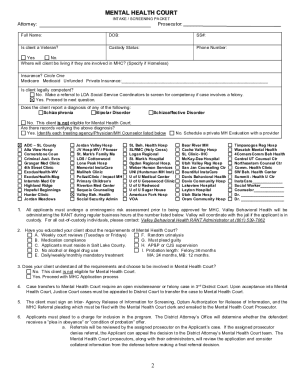

Get the free 2012-2013 Child Eligibility Cover Sheet

Show details

This document outlines the eligibility requirements and necessary submissions for enrolling a child in the 2012-2013 program. It details the required forms, proofs of residency, income documentation,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012-2013 child eligibility cover

Edit your 2012-2013 child eligibility cover form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012-2013 child eligibility cover form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012-2013 child eligibility cover online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2012-2013 child eligibility cover. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012-2013 child eligibility cover

How to fill out 2012-2013 Child Eligibility Cover Sheet

01

Obtain the 2012-2013 Child Eligibility Cover Sheet form.

02

Fill in the child's personal information at the top, including their name, date of birth, and identification number.

03

Specify the program or service for which the eligibility is being determined.

04

Complete the parent's or guardian's information, including name, address, and contact details.

05

Indicate the child's eligibility category based on the provided criteria (e.g., income, special needs).

06

Attach all necessary documentation that supports the eligibility claims, such as income verification.

07

Review the completed form for accuracy and completeness.

08

Submit the form to the designated agency or organization by the specified deadline.

Who needs 2012-2013 Child Eligibility Cover Sheet?

01

Parents or guardians applying for early childhood programs, such as Head Start.

02

Nonprofit organizations and agencies assessing child eligibility for funding or programs.

03

Childcare providers seeking to determine eligibility for specific services.

Fill

form

: Try Risk Free

People Also Ask about

How to claim $3600 child tax credit?

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040, U.S. Individual Income Tax Return, and attaching a completed Schedule 8812, Credits for Qualifying Children and Other Dependents.

Why am I only getting $2000 for child tax credit?

You can get up to $2,000 per child, but the actual amount you receive depends on your modified adjusted gross income and filing status. High earners may receive a reduced credit amount or may not qualify at all.

What is the child tax credit for 2016?

The child tax credit provides a credit of up to $2,000 per child under age 17. If the credit exceeds taxes owed, families may receive up to $1,700 per child as a refund. Other dependents—including children ages 17–18 and full-time college students ages 19–23—can be claimed for a nonrefundable credit of up to $500 each.

What is the child tax credit for 2012?

The American Taxpayer Relief Act of 2012 increased the value of the federal child tax credit to $1,000 and increased the income threshold to correspond with the earned income tax credit.

How to calculate child tax credit?

The maximum amount of the credit is equal to the number of qualifying children a taxpayer has multiplied by $2,000. If their tax liability is less than the value of their child tax credit, they may be eligible for a refundable credit calculated using the earned income formula.

What are the two child tax credits?

The Child Tax Credit (CTC) and Additional Child Tax Credit (ACTC) are credits for individuals who claim a child as a dependent if the child meets certain eligibility requirements. The CTC is a nonrefundable credit and the ACTC is a refundable credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012-2013 Child Eligibility Cover Sheet?

The 2012-2013 Child Eligibility Cover Sheet is a document used in various educational and childcare programs to provide essential information regarding the eligibility of children for specific services or benefits during that academic year.

Who is required to file 2012-2013 Child Eligibility Cover Sheet?

Providers and organizations offering services to children, such as daycare centers, preschools, and educational institutions, are required to file the 2012-2013 Child Eligibility Cover Sheet for each child enrolled in their programs.

How to fill out 2012-2013 Child Eligibility Cover Sheet?

To fill out the 2012-2013 Child Eligibility Cover Sheet, one must gather necessary information including child’s name, date of birth, family income details, enrollment status, and any relevant documentation, and then enter the information into the designated fields on the cover sheet.

What is the purpose of 2012-2013 Child Eligibility Cover Sheet?

The purpose of the 2012-2013 Child Eligibility Cover Sheet is to determine and document the eligibility of children for various programs, ensuring that the services are provided to those who meet the eligibility criteria based on the provided information.

What information must be reported on 2012-2013 Child Eligibility Cover Sheet?

The information that must be reported on the 2012-2013 Child Eligibility Cover Sheet includes the child's personal details (name, date of birth), the family's income level, household size, and any other relevant eligibility criteria as required by the program.

Fill out your 2012-2013 child eligibility cover online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012-2013 Child Eligibility Cover is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.