KE Form D free printable template

Show details

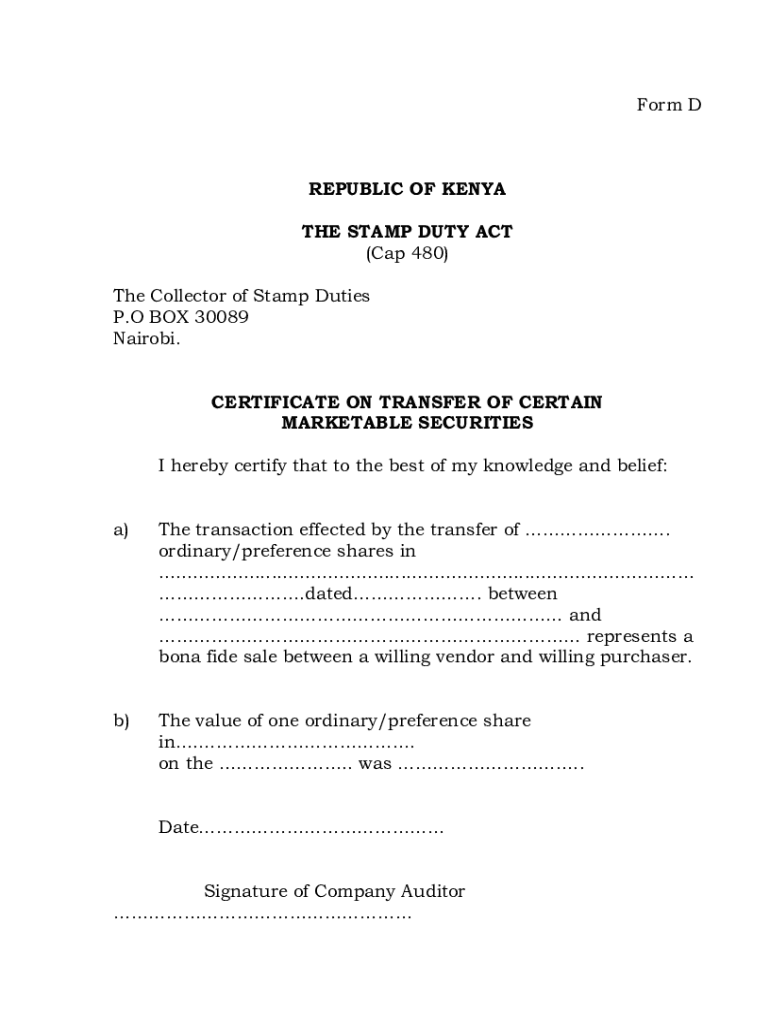

Form REPUBLIC OF KENYA

THE STAMP DUTY ACT

(Cap 480)

The Collector of Stamp Duties

P. O BOX 30089

Nairobi.

CERTIFICATE ON TRANSFER OF CERTAIN

MARKETABLE SECURITIES

I hereby certify that to the best

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign duty act cap 480 form

Edit your stamp duty transfer securities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stamp duty transfer securities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing stamp duty transfer securities online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit stamp duty transfer securities. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out stamp duty transfer securities

How to fill out KE Form D

01

Gather necessary information including your personal details, income, and deductions.

02

Obtain the KE Form D document from the relevant tax authority or download it from their official website.

03

Start filling out the form by entering your name and identification details in the designated sections.

04

Complete the income section by reporting all sources of income accurately.

05

Fill in the deductions section by listing any eligible expenses that may reduce your taxable income.

06

Review all entered information for accuracy and completeness.

07

Sign and date the form in the appropriate section.

08

Submit the completed form according to the submission guidelines provided by the tax authority.

Who needs KE Form D?

01

Individuals who are required to declare their income for tax purposes.

02

Self-employed individuals and freelancers who need to report their earnings.

03

Taxpayers who are eligible for deductions and must report them.

04

Residents and non-residents earning income within the jurisdiction that requires filing Form D.

Fill

form

: Try Risk Free

People Also Ask about

How can I get share transfer form?

How to Transfer Shares of a Private Limited Company Step 1: Obtain share transfer deed in the prescribed format. Step 2: Execute the share transfer deed duly signed by the Transferor and Transferee. Step 3: Stamp the share transfer deed as per the Indian Stamp Act and Stamp Duty Notification in force in the State.

What documents are needed for a share transfer?

Documents Required For Transfer of Shares Original Share Certificate of share to be transferred. Certificate of Stamp duty payment (Franking) on issue of share certificate. Valuation and the share transfer agreement. Share transfer form duly signed by the parties. ID and address proof of the transferor and transferee.

How to fill share transfer form sh-4?

SH-4 should be Duly stamped. Dated. Specifying the Name, Fatehr Name, Address and Occupation, if any, of the transferee & Transferor. Folio No. Distinctive No, Certificate No. of Share Transfer. Nominal Value of Shares, Consideration Received. Executed by or on behalf of the transferor and the transferee and '

How do I fill out a share transfer form?

Don't use correction fluid or stick labels on the form. 1 Consideration money. 2 Full name of Undertaking. 3 Full description of Security. 4 Number or amount of Shares, Stock or other security. 5 Name(s) and address of registered holder(s) 6 Signature(s) 7 Name(s) and address of person(s) receiving the shares.

Can I complete a tr1 form myself?

You don't have to use a solicitor or other legal adviser to complete the form and send it to us, but the help we can give you is limited. We cannot give you legal advice. If a mortgage is involved, the lender may insist you use a solicitor or licensed conveyancer.

How do I fill out a share transfer deed?

A person who gives his signature, name and address as approval for transfer must see the transferor and the transferee sign the share/debentures transfer deed in person. The relevant share/debenture certificate or allotment letter with the transfer deed must be attached and sent to the company.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute stamp duty transfer securities online?

pdfFiller makes it easy to finish and sign stamp duty transfer securities online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit stamp duty transfer securities online?

With pdfFiller, the editing process is straightforward. Open your stamp duty transfer securities in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my stamp duty transfer securities in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your stamp duty transfer securities and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is KE Form D?

KE Form D is a tax declaration form used in certain jurisdictions to report income and deductions for individuals or businesses.

Who is required to file KE Form D?

Individuals or entities that have taxable income or specific deductions that must be reported to the tax authorities are usually required to file KE Form D.

How to fill out KE Form D?

To fill out KE Form D, gather the necessary financial documents, complete the form by entering all required information accurately, and submit it to the tax authority by the specified deadline.

What is the purpose of KE Form D?

The purpose of KE Form D is to provide a standardized way for taxpayers to report their income, claim deductions, and calculate their tax liability.

What information must be reported on KE Form D?

KE Form D typically requires reporting personal identification information, sources of income, applicable deductions, and other relevant financial details necessary for tax assessment.

Fill out your stamp duty transfer securities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Stamp Duty Transfer Securities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.