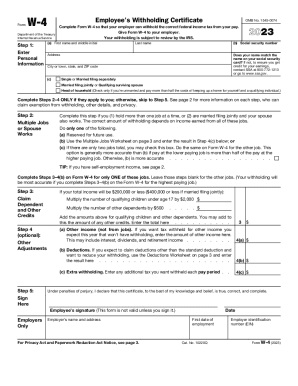

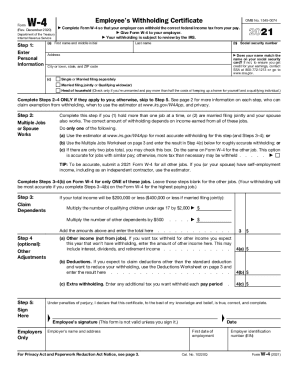

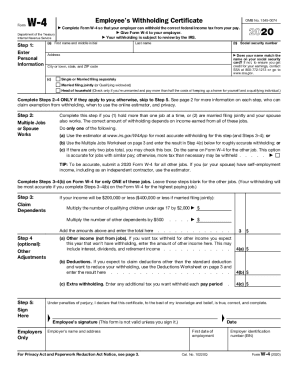

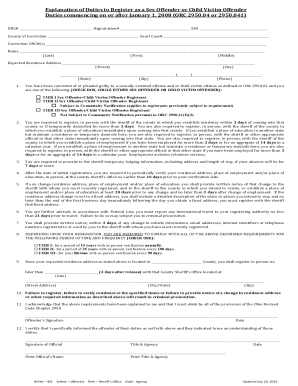

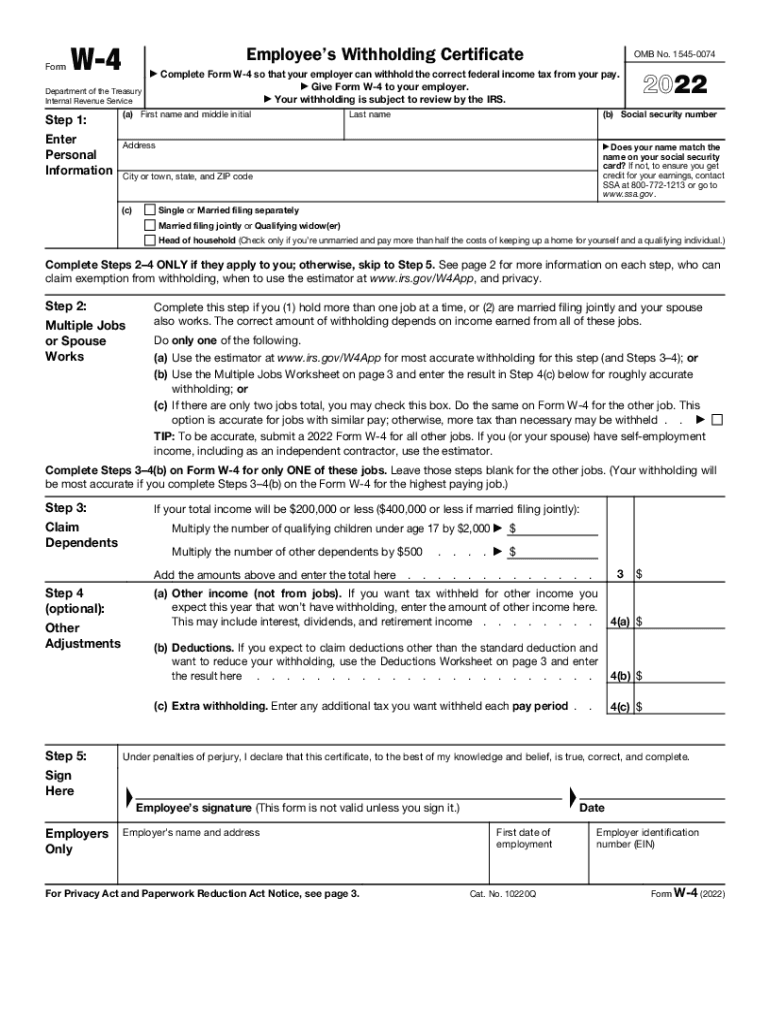

IRS W-4 2022 free printable template

Instructions and Help about IRS W-4

How to edit IRS W-4

How to fill out IRS W-4

About IRS W-4 2022 previous version

What is IRS W-4?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

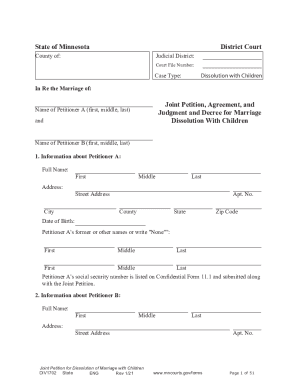

Is the form accompanied by other forms?

FAQ about IRS W-4

What should you do if you realize you've made an error on your filed IRS W-4?

If you discover an error on your submitted IRS W-4, you can correct it by submitting a new W-4 form to your employer. It’s advisable to inform your employer about the mistake as soon as possible to avoid further discrepancies in your withholding.

How can you track the processing status of your IRS W-4 submission?

To track the processing of your IRS W-4, contact your employer's payroll department. They can confirm whether your form has been processed and if any adjustments have been made to your withholding.

What should you be aware of regarding privacy and data security when submitting IRS W-4 forms?

When submitting your IRS W-4, ensure that it is sent through secure channels. Be cautious about sharing personal information, and confirm that your employer has measures in place to protect your data from unauthorized access.

What are some common errors people make when submitting their IRS W-4, and how can they be avoided?

Common errors include incorrect withholding allowances and failing to update your W-4 after life changes. To avoid these mistakes, regularly review your W-4 and consult with a tax professional if you’re unsure about your allowances.

How does e-filing affect the submission of the IRS W-4 and what should you consider?

E-filing your IRS W-4 may not always be an option, as many employers require a physical copy. Be aware of your employer's submission preferences and check for any technical requirements for electronic submissions, such as compatible software.

See what our users say