Get the free Individual Retirement Annuity Claimant Statement

Show details

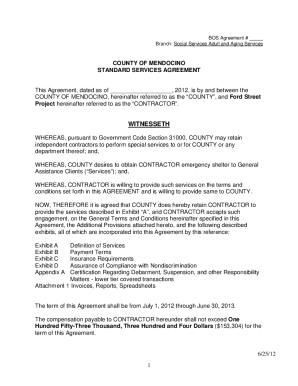

This form is required to process benefits for an annuity policy following the death of the policy owner. It includes instructions on the necessary documentation, settlement options, and tax withholding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual retirement annuity claimant

Edit your individual retirement annuity claimant form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual retirement annuity claimant form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing individual retirement annuity claimant online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit individual retirement annuity claimant. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual retirement annuity claimant

How to fill out Individual Retirement Annuity Claimant Statement

01

Obtain the Individual Retirement Annuity Claimant Statement form from the financial institution.

02

Provide your personal information, including your name, address, and social security number.

03

Indicate the reason for the claim and any relevant details regarding your retirement annuity.

04

Sign and date the form in the appropriate section.

05

Attach any required documentation, such as proof of identity or verification of retirement status.

06

Submit the completed form and attachments to the designated address of the financial institution.

Who needs Individual Retirement Annuity Claimant Statement?

01

Individuals who have a retirement annuity and need to claim benefits.

02

Beneficiaries of deceased annuity holders seeking to access the benefits.

03

Those who are retiring and need to start their annuity payments.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of retirement annuity?

A retirement annuity is a long term investment that aims to help you provide for your retirement years. This investment takes the form of a policy with a product supplier (company) like Old Mutual. Typical retirement annuities require a monthly investment amount but there are a few that accept lump sums only, or both.

What is a claimant's statement?

This form is used to collect information relating to the payment of death benefits. The information provided will be used to determine entitlement to death benefits. Persons are not required to respond to the collection of information unless it displays a currently valid OMB Control Number.

How much does a $100 000 annuity pay per month?

$100,000 Annuity Payments Analyzed. As of March 9, 2023, a $100,000 annuity would pay you $614 per month if you purchased the annuity at age 65 and began taking payments immediately.

What is a retirement annuity statement?

Annuity statements tell you how your retirement accounts are performing. They show how your money is performing, how much your savings have grown, and what you might expect to earn in a certain timeframe. By reading and analyzing your annuity statement, you can make more intelligent choices about your future savings.

What is a retirement statement?

Your retirement account statement makes it easy for you to find critical information at a glance. Details are organized in a simple, easy-to-read format. The “Your Account Summary” section displays your progress toward your retirement savings goals.

What is the difference between an individual retirement account and an individual retirement annuity?

Both IRAs and retirement annuities are tools for retirement saving with tax-advantaged benefits. The differences are that an annuity is an insurance product while an IRA is an account that holds retirement funds, and annuities have higher fees than IRAs.

What is the downside of an annuity?

Annuities tie money up in a long-term investment plan that has poor liquidity and does not allow you to take advantage of better investment opportunities if interest rates increase or if the markets are on the rise.

What is an annuity claimant statement?

Claimant Statement Form—Income Annuity. Use this form to complete the settlement of your inherited income annuity contract. If you need more room for information or signatures, make a copy of the relevant page.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Individual Retirement Annuity Claimant Statement?

The Individual Retirement Annuity Claimant Statement is a document used to provide necessary information about a claimant's eligibility and details regarding their retirement annuity benefits.

Who is required to file Individual Retirement Annuity Claimant Statement?

Individuals who are claiming benefits from their Individual Retirement Annuity are required to file the statement.

How to fill out Individual Retirement Annuity Claimant Statement?

To fill out the statement, claimants need to provide personal information, details about the annuity, and any additional documentation required to support their claim.

What is the purpose of Individual Retirement Annuity Claimant Statement?

The purpose of the statement is to verify the claimant's eligibility for retirement benefits and to streamline the processing of their claims.

What information must be reported on Individual Retirement Annuity Claimant Statement?

The statement must report personal identification information, retirement account details, beneficiary information, and any relevant financial data that pertains to the annuity.

Fill out your individual retirement annuity claimant online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Retirement Annuity Claimant is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.