Get the free www.irs.govcharities-non-profitsannualAnnual Electronic Filing Requirement for ... -...

Show details

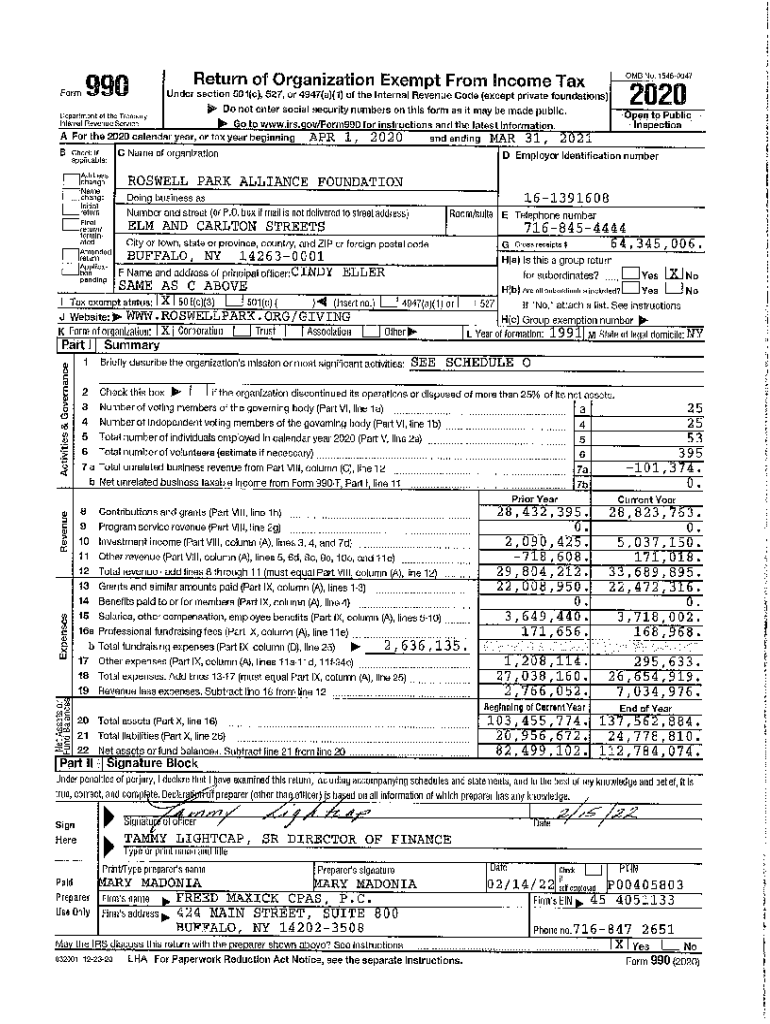

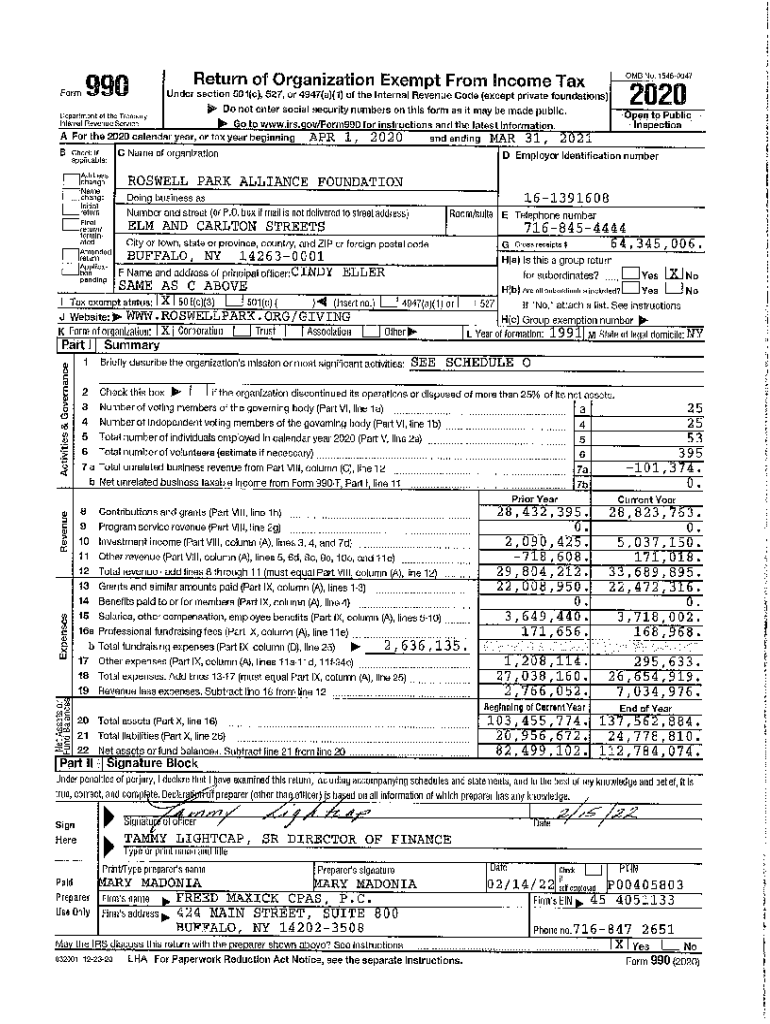

Form 990Do not enter social security numbers on this form as it may be made public. Department of the Treasury Internal Revenue Service address | | change 1 Name 1 (change 1 1 Initial 1 1 return1

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wwwirsgovcharities-non-profitsannualannual electronic filing requirement

Edit your wwwirsgovcharities-non-profitsannualannual electronic filing requirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wwwirsgovcharities-non-profitsannualannual electronic filing requirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wwwirsgovcharities-non-profitsannualannual electronic filing requirement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wwwirsgovcharities-non-profitsannualannual electronic filing requirement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wwwirsgovcharities-non-profitsannualannual electronic filing requirement

How to fill out wwwirsgovcharities-non-profitsannualannual electronic filing requirement

01

To fill out the www.irsgov/charities-non-profits/annual/annual electronic filing requirement, follow these steps:

02

Visit the official website of the IRS (www.irsgov) and navigate to the 'Charities & Non-Profits' section.

03

Look for the 'Annual Filing and Forms' section and click on it.

04

Find the option for 'Electronic Filing Requirement' and select it.

05

Read the guidelines and requirements for electronic filing carefully.

06

Make sure you have all the necessary documents and information handy, such as the organization's financial records, Form 990, and other supporting documents.

07

Create an account on the IRS website if you don't already have one.

08

Provide all the required details and complete the registration process.

09

Once registered, log in to your account and locate the 'Electronic Filing' section.

10

Choose the appropriate form for annual filing and click on it.

11

Fill out the form accurately and provide all the requested information.

12

Review your entries carefully to ensure they are correct and complete.

13

Submit the form electronically by following the designated submission process.

14

Wait for confirmation or acknowledgment of successful submission.

15

Keep a copy of the submitted form and any confirmation received for your records.

16

Note: It is advisable to consult a tax professional or refer to the official IRS guidelines for specific instructions and compliance details.

Who needs wwwirsgovcharities-non-profitsannualannual electronic filing requirement?

01

Charities, non-profit organizations, and certain exempt organizations are required to fulfill the www.irsgov/charities-non-profits/annual/annual electronic filing requirement.

02

Specifically, organizations that qualify for tax-exempt status under section 501(c)(3) of the Internal Revenue Code must file an annual information return with the IRS.

03

These organizations include charitable, religious, educational, scientific, literary, and other similar organizations that operate for exempt purposes and meet the IRS criteria.

04

Additionally, organizations with gross receipts of $200,000 or more, or total assets of $500,000 or more, are generally required to file electronically.

05

Exemptions or special rules may apply in certain cases, so it is recommended to review the IRS guidelines or consult a tax professional for accurate determination of the filing requirement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find wwwirsgovcharities-non-profitsannualannual electronic filing requirement?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific wwwirsgovcharities-non-profitsannualannual electronic filing requirement and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the wwwirsgovcharities-non-profitsannualannual electronic filing requirement in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your wwwirsgovcharities-non-profitsannualannual electronic filing requirement right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete wwwirsgovcharities-non-profitsannualannual electronic filing requirement on an Android device?

On an Android device, use the pdfFiller mobile app to finish your wwwirsgovcharities-non-profitsannualannual electronic filing requirement. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is wwwirsgovcharities-non-profitsannualannual electronic filing requirement?

The www.irsgovcharities-non-profitsannualannual electronic filing requirement is a mandatory process for certain tax-exempt organizations to submit their financial information to the IRS.

Who is required to file wwwirsgovcharities-non-profitsannualannual electronic filing requirement?

Non-profit organizations that meet certain criteria set by the IRS are required to file the wwwirsgovcharities-non-profitsannualannual electronic filing requirement.

How to fill out wwwirsgovcharities-non-profitsannualannual electronic filing requirement?

Organizations can fill out the wwwirsgovcharities-non-profitsannualannual electronic filing requirement by using the IRS Form 990 or through authorized third-party software.

What is the purpose of wwwirsgovcharities-non-profitsannualannual electronic filing requirement?

The purpose of the wwwirsgovcharities-non-profitsannualannual electronic filing requirement is to provide transparency and accountability of tax-exempt organizations' financial activities.

What information must be reported on wwwirsgovcharities-non-profitsannualannual electronic filing requirement?

The wwwirsgovcharities-non-profitsannualannual electronic filing requirement typically includes financial data such as revenue, expenses, assets, and activities of the tax-exempt organization.

Fill out your wwwirsgovcharities-non-profitsannualannual electronic filing requirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wwwirsgovcharities-Non-Profitsannualannual Electronic Filing Requirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.