Get the free Significant accounting policies in financial statements - AccountingSignificant acco...

Show details

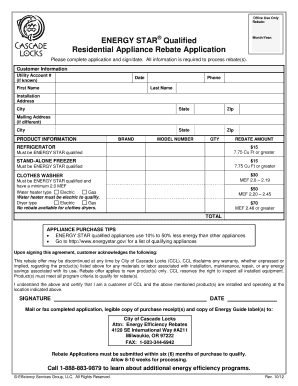

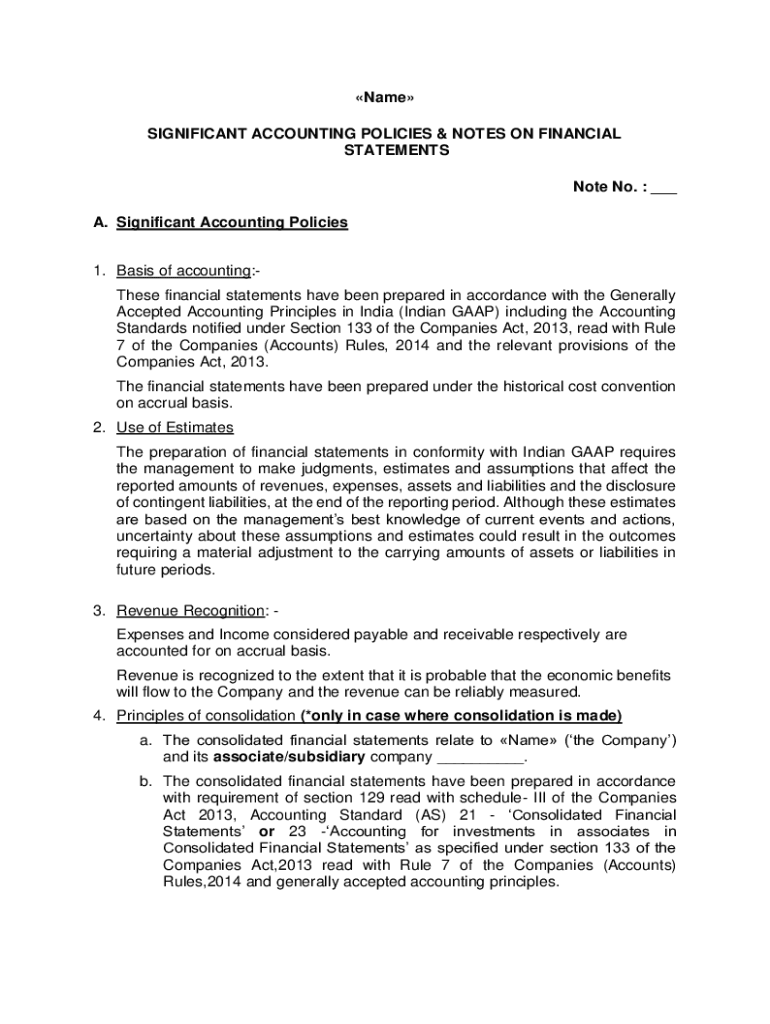

Name SIGNIFICANT ACCOUNTING POLICIES & NOTES ON FINANCIAL STATEMENTS Note No. ___ A. Significant Accounting Policies 1. Basis of accounting:These financial statements have been prepared in accordance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign significant accounting policies in

Edit your significant accounting policies in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your significant accounting policies in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit significant accounting policies in online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit significant accounting policies in. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out significant accounting policies in

How to fill out significant accounting policies in

01

To fill out significant accounting policies, follow these steps:

02

Start by reviewing your company's financial statements and any relevant accounting standards or guidelines.

03

Identify the key accounting policies that are significant to your organization, such as revenue recognition, expense classification, or inventory valuation.

04

Document the specific accounting principles, methods, and estimates used by your organization for each significant policy.

05

State the rationale for choosing these policies and any specific circumstances or considerations that guided your decision-making process.

06

Ensure that the accounting policies are consistent with industry best practices and comply with applicable accounting standards.

07

Review and update your significant accounting policies regularly to reflect changes in accounting standards or evolving business practices.

08

Communicate the significant accounting policies to internal stakeholders, such as management and staff, to ensure understanding and compliance.

09

Consider obtaining external auditing or consulting services to validate the adequacy and appropriateness of your significant accounting policies.

10

Retain documentation of your significant accounting policies in a secure and accessible manner for reference and audit purposes.

Who needs significant accounting policies in?

01

Significant accounting policies are needed by organizations that prepare financial statements.

02

This includes publicly traded companies, private companies, non-profit organizations, government entities, and any other entity that requires financial reporting.

03

The accounting policies provide a framework for recording and reporting financial information consistently and accurately.

04

They are necessary to comply with accounting standards, communicate relevant information to stakeholders, and maintain transparency and accountability.

05

Financial statement users, such as investors, creditors, regulators, and internal management, rely on the information conveyed through accounting policies to make informed decisions.

06

By having well-defined and properly documented accounting policies, organizations can enhance credibility, improve financial analysis, and facilitate comparison with other entities in the same industry.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the significant accounting policies in in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your significant accounting policies in.

How can I edit significant accounting policies in on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing significant accounting policies in.

How do I complete significant accounting policies in on an Android device?

Use the pdfFiller mobile app and complete your significant accounting policies in and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is significant accounting policies in?

Significant accounting policies are the specific accounting principles and methods used by a company to prepare its financial statements.

Who is required to file significant accounting policies in?

Publicly traded companies are required to file significant accounting policies in their financial statements.

How to fill out significant accounting policies in?

To fill out significant accounting policies, companies should disclose their policies for revenue recognition, inventory valuation, depreciation methods, etc.

What is the purpose of significant accounting policies in?

The purpose of significant accounting policies is to provide transparency and consistency in financial reporting.

What information must be reported on significant accounting policies in?

Information such as how revenue is recognized, how inventory is valued, how assets are depreciated, etc., must be reported on significant accounting policies.

Fill out your significant accounting policies in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Significant Accounting Policies In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.