Get the free Independent Contractor Information Application

Show details

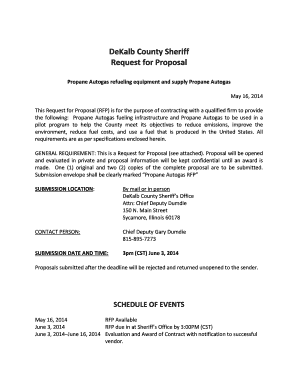

This document is an application form for independent contractors looking to work with Allied American Adjusting Company. It outlines the necessary qualifications, required paperwork, and various sections

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent contractor information application

Edit your independent contractor information application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent contractor information application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing independent contractor information application online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit independent contractor information application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out independent contractor information application

How to fill out Independent Contractor Information Application

01

Obtain the Independent Contractor Information Application form from the relevant authority or organization's website.

02

Start by filling in your personal information, including your full name, address, phone number, and email.

03

Provide your business name if applicable, along with the type of business entity (e.g., sole proprietorship, LLC, etc.).

04

Fill in the tax identification number (TIN) or Social Security number (SSN) as required.

05

Provide information about the nature of the services you will be offering as an independent contractor.

06

Include details regarding your payment preferences, such as payment methods and billing frequency.

07

Sign and date the application to confirm that all provided information is accurate.

Who needs Independent Contractor Information Application?

01

Individuals who wish to work as independent contractors in various industries.

02

Businesses that plan to hire independent contractors for specific projects or services.

03

Freelancers who need to provide their information for legal and tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is independent contractor in English?

The general rule is that an individual is an independent contractor if the person for whom the services are performed has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

How to write a job description for an independent contractor?

This should include the job title, a brief summary of the project, key responsibilities, required skills and qualifications, and any other important information. Your job description should be clear, concise, and easy to understand. Be specific about what you're looking for, and use bullet points to break up the text.

How do you describe an independent contractor on a resume?

How to list contract work on your resume List an employer. Give yourself a standard job title. Add "contractor" or "consultant" at the end of your title. List the dates of your contract (month and year is fine). Add a short blurb describing the nature of your work.

What is the job description of an independent contractor?

An independent contractor provides goods, labor or services to another individual or organization. An independent contractor is not employed by a business—instead, they work with a business as a third party.

How do I write an independent contractor agreement?

Below are eight important points to consider including in an independent contractor agreement. Define a Scope of Work. Set a Timeline for the Project. Specify Payment Terms. State Desired Results and Agree on Performance Measurement. Detail Insurance Requirements. Include a Statement of Independent Contractor Relationship.

What do you fill out as an independent contractor?

There are many types of 1099 forms, each used for reporting different kinds of income. The most common form for independent contractors is the 1099-NEC (Non-Employee Compensation). This reports payments a company makes of $600 or more to a non-employee. Employers must issue these forms to contractors or freelancers.

How do I write a self-employed job description?

You'll want to include: A job title (that clearly signals you were self-employed) A company name. The dates you started and ended each position or gig (dividing up certain freelance projects, for example) Bullet points with compelling descriptions of what you did. A well-written resume summary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

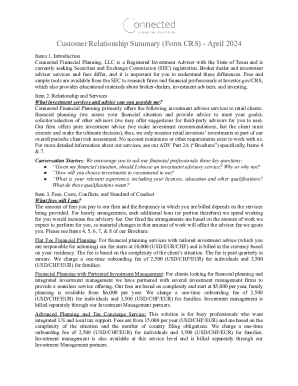

What is Independent Contractor Information Application?

The Independent Contractor Information Application is a form used to collect essential information about independent contractors to ensure compliance with tax laws and regulations.

Who is required to file Independent Contractor Information Application?

Businesses that hire independent contractors must file the Independent Contractor Information Application to report their earnings and to collect necessary tax-related information.

How to fill out Independent Contractor Information Application?

To fill out the Independent Contractor Information Application, you need to provide details such as the contractor's name, address, social security number or tax identification number, and the nature of the work performed.

What is the purpose of Independent Contractor Information Application?

The purpose of the Independent Contractor Information Application is to document and verify the contractor's identity and tax status, ensuring accurate tax reporting and compliance.

What information must be reported on Independent Contractor Information Application?

The information that must be reported on the Independent Contractor Information Application includes the contractor's personal and contact details, tax identification number, total payment amount, and the duration of the contract.

Fill out your independent contractor information application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Contractor Information Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.