Get the free Helpful Hints for Switching your Account

Show details

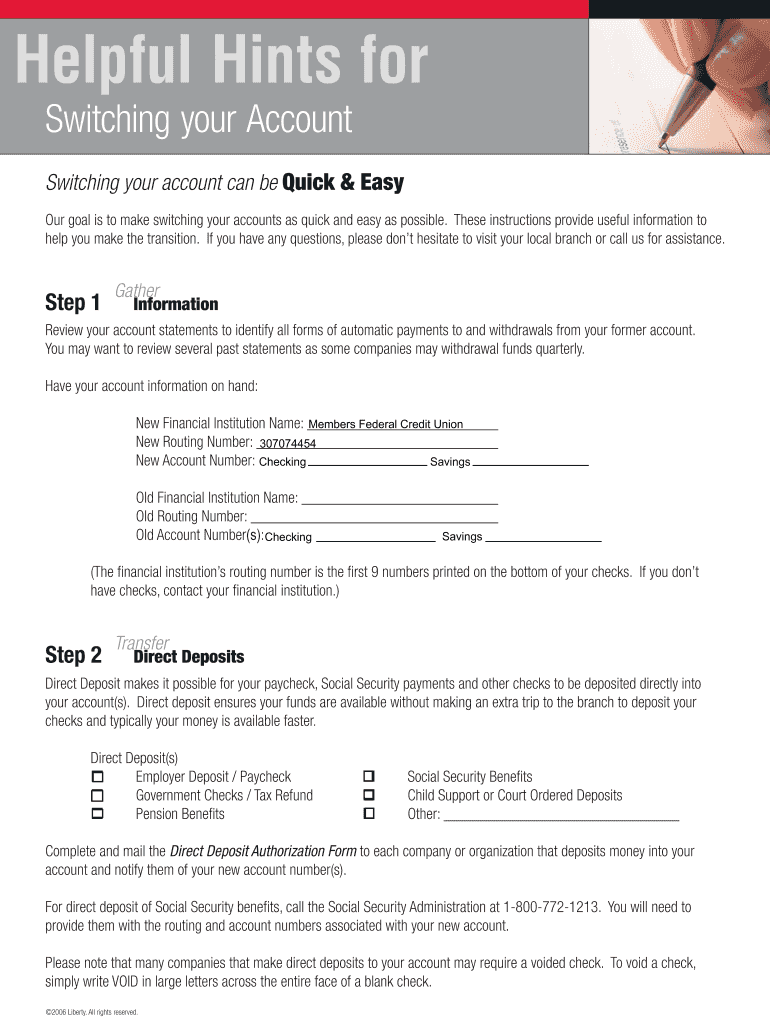

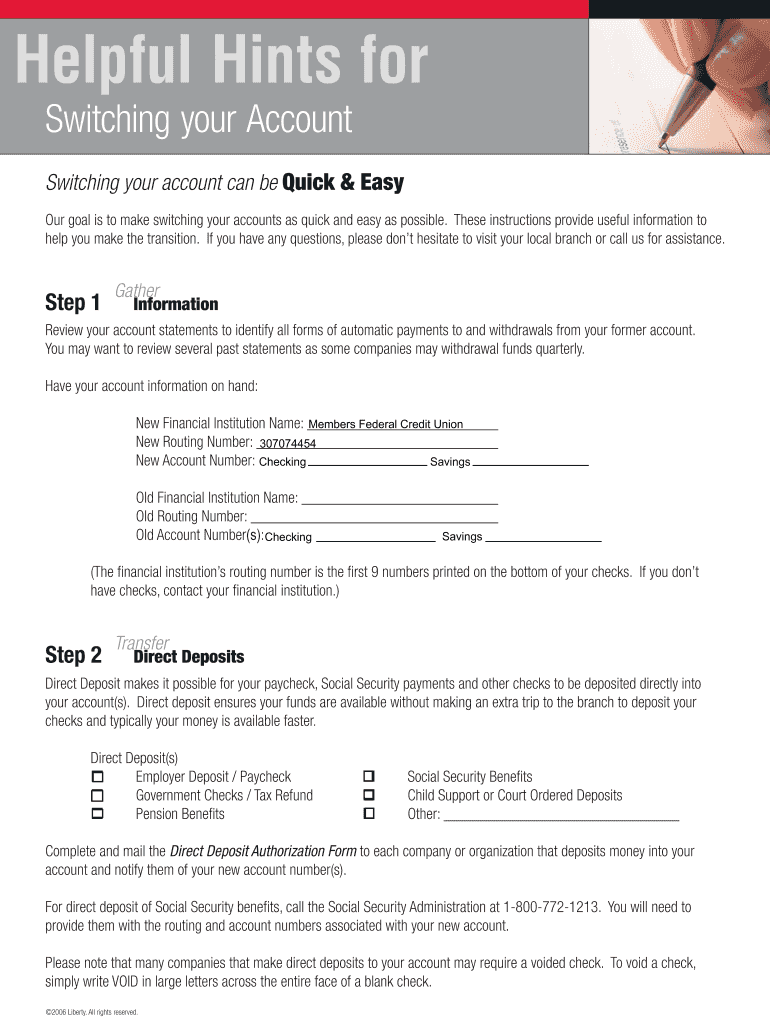

This document provides a comprehensive switch kit for individuals transitioning their automatic payments and deposits to Members Federal Credit Union. It includes checklists, forms for direct deposits,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign helpful hints for switching

Edit your helpful hints for switching form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your helpful hints for switching form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing helpful hints for switching online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit helpful hints for switching. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out helpful hints for switching

How to fill out Helpful Hints for Switching your Account

01

Gather your current account information including account number and type.

02

Visit the financial institution's website or contact customer service for the necessary forms.

03

Fill out the switching form with accurate details of your existing account.

04

Provide information on the new account type you wish to switch to.

05

Attach any requested documents, such as identification or proof of address.

06

Review all entered information for accuracy before submission.

07

Submit the completed form through the specified method (online, mail, or in-person).

08

Confirm the status of your switch with the bank and track the progress.

Who needs Helpful Hints for Switching your Account?

01

Current account holders looking to switch to a different financial institution.

02

Individuals unsatisfied with their current bank services or fees.

03

People seeking better interest rates or account benefits.

04

Customers needing to consolidate accounts or simplify their banking.

Fill

form

: Try Risk Free

People Also Ask about

What to do when switching current accounts?

Review your existing payments. Go through your payments – if there are any you no longer use or want, it makes sense to cancel them rather than switch them to your new bank account. Gather your documentation. Open your new account with your chosen bank. Choose your switch date. Start your switch. Know your rights.

Is switching accounts easy?

You can choose to close an account or change banks at any time. Switching is usually very easy, with all your payments automatically moved over for you.

What happens when you switch current accounts?

A full switch will transfer all of your details and payments from the old account to the new one within seven working days. Once that is done, your old account will then be closed.

What banks give you money for switching?

Banks that will pay you up to switch ProviderProductAccount Type First Direct 1st Account standard Halifax Reward Current Account + Reward Extras standard Halifax Reward Current Account standard Halifax Ultimate Reward Current Account added value11 more rows

What is the $3000 bonus at Chase bank?

Skip ahead to read about FDIC limits and this bonus. Offer: Get a $1,000, $2,000 or $3,000 bonus when you open or upgrade to a new Chase Private Client Open Checking℠ account and complete qualifying transfers within the specified time frame. Minimum deposit to qualify: $150,000. Expiration: 07/16/2025.

How to easily switch banks?

Switch your personal bank accounts in three simple steps. Open your account. Apply online in under five minutes or apply at a branch. Transfer recurring deposits & payments. Add money to your new account with an online transfer or at a branch. Close your old bank account. Make sure to confirm your account closure.

Which bank gives money for switching?

Banks that will pay you up to switch ProviderProductAccount Type First Direct 1st Account standard Halifax Reward Current Account + Reward Extras standard Halifax Reward Current Account standard Halifax Ultimate Reward Current Account added value11 more rows

Does switching current accounts affect your credit score?

Although it's important to limit the number of hard credit checks you have, the credit score impact for most people switching bank accounts will be negligible and short lived. However, there are some situations where you might want to reconsider whether now is the best time to switch accounts.

Is it difficult to switch bank accounts?

Opening a new bank account doesn't take much time. Generally, though, you'll want to plan for several weeks to set up new direct deposits, change automatic withdrawals and wait for any stray charges to come through your old bank accounts.

How to get $900 from Chase bank?

Currently, Chase offers $900 if you open a new total checking account (&setup direct deposit) and a saving account (maintain $15000 for 90 days).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Helpful Hints for Switching your Account?

Helpful Hints for Switching your Account provides guidelines and tips for individuals or businesses transitioning from one account to another to ensure a smooth process.

Who is required to file Helpful Hints for Switching your Account?

Individuals or businesses that are changing their bank accounts or financial institutions are typically required to file Helpful Hints for Switching your Account.

How to fill out Helpful Hints for Switching your Account?

To fill out Helpful Hints for Switching your Account, provide your current account details, the new account information, and any necessary authorization or signatures needed for the switch.

What is the purpose of Helpful Hints for Switching your Account?

The purpose of Helpful Hints for Switching your Account is to assist users in managing the transition between accounts effectively, minimizing disruptions to their financial activities.

What information must be reported on Helpful Hints for Switching your Account?

Information to be reported includes existing account details, new account information, dates for the switch, and any relevant identifiers or authorizations for processing the change.

Fill out your helpful hints for switching online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Helpful Hints For Switching is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.