Get the free CIESCO Credit Application

Show details

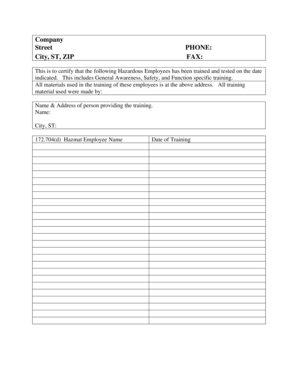

This document is a credit application and agreement for businesses seeking to establish credit with CIESCO, Inc. It includes sections for business information, ownership details, bank references,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ciesco credit application

Edit your ciesco credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ciesco credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ciesco credit application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ciesco credit application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ciesco credit application

How to fill out CIESCO Credit Application

01

Gather all necessary personal and financial documents, including proof of income, identification, and credit history.

02

Begin filling out the application form by entering your personal details, such as your name, address, and contact information.

03

Provide employment information, including your employer's name, address, and your job title.

04

List your income sources and monthly income amounts accurately.

05

Outline your existing financial obligations, such as loans, mortgages, and credit card debts.

06

Review the application for completeness and accuracy before submission.

07

Submit the application electronically or via mail as instructed by CIESCO.

Who needs CIESCO Credit Application?

01

Individuals or businesses seeking credit and financing options.

02

Those looking to purchase goods or services that require financing.

03

Applicants with varying credit histories who need support in managing their financial activities.

Fill

form

: Try Risk Free

People Also Ask about

How do I write a credit application?

However, the following are some general items that should be included. Full Contact Details. It is important that you obtain full details of your customers. Background information. Obtain as much information about the company as you can. Business and Bank References. Other information.

What does it mean if credit card application is in process?

If the status of your application is 'In-Process' that means your application is still under review and may take some more time to be dispatched. If the status is dispatched, your card has already been sent by the bank is on the way.

What is the 2/3/4 rule for credit cards?

The 2/3/4 rule: ing to this rule, applicants are limited to two new cards in a 30-day period, three new cards in a 12-month period and four new cards in a 24-month period.

What is a full credit application?

A well-defined credit application provides the basis for gathering information and implementing the company's policies. The credit application is the primary document which allows the credit professional to “Know Your Customer (KYC).” It may also serve as a contract. DISCIPLINARY. CORE IDEAS.

What is credit card ke benefits in english?

Benefits of Credit Cards Credit cards function on a deferred payment basis, which means you get to use your card now and pay for your purchases later. The money used does not go out of your account, thus not denting your bank balance every time you swipe. Credit cards offer you the chance to build up a line of credit.

How to use credit card in English?

Smart Ways To Use Your Credit Card Keep an eye on your spending. You can get caught in a debt trap if you do not pay attention to your spending. Set an ideal credit limit. Check Credit Card statements regularly. Use free offers and rewards. Pay Credit Card bills on time. Avail of easy loans. Opt for Contactless Credit Cards.

What are the steps of the credit approval process?

The 5 basic steps of the loan approval process Step 1: Gathering and Submitting Application & Required Documentations. The first step in obtaining any loan is to complete an application and submit the required documents. Step 2: Loan Underwriting. Step 3: Decision & Pre-Closing. Step 4: Closing. Step 5: Post Closing.

What is the credit application process?

A credit application can be submitted in writing either through online and offline modes or orally in person at the lender's premises. A credit application should have all requested details, without which the lender will not be able to proceed with a credit application.

How does applying for credit work?

Credit applications can be made either orally or in written form, as well as online. Whether it's submitted in person or otherwise, the application must contain all of the information the lender asks for in order to make a decision. Credit applicants also have a right to fair treatment under the law.

What is the credit process procedure?

The credit process evaluates the ability and willingness of a borrower to repay the debt, underwrites the risk, prices the loan, and determines whether the loan fits the bank's portfolio. An integral part of the credit process is analysis of the borrower's cash flows and financial statements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CIESCO Credit Application?

CIESCO Credit Application is a financial form used by individuals or businesses to apply for credit services offered by CIESCO.

Who is required to file CIESCO Credit Application?

Individuals or entities seeking to obtain credit or financing from CIESCO are required to file the CIESCO Credit Application.

How to fill out CIESCO Credit Application?

To fill out the CIESCO Credit Application, applicants should provide personal or business information, financial history, and any other required documents as specified in the application form.

What is the purpose of CIESCO Credit Application?

The purpose of the CIESCO Credit Application is to assess the creditworthiness of applicants and to determine eligibility for credit services offered by CIESCO.

What information must be reported on CIESCO Credit Application?

Applicants must report personal identification details, financial status, credit history, and any relevant business information when completing the CIESCO Credit Application.

Fill out your ciesco credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ciesco Credit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.