Get the free XXXXXX XXXXXX 9499 Samuel S. Beus 0.00 0.00 0.00 2,142.18 ... - sos idaho

Show details

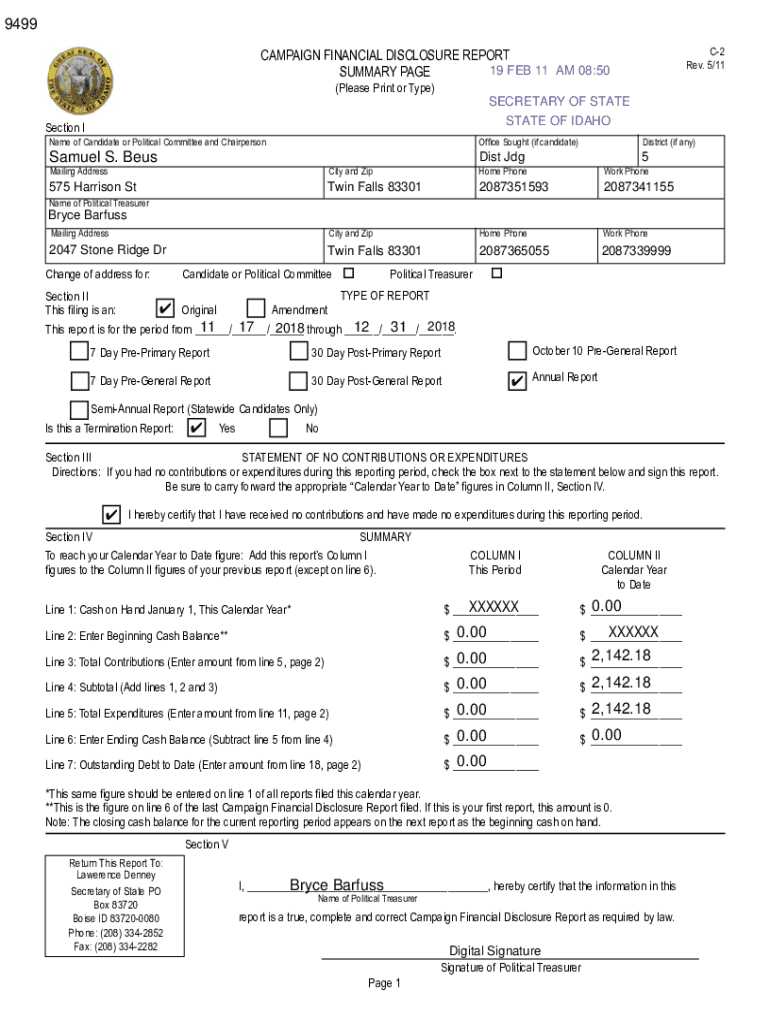

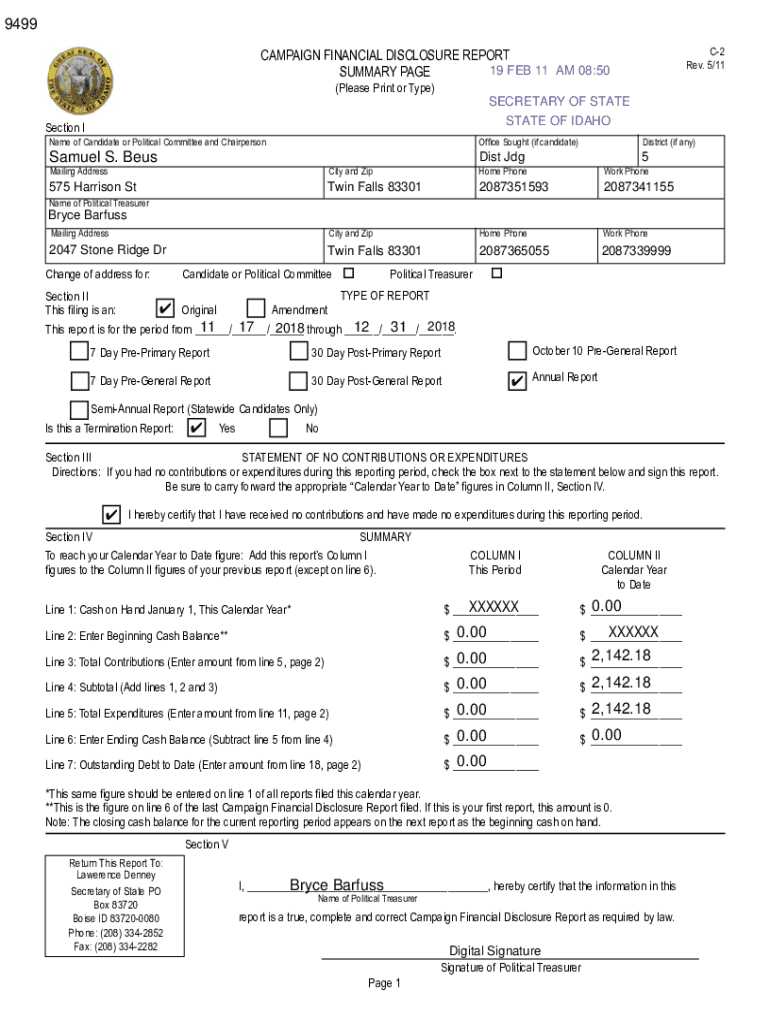

9499 C2 Rev. 5/11CAMPAIGN FINANCIAL DISCLOSURE REPORT 19 FEB 11 AM 08:50 SUMMARY PAGE (Please Print or Type) SECRETARY OF STATE OF IDAHOSection I Name of Candidate or Political Committee and ChairpersonOffice

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign xxxxxx xxxxxx 9499 samuel

Edit your xxxxxx xxxxxx 9499 samuel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your xxxxxx xxxxxx 9499 samuel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing xxxxxx xxxxxx 9499 samuel online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit xxxxxx xxxxxx 9499 samuel. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out xxxxxx xxxxxx 9499 samuel

How to fill out xxxxxx xxxxxx 9499 samuel

01

To fill out xxxxxx xxxxxx 9499 Samuel, follow these steps:

02

Start by writing your full name in the provided space labeled 'Full Name.'

03

Next, enter your address in the space labeled 'Address.' Ensure that you include the correct details such as street name, apartment number, city, state, and ZIP code.

04

In the section 'Contact Information,' provide your phone number and email address. This information is essential for communication purposes.

05

If applicable, specify any additional information requested, such as a job title or company name, in the respective fields provided.

06

Review all the information you have entered to ensure accuracy and completeness.

07

Finally, sign and date the document in the designated spaces. If required, you may need witnesses or a notary public to validate the signature.

08

Make a copy of the filled-out form for your records before submitting it as necessary.

Who needs xxxxxx xxxxxx 9499 samuel?

01

Xxxxxx xxxxxx 9499 Samuel may be needed by individuals or organizations who require personal information and contact details of Samuel for a specific purpose.

02

Some possible scenarios where someone might need Xxxxxx xxxxxx 9499 Samuel include:

03

- Employment purposes: Potential employers may request this information as part of the job application process to verify identity and contact details.

04

- Rental or lease agreements: Landlords or property managers may require this information to finalize rental contracts and maintain records of tenants.

05

- Government agencies: Xxxxxx xxxxxx 9499 Samuel may be needed by government institutions for various purposes, such as tax filings, benefit applications, or official documentation.

06

- Legal or financial transactions: Lawyers, banks, or other institutions may need this information to carry out legal or financial transactions involving Samuel.

07

It is important to note that the specific reasons for needing Xxxxxx xxxxxx 9499 Samuel can vary depending on the context and requirements of the requesting party.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my xxxxxx xxxxxx 9499 samuel directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your xxxxxx xxxxxx 9499 samuel and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit xxxxxx xxxxxx 9499 samuel from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your xxxxxx xxxxxx 9499 samuel into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete xxxxxx xxxxxx 9499 samuel online?

pdfFiller has made it easy to fill out and sign xxxxxx xxxxxx 9499 samuel. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

What is xxxxxx xxxxxx 9499 samuel?

xxxxx xxxxxx 9499 samuel is a specific tax form used for reporting certain types of income to the IRS.

Who is required to file xxxxxx xxxxxx 9499 samuel?

Individuals or entities who have received certain types of income, such as interest or dividends, are required to file xxxxxx xxxxxx 9499 samuel.

How to fill out xxxxxx xxxxxx 9499 samuel?

You can fill out xxxxxx xxxxxx 9499 samuel by providing the required information about the income you received in the specified boxes on the form.

What is the purpose of xxxxxx xxxxxx 9499 samuel?

The purpose of xxxxxx xxxxxx 9499 samuel is to report certain types of income to the IRS for tax purposes.

What information must be reported on xxxxxx xxxxxx 9499 samuel?

Information such as the type of income received, the amount of income, and the payer of the income must be reported on xxxxxx xxxxxx 9499 samuel.

Fill out your xxxxxx xxxxxx 9499 samuel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Xxxxxx Xxxxxx 9499 Samuel is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.