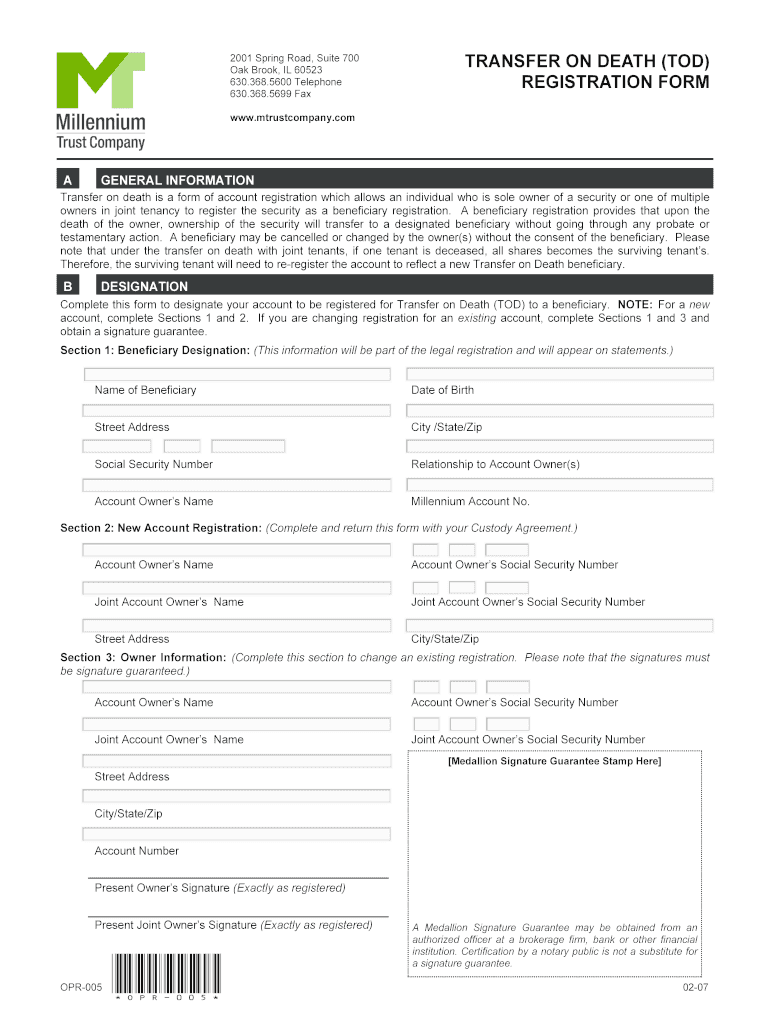

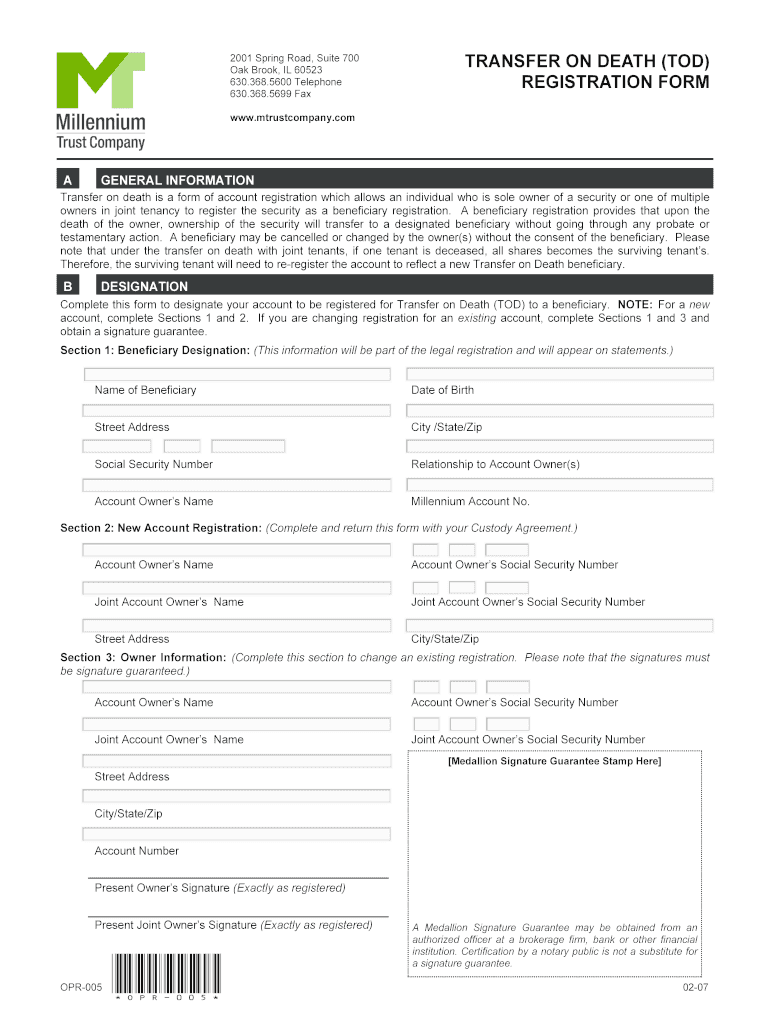

Get the free TRANSFER ON DEATH (TOD) REGISTRATION FORM

Show details

Este formulario permite designar un beneficiario para la transferencia de propiedad de valores al fallecer el propietario, evitando la burocracia del testamento. Incluye información sobre designación

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer on death tod

Edit your transfer on death tod form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer on death tod form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transfer on death tod online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit transfer on death tod. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer on death tod

How to fill out TRANSFER ON DEATH (TOD) REGISTRATION FORM

01

Obtain the Transfer on Death (TOD) Registration Form from your financial institution or relevant website.

02

Fill in your personal information, including your full name, address, and contact details.

03

Provide information about the account or assets that you wish to transfer on death.

04

Designate one or more beneficiaries who will receive the assets upon your passing.

05

Include any additional instructions or conditions regarding the transfer, if applicable.

06

Sign and date the form to make it legally binding.

07

Submit the completed form to the financial institution or administrator in charge of the assets.

Who needs TRANSFER ON DEATH (TOD) REGISTRATION FORM?

01

Individuals with assets such as bank accounts, stocks, or real estate who want to designate beneficiaries to receive those assets after their death.

02

People who wish to avoid probate for their assets and streamline the transfer process for their loved ones.

03

Anyone wanting to ensure that their assets are distributed according to their wishes without the complications of a will.

Fill

form

: Try Risk Free

People Also Ask about

Does MN allow transfer on death deed?

Can I transfer my home to my children and avoid probate? Yes, Minnesota has a law that lets you transfer the title to real estate when you die to avoid probate. It is an estate planning tool called a Transfer on Death Deed (TODD). It is like the "payable on death" (POD) designation on a bank account.

Which is better, tod or beneficiary after death?

Designated beneficiaries receive the funds without having to wait for probate to conclude, which can take months. A POD or TOD account allows loved ones to get money almost immediately. Typically, all they need to provide is the death certificate and identification to the account-holding institution.

Do I need an attorney to do a transfer on death deed?

If you're thinking about ways to keep your home out of probate, and TOD deeds are an available option in your state, they are well worth considering. Unless you have a complex situation or have specific concerns, you likely won't need a lawyer to create a TOD deed.

What is the downside of a tod?

Beneficiary Liability: A beneficiary named in a TOD deed becomes personally liable for the property owner's unsecured debts up to the value of the property received. This result may have been unintended by the owner and as an unpleasant surprise to the beneficiary.

Does the state of Georgia allow a transfer on death deed?

(a) An interest in real estate may be titled in a transfer-on-death form by recording a deed, signed by the record owner of the interest, designating a grantee beneficiary or beneficiaries of the interest. Such deed shall transfer ownership of such interest upon the death of the record owner.

Do you need an attorney for a transfer on a death deed?

If you're thinking about ways to keep your home out of probate, and TOD deeds are an available option in your state, they are well worth considering. Unless you have a complex situation or have specific concerns, you likely won't need a lawyer to create a TOD deed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TRANSFER ON DEATH (TOD) REGISTRATION FORM?

A Transfer on Death (TOD) Registration Form is a legal document that allows an individual to designate a beneficiary to receive their assets automatically upon their death, without going through probate.

Who is required to file TRANSFER ON DEATH (TOD) REGISTRATION FORM?

Individuals who wish to designate beneficiaries for their assets, such as bank accounts or real estate, should file a Transfer on Death (TOD) Registration Form.

How to fill out TRANSFER ON DEATH (TOD) REGISTRATION FORM?

To fill out a TOD Registration Form, provide your personal information, list the assets you wish to transfer, and clearly identify the beneficiary or beneficiaries you want to designate.

What is the purpose of TRANSFER ON DEATH (TOD) REGISTRATION FORM?

The purpose of the TOD Registration Form is to allow for the direct transfer of assets to beneficiaries upon the owner's death, simplifying the process and avoiding probate.

What information must be reported on TRANSFER ON DEATH (TOD) REGISTRATION FORM?

The form typically requires the owner's name, address, a description of the assets being transferred, the names and addresses of the beneficiaries, and the owner's signature.

Fill out your transfer on death tod online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer On Death Tod is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.