Get the free PGH-40 - cs cmu

Show details

Este formulario es la declaración de impuestos sobre ingresos ganados para el año calendario 1999 y el año fiscal que termina. Se utiliza para reportar los ingresos obtenidos y calcular los impuestos

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pgh-40 - cs cmu

Edit your pgh-40 - cs cmu form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pgh-40 - cs cmu form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pgh-40 - cs cmu online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pgh-40 - cs cmu. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pgh-40 - cs cmu

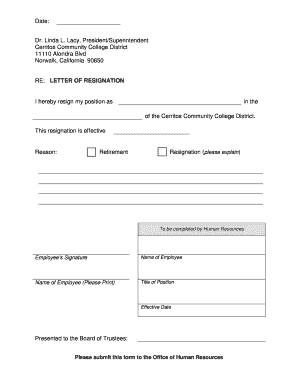

How to fill out PGH-40

01

Obtain the PGH-40 form from the appropriate source.

02

Fill out your personal information in the designated sections, including name, address, and contact details.

03

Ensure to provide accurate information regarding any required financial data.

04

Review the eligibility criteria listed on the form and ensure you meet them.

05

Attach any necessary documentation that supports your application, such as proof of income or identification.

06

Double-check all entered information for completeness and accuracy.

07

Sign and date the form at the bottom before submission.

08

Submit the completed form to the appropriate agency or office by the deadline.

Who needs PGH-40?

01

Individuals applying for specific financial assistance or assistance programs.

02

Those who need to report changes in their financial status to relevant authorities.

03

Applicants seeking federal or state benefits that require financial disclosure.

Fill

form

: Try Risk Free

People Also Ask about

What happens if you don't file local earned income tax?

Is there a late filing fee? There may be a $25.00 fee for failure to file a Local Earned Income Tax Return by April 15th of the following tax year. The fee is per individual. Persons filing a combined return with a spouse could owe a late filing fee of $50.00.

What is Pittsburgh C income tax?

Income Tax Personal income tax is a flat 3.07% for Pennsylvania and another 3% for Pittsburgh residents. Earned income tax in Pittsburgh's surrounding suburbs varies by location, but is generally lower than Pittsburgh's 3%.

Does everyone have to file local taxes in PA?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Who has to pay LST tax in PA?

The Local Services Tax is a local tax payable by all individuals who hold a job or profession in the Commonwealth of Pennsylvania. Indiana Borough assesses a total of $52.00 per employee and is deducted in an equal amount per paycheck.

Who is exempt from Pittsburgh local taxes?

Employers must discontinue withholding the Local Services Tax when (i) the total earned income from all sources within the City of Pittsburgh is less than $12,000; (ii) the employee is on active duty in the military; or (iii) the employee is an honorably discharged veteran of the armed forces with a 100% service-

Do I have to pay local earned income tax?

Yes. If you live in a jurisdiction with an Earned Income tax in place and had wages for the year in question, a local earned income return must be filed annually by April 15, (unless the 15th falls on a Saturday or Sunday then the due date becomes the next business day) for the preceding calendar year.

How do I know if I have to pay local income tax?

In most cases, local income taxes apply to individuals who work or live in a specific locality or area.

Is interest income taxable for local taxes in PA?

Interest is not taxable income if received from direct obligations of the Commonwealth of Pennsylvania, its political subdivisions and authorities or the U.S. government. Likewise, interest from Series E, F, G, H, EE and HH bonds and federal treasury bills and notes are not taxable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PGH-40?

PGH-40 is a tax form used for filing personal income taxes in certain jurisdictions, specifically for residents to report their income and calculate their tax liability.

Who is required to file PGH-40?

Individuals who have a tax obligation, including residents and part-year residents of the jurisdiction, are required to file PGH-40 if their income meets the minimum filing thresholds.

How to fill out PGH-40?

To fill out PGH-40, taxpayers must gather their income information, complete each section accurately, and ensure all applicable deductions and credits are included before submitting the form to the tax authority.

What is the purpose of PGH-40?

The purpose of PGH-40 is to provide a standardized method for individuals to report their income and calculate any taxes owed to the state or local government.

What information must be reported on PGH-40?

On PGH-40, taxpayers must report their total income, any applicable deductions, credits, filing status, and the calculation of taxes owed or refunds due.

Fill out your pgh-40 - cs cmu online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pgh-40 - Cs Cmu is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.