Get the free Health Savings Account (HSA) Distribution Form - WPS Bank

Show details

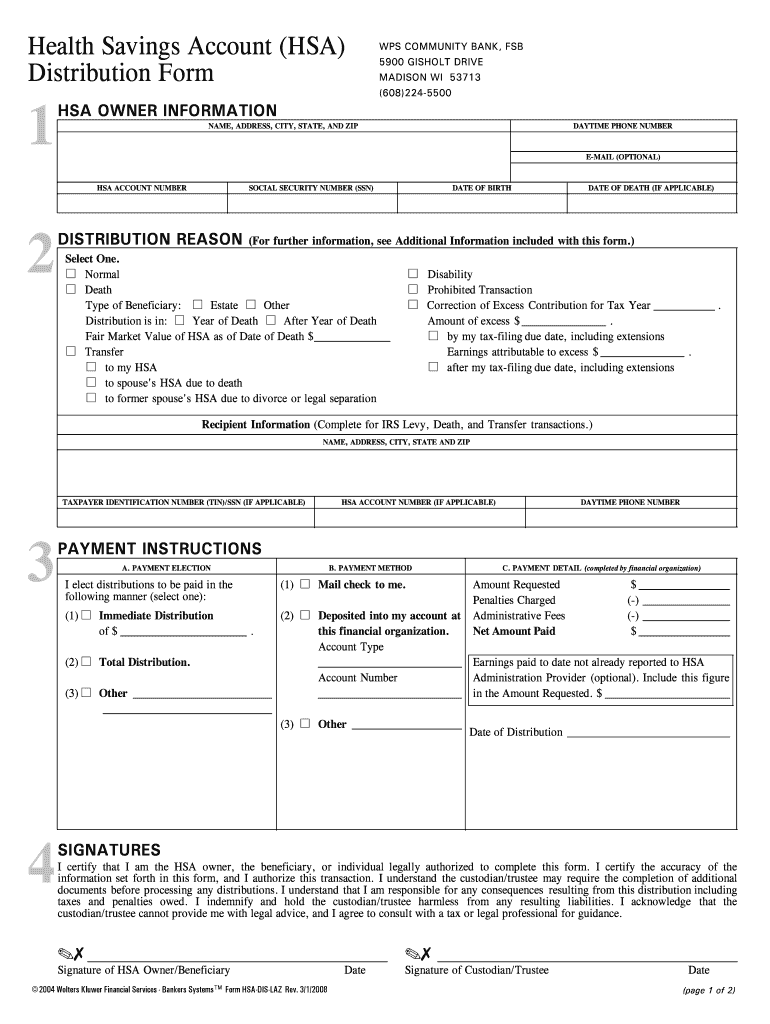

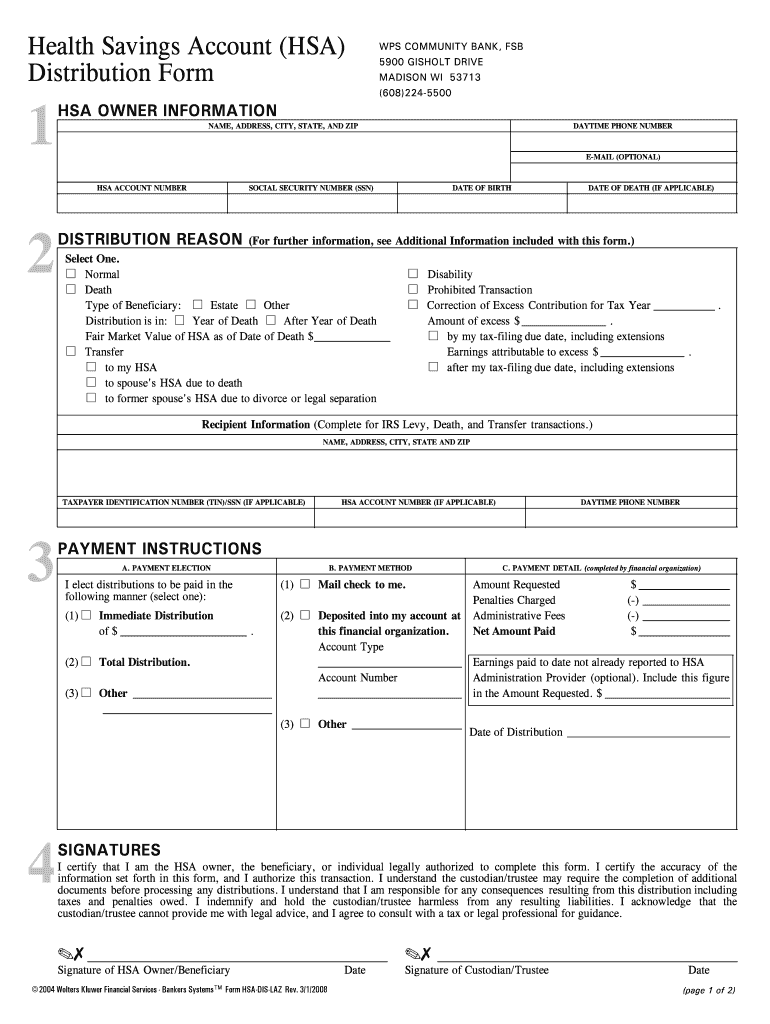

Health Savings Account (HSA) Distribution Form WPS COMMUNITY BANK, FSB 5900 SHORT DRIVE MADISON WI 53713 (608)224-5500 1 HSA OWNER INFORMATION NAME, ADDRESS, CITY, STATE, AND ZIP E-MAIL (OPTIONAL)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health savings account hsa

Edit your health savings account hsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health savings account hsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit health savings account hsa online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit health savings account hsa. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health savings account hsa

How to Fill Out Health Savings Account (HSA):

01

Research and choose a suitable HSA provider: Start by researching different HSA providers and comparing their offerings such as fees, investment options, customer service, and convenience. Look for a provider that aligns with your specific needs and preferences.

02

Open an HSA account: Once you've selected a provider, follow their instructions to open an HSA account. This may involve filling out an application form, providing personal and financial information, and agreeing to the terms and conditions of the account.

03

Determine your eligibility: Ensure that you meet the eligibility requirements for an HSA. In general, you must have a high-deductible health plan (HDHP) and cannot be covered by any other non-HDHP insurance plan. Verify your eligibility with your HSA provider or consult a healthcare professional if you have any doubts.

04

Contribute to your HSA: Decide how much you want to contribute to your HSA. These contributions are tax-deductible and have an annual limit set by the IRS. Make regular contributions to maximize the benefits of your HSA and save for future healthcare expenses. Set up automatic contributions if your HSA provider offers that option.

05

Keep track of your expenses: Maintain careful records of all qualified medical expenses paid out of your HSA. This helps you keep track of your healthcare spending and ensures compliance with IRS regulations. Retain receipts, statements, and other documentation for future reference and to support any claims made.

06

Utilize the funds for eligible expenses: Use your HSA funds to pay for qualified medical expenses, which typically include medical, dental, and vision expenses. Refer to IRS Publication 502 for a comprehensive list of eligible expenses. By using HSA funds for these expenses, you can enjoy tax-free withdrawals and potentially earn interest or investment returns on your remaining HSA balance.

Who Needs a Health Savings Account (HSA):

01

Individuals with high-deductible health plans (HDHP): HSAs are specifically designed for individuals covered by HDHPs. If you have an HDHP, it can be highly beneficial to open an HSA as it allows you to save for medical expenses while enjoying potential tax advantages.

02

Individuals seeking to save on healthcare costs: HSAs provide individuals with an opportunity to save money specifically for medical expenses. By contributing to an HSA, you can cover your deductible, copayments, and other qualifying medical expenses using pre-tax dollars, which can lead to significant savings over time.

03

Those looking for a flexible and portable healthcare savings option: Unlike flexible spending accounts (FSAs), HSAs are not subject to a use-it-or-lose-it rule. Any unused funds in your HSA rollover from year to year, allowing you to build savings for future healthcare needs. Additionally, HSAs are portable, meaning you can take them with you even if you change jobs or health insurance plans.

04

Individuals seeking potential tax advantages: Contributions to an HSA are tax-deductible, reducing your taxable income for the year. The funds within the account can also grow tax-free through investments, and qualified withdrawals are not subject to federal income tax. This tax advantage can provide significant long-term savings.

Overall, anyone with an HDHP who wants to take control of their healthcare expenses, save money on taxes, and build a dedicated healthcare fund should consider opening and utilizing a health savings account (HSA). However, it is essential to carefully evaluate your own circumstances and consult with a financial advisor or tax professional to determine if an HSA is the right choice for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my health savings account hsa directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your health savings account hsa and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I execute health savings account hsa online?

pdfFiller makes it easy to finish and sign health savings account hsa online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I edit health savings account hsa on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign health savings account hsa on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is health savings account hsa?

A health savings account (HSA) is a tax-advantaged account that allows individuals to save money for medical expenses.

Who is required to file health savings account hsa?

Individuals who have a high-deductible health plan (HDHP) are eligible to open and contribute to an HSA.

How to fill out health savings account hsa?

To fill out an HSA, individuals must provide information about their contributions, distributions, and qualified medical expenses.

What is the purpose of health savings account hsa?

The purpose of an HSA is to help individuals save for medical expenses and reduce their taxable income.

What information must be reported on health savings account hsa?

Information such as contributions, distributions, and qualified medical expenses must be reported on an HSA.

Fill out your health savings account hsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Savings Account Hsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.