Get the free Internal Revenue Bulletin: 2014-23 - IRS tax forms - bllcrecords baltimorecity

Show details

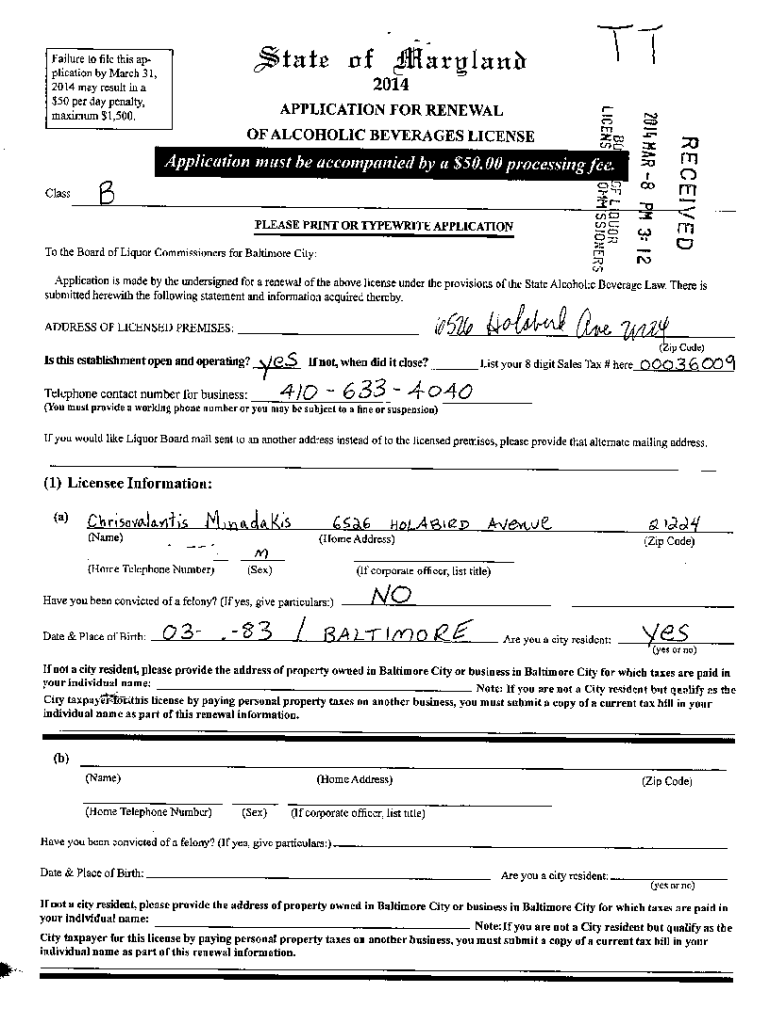

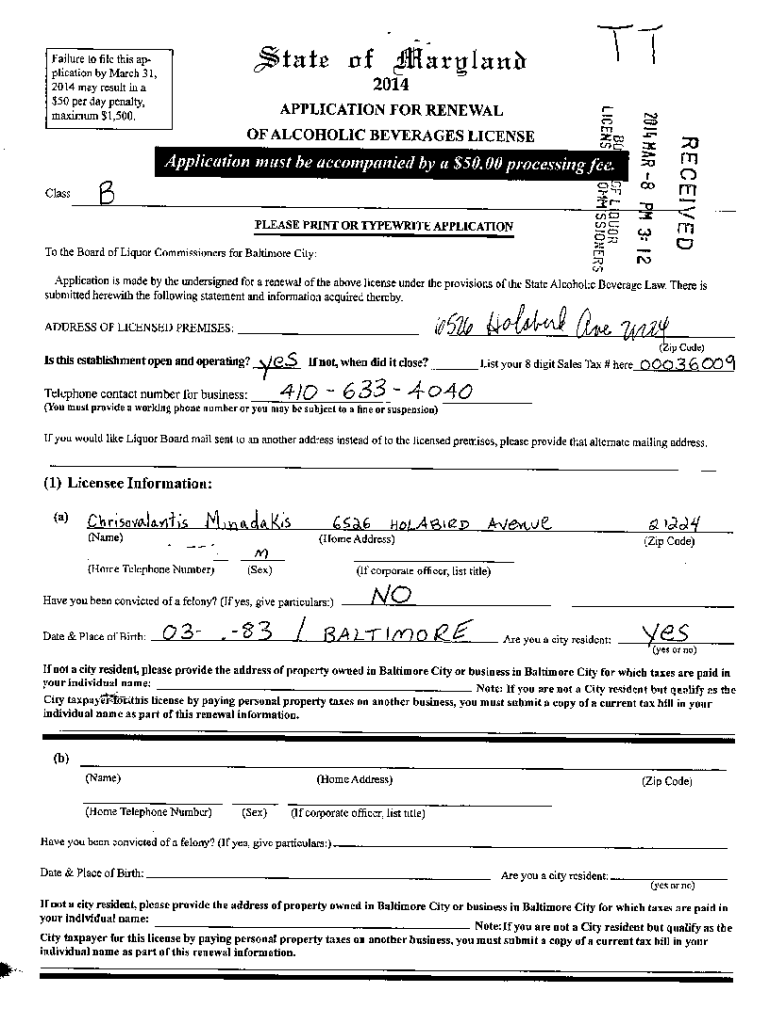

Take of 4Jllarg1anttFailuretofilethisapplication by March 31, 2014, may result in a2014×50 per day penalty, APPLICATION FOR RENEWAL maximum $1,500. COC, OF ALCOHOLIC BEVERAGES License?nhFTlwiainwtI1IcrvNlrin:nnhJIFr7IAArf×50x/I/aIJzlxlI!r4.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign internal revenue bulletin 2014-23

Edit your internal revenue bulletin 2014-23 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your internal revenue bulletin 2014-23 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit internal revenue bulletin 2014-23 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit internal revenue bulletin 2014-23. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out internal revenue bulletin 2014-23

How to fill out internal revenue bulletin 2014-23

01

Start by obtaining a copy of the Internal Revenue Bulletin 2014-23. This can be done by visiting the official website of the Internal Revenue Service (IRS).

02

Carefully read through the bulletin and familiarize yourself with its content. Pay attention to any specific instructions or guidelines that may be provided.

03

Begin filling out the bulletin by entering your personal information in the designated fields. This may include your name, social security number, and contact details.

04

Follow the instructions provided within the bulletin to report any income or deductions that may be applicable to you. Provide accurate information to ensure compliance with tax regulations.

05

Pay close attention to any additional forms or schedules that may need to be attached or referenced in the bulletin. Fill out these forms accurately and include them as required.

06

Review your completed bulletin for any errors or omissions. Make sure that all information provided is accurate and supported by relevant documentation.

07

Sign and date the bulletin as required. Failure to do so may result in processing delays or rejection of the form.

08

Keep a copy of the completed bulletin for your records. This will be useful in case of any future inquiries or audits by the IRS.

09

Submit the completed bulletin to the IRS according to the specified instructions. This may involve mailing it to a specific address or electronically filing it through the IRS website.

10

Wait for confirmation of receipt from the IRS. This typically includes a notification or acknowledgment that your bulletin has been processed successfully.

Who needs internal revenue bulletin 2014-23?

01

Internal Revenue Bulletin 2014-23 is needed by individuals, tax professionals, and businesses who are required to stay updated on the latest IRS rules, regulations, and guidance.

02

It provides important information regarding tax law changes, updated forms, deadlines, and other important updates that may affect tax filing obligations.

03

Taxpayers who have specific questions or need clarification on certain tax topics can refer to the bulletin for authoritative guidance from the IRS.

04

Additionally, tax professionals and businesses may use the bulletin to ensure compliance with current tax regulations and to stay informed about any changes that may impact their clients or operations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify internal revenue bulletin 2014-23 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your internal revenue bulletin 2014-23 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I get internal revenue bulletin 2014-23?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific internal revenue bulletin 2014-23 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out the internal revenue bulletin 2014-23 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign internal revenue bulletin 2014-23 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is internal revenue bulletin 23?

Internal Revenue Bulletin 23 is a publication issued by the IRS that provides official guidance, rulings, and procedures for taxpayers.

Who is required to file internal revenue bulletin 23?

Certain taxpayers, businesses, and organizations may be required to file internal revenue bulletin 23 if they have reportable transactions or meet specific criteria set forth by the IRS.

How to fill out internal revenue bulletin 23?

Internal revenue bulletin 23 can be filled out electronically using the IRS website or through a tax preparation software. It is important to ensure all required information is accurately reported.

What is the purpose of internal revenue bulletin 23?

The purpose of internal revenue bulletin 23 is to provide transparency and guidance to taxpayers regarding tax laws, regulations, and procedures set forth by the IRS.

What information must be reported on internal revenue bulletin 23?

Information such as income, expenses, deductions, credits, and any reportable transactions must be accurately reported on internal revenue bulletin 23.

Fill out your internal revenue bulletin 2014-23 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Internal Revenue Bulletin 2014-23 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.