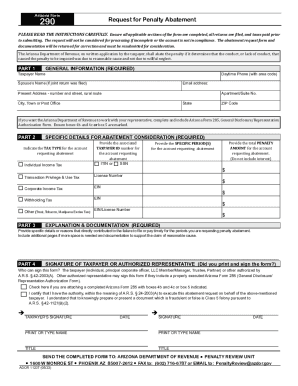

AZ ADOR 11237 (Form 290) 2021 free printable template

Get, Create, Make and Sign AZ ADOR 11237 Form 290

How to edit AZ ADOR 11237 Form 290 online

Uncompromising security for your PDF editing and eSignature needs

AZ ADOR 11237 (Form 290) Form Versions

How to fill out AZ ADOR 11237 Form 290

How to fill out AZ ADOR 11237 (Form 290)

Who needs AZ ADOR 11237 (Form 290)?

Instructions and Help about AZ ADOR 11237 Form 290

Hey everyone I Rick Scott here now what I'm going to do I'm going to put on my cycling shoes as you can tell I've actually put SPD pedals on this Preform bike and that's one of the good things about this Preform bike is that you could use if you're a mountain biker or road biker, and you have your clipless shoes you can attach the pedals and use your same shoes that you use on a real bike on the stationary bike, so it just gives it a perfect gives it a perfect feel now I know a few of you too questioned the noise the amount of noise that this makes while riding so what I'm going to do is without turning TV or anything on I'm going to ride, and I'm going to dust attention or the resistance rather, so you can hear the sound it's loud, but it's not that unbearable so here we go I'm going to clip into my pedals, and I'm going to start out with a light tension okay, so now I'm just barely pedaling, so you can hear the chain and with very low resistance I'm going to start pedaling faster, so that's about max pedal speed right there, and you can tell there's not there's very little noise pretty much all you can hear is the chain going around, so it's very quiet now let's add some resistance so say now you can start here you can start to hear the which is the friction pad against the flywheel let's make it equal is it let's add more resistance now I'm going to stand up the back the resistance all very little resistance now I'm going to add resistance off lesson rather, so I'm not going to do my entire workout on film because I do like half hour, but you can hear that's the noise I mean that's a true-life representation of the Preform 290 SIX is it too much noise for me no I can still watch my TV I can hear it sure I have to turn the volume up a little but when I consider that Dilbert a dealbreaker if I was going to purchase the Preform 290 SIX again no no I absolutely love this the stationary spin bike is very well crafted my only minor complaint is the lifespan of those friction pads if they could improve that they would have the perfect spin bike and that's not a problem though you just got to remember if you do get a 290 SIX and you want to put a lot of resistance on it be prepared to replace those friction pads periodically I mean they may last they may last a few months they may be last year depending on how hard you ride it with a lot of with a lot of resistance, so I started doing longer duration less resistance to prolong the life of my pads and then also by using less resistance it also it doesn't make as much noise and like I said noise to me is not a concern sure it does make as you just heard, but it's not a deal-breaker in my opinion feel free to subscribe to my YouTube channel if you haven't already it's YouTube.com forward slash Erik's guy and share this video with others ask me questions I welcome your feedback, and thanks again for watching you all have a good day

People Also Ask about

What is an IRS penalty abatement?

What is AZ 285?

Can I file an Arizona tax extension online?

Do I need to file a state tax extension Arizona?

What is the extended tax deadline for 2022?

What is an ad 285 request?

How do I fill out Arizona Form 285?

Is there a penalty for filing taxes late if you don't owe?

Can I electronically file a tax extension?

Is there a way to get tax penalties waived?

How do I file an extension in AZ?

How do I get tax forms in the mail?

What is a Form 290 used for?

What is the penalty for filing taxes late in Arizona?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get AZ ADOR 11237 Form 290?

How can I edit AZ ADOR 11237 Form 290 on a smartphone?

How can I fill out AZ ADOR 11237 Form 290 on an iOS device?

What is AZ ADOR 11237 (Form 290)?

Who is required to file AZ ADOR 11237 (Form 290)?

How to fill out AZ ADOR 11237 (Form 290)?

What is the purpose of AZ ADOR 11237 (Form 290)?

What information must be reported on AZ ADOR 11237 (Form 290)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.