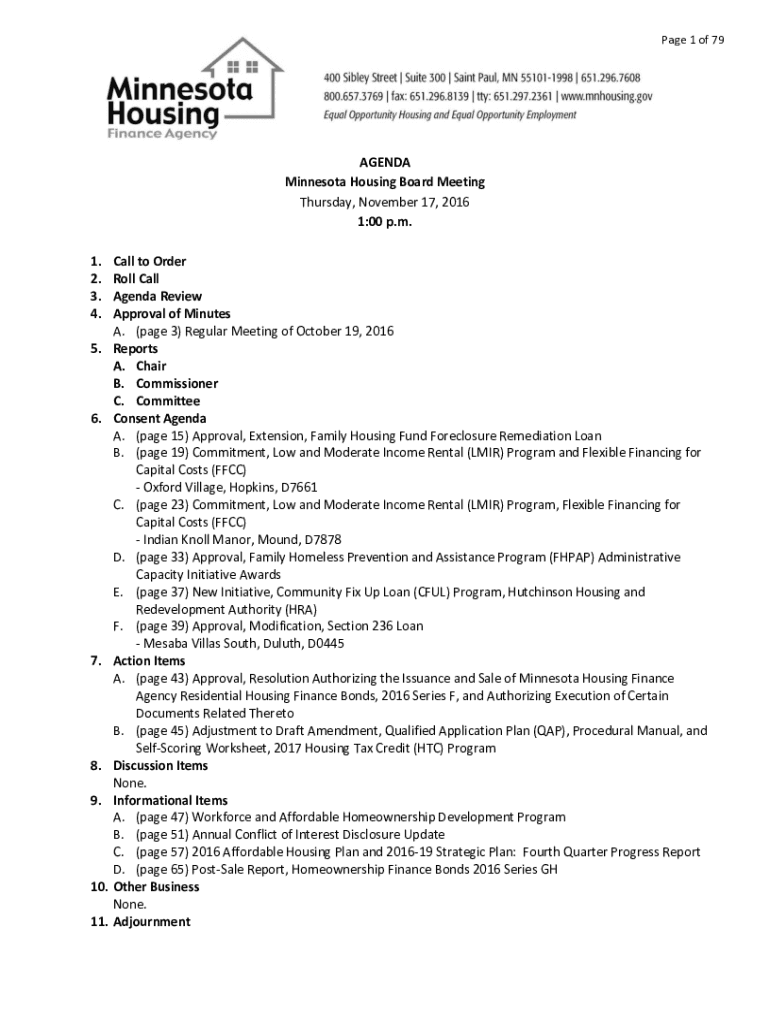

Page 1 of 79AGENDA Minnesota Housing Board Meeting Thursday, November 17, 2016 1:00 p.m. 1. 2. 3. 4. 5.6.7.8. 9.10. 11. Call to Order Roll Call Agenda Review Approval of Minutes A. (page 3) Regular

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign multifamily underwriting standards

Edit your multifamily underwriting standards form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your multifamily underwriting standards form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing multifamily underwriting standards online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit multifamily underwriting standards. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out multifamily underwriting standards

How to fill out multifamily underwriting standards

01

To fill out multifamily underwriting standards, follow these steps:

02

Gather all relevant financial information about the property, including income and expenses, rental rates, and vacancy rates.

03

Determine the appropriate capitalization rate or cap rate for the property. This is a measure of its potential return on investment.

04

Assess the property's current market value and projected future value based on market trends and economic factors.

05

Evaluate the property's financial performance by analyzing its cash flow, operating income, and operating expenses.

06

Consider the property's potential risks and ensure it meets the lender's risk tolerance.

07

Calculate the debt service coverage ratio (DSCR) to determine if the property generates enough income to cover its debt obligations.

08

Review the borrower's credit history and financial capacity to repay the loan.

09

Compare the property's underwriting standards with industry benchmarks and guidelines.

10

Make recommendations for any necessary adjustments to align with underwriting standards and ensure a successful loan application.

11

Document all findings and supporting data in a comprehensive underwriting report.

Who needs multifamily underwriting standards?

01

Multifamily underwriting standards are needed by various individuals and institutions involved in the real estate industry, including:

02

- Lenders and financial institutions: They require underwriting standards to assess the risk associated with multifamily loan applications and make informed lending decisions.

03

- Real estate developers and investors: They use underwriting standards to evaluate the financial viability and potential returns of multifamily properties before making investment decisions.

04

- Appraisers and valuation professionals: They rely on underwriting standards to estimate the market value of multifamily properties and provide accurate appraisal reports.

05

- Housing agencies and authorities: They utilize underwriting standards to ensure compliance with regulations and guidelines when financing affordable housing projects.

06

- Government entities: They may use underwriting standards to evaluate the financial feasibility of providing loans or guarantees for multifamily housing developments.

07

- Insurance companies: They use underwriting standards to assess the risk and potential insurability of multifamily properties for property and casualty insurance coverage.

08

- Industry professionals and consultants: They utilize underwriting standards to provide advisory services, conduct due diligence, and offer expertise in multifamily property transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in multifamily underwriting standards without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing multifamily underwriting standards and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my multifamily underwriting standards in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your multifamily underwriting standards right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the multifamily underwriting standards form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign multifamily underwriting standards and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is multifamily underwriting standards?

Multifamily underwriting standards are guidelines and criteria used by lenders to evaluate the creditworthiness of borrowers seeking financing for multifamily properties.

Who is required to file multifamily underwriting standards?

Lenders and financial institutions are required to file multifamily underwriting standards when assessing loan applications for multifamily properties.

How to fill out multifamily underwriting standards?

Multifamily underwriting standards are typically filled out by lenders using a standardized form that includes information such as borrower's financial data, property details, and loan terms.

What is the purpose of multifamily underwriting standards?

The purpose of multifamily underwriting standards is to ensure that loans for multifamily properties are made responsibly and that the risks associated with these loans are properly assessed.

What information must be reported on multifamily underwriting standards?

Information that must be reported on multifamily underwriting standards includes borrower's credit history, employment status, property appraisal, and rental income projections.

Fill out your multifamily underwriting standards online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Multifamily Underwriting Standards is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.