Chase 39932 PL 2012 free printable template

Show details

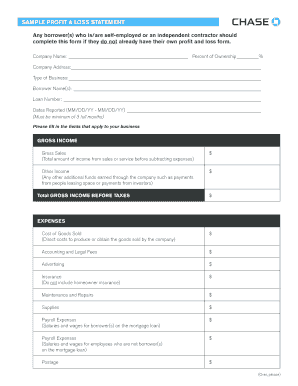

SAMPLE PROFIT & LOSS STATEMENT

Percentage of Ownership ___loan Number:

Business Owner Name(s):

Company Name:

Company Address:

Type/Nature of Business:

Dates Reported (mm/dd/YYY): from ___/ ___/ ___to

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Chase 39932 PL

Edit your Chase 39932 PL form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Chase 39932 PL form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Chase 39932 PL online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Chase 39932 PL. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Chase 39932 PL Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Chase 39932 PL

How to fill out Chase 39932 PL

01

Gather personal information: Start by collecting all necessary personal and financial information, including your name, address, Social Security number, and employment details.

02

Locate the form: Find the Chase 39932 PL form, either online or at a local Chase branch.

03

Read the instructions: Carefully review any instructions provided with the form to ensure accuracy.

04

Fill out personal information: Enter your gathered personal information in the required fields on the form.

05

Provide financial details: Include relevant financial information, such as income and expenses, as required by the form.

06

Review the form: Double-check all entries for accuracy and completeness before submission.

07

Sign and date the form: Ensure that you sign and date the form as required.

08

Submit the form: Send the completed form to the appropriate Chase address or submit it online as directed.

Who needs Chase 39932 PL?

01

Individuals looking to apply for a specific Chase loan or financial product.

02

Customers who need assistance with personal or commercial banking services from Chase.

03

Anyone required to provide financial documentation to Chase for approval or processing purposes.

Fill

form

: Try Risk Free

What is profit and loss statement template?

This profit and loss (P&L) statementProfit and Loss Statement (P&L)A profit and loss statement (P&L), or income statement or statement of operations, is a financial report that provides a summary of a template summarizes a company's income and expenses for a period of time to arrive at its net earnings for the period.

People Also Ask about

How do I get a profit and loss statement?

A profit and loss statement is calculated by totaling all of a business's revenue sources and subtracting from that all the business's expenses that are related to revenue.

What a profit and loss statement looks like?

A P&L statement shows a company's revenue minus expenses for running the business, such as rent, cost of goods, freight, and payroll. Each entry on a P&L statement provides insight into the cash flow of the company and shows where money is coming from and how it is used.

How do I write a profit and loss statement for self-employed?

How to Write a Profit and Loss Statement Step 1 – Track Your Revenue. Step 2 – Determine the Cost of Sales. Step 3 – Figure Out Your Gross Profit. Step 4 – Add Up Your Overhead. Step 5 – Calculate Your Operating Income. Step 6 – Adjust for Other Income and/or Expenses. Step 7 – Net Profit: The Bottom Line.

How do you write a profit and loss statement?

How to Write a Profit and Loss Statement Step 1 – Track Your Revenue. Step 2 – Determine the Cost of Sales. Step 3 – Figure Out Your Gross Profit. Step 4 – Add Up Your Overhead. Step 5 – Calculate Your Operating Income. Step 6 – Adjust for Other Income and/or Expenses. Step 7 – Net Profit: The Bottom Line.

How should a profit and loss statement look?

The P & L statement contains uniform categories of sales and expenses. The categories include net sales, costs of goods sold, gross margin, selling and administrative expense (or operating expense), and net profit. These are categories that you, too, will use when constructing a P & L statement.

Do you need a profit and loss statement for self-employed?

In addition to being required by the IRS, as a self-employed individual, you may also find it useful to prepare a profit and loss statement for your business if you've applied for financing. Potential creditors can use your P&L statement to conduct a profit and loss statement analysis.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in Chase 39932 PL?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your Chase 39932 PL to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit Chase 39932 PL on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share Chase 39932 PL on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I fill out Chase 39932 PL on an Android device?

Use the pdfFiller mobile app to complete your Chase 39932 PL on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is Chase 39932 PL?

Chase 39932 PL is a form used by Chase Bank for specific reporting or documentation purposes related to client transactions.

Who is required to file Chase 39932 PL?

Individuals or businesses that engage in certain financial transactions or meet specific criteria set by Chase Bank are required to file Chase 39932 PL.

How to fill out Chase 39932 PL?

To fill out Chase 39932 PL, you need to provide personal or business information, transaction details, and any other required data as instructed on the form.

What is the purpose of Chase 39932 PL?

The purpose of Chase 39932 PL is to ensure accurate reporting of transactions and compliance with regulatory requirements.

What information must be reported on Chase 39932 PL?

The information that must be reported on Chase 39932 PL includes identification details of the filer, transaction amounts, dates, and any relevant financial details prescribed by Chase Bank.

Fill out your Chase 39932 PL online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chase 39932 PL is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.