Get the free W1A - revenue delaware

Show details

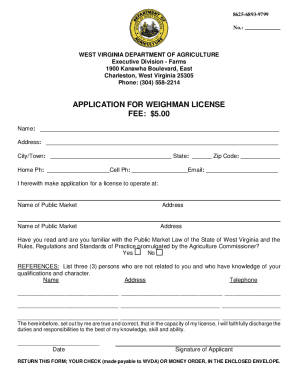

This form is used for filing the Delaware withholding tax for employers who are required to file on an eighth-monthly basis. It includes important instructions for submitting the tax withheld and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign w1a - revenue delaware

Edit your w1a - revenue delaware form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w1a - revenue delaware form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w1a - revenue delaware online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit w1a - revenue delaware. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out w1a - revenue delaware

How to fill out W1A

01

Start by obtaining a copy of the W1A form from HMRC's website or your employer.

02

Fill in your personal details at the top, including your name, address, and National Insurance number.

03

Provide the relevant information about your employment and pay, including the period for which you're reporting.

04

Indicate your pay rate and hours worked during the reporting period.

05

Check any applicable boxes regarding your tax code and benefits.

06

Review the completed form for accuracy before submission.

07

Submit the W1A form to HMRC as instructed, either electronically or via mail.

Who needs W1A?

01

The W1A form is required for those who are receiving employment income and need to report their pay and deductions to HMRC.

02

Employers using the PAYE system also need the form to report on their employees' tax and National Insurance contributions.

Fill

form

: Try Risk Free

People Also Ask about

What is the W1A theme tune?

Las Vegas (Animal Magic / W1A Theme) - Single - Album by Laurie Johnston Orchestra - Apple Music.

What is the main theme of the song?

Fawlty Towers Theme music composer Dennis Wilson Opening theme "Fawlty Towers" Ending theme "Fawlty Towers" Country of origin United Kingdom17 more rows

What is the theme song in the film?

Theme music is a musical composition which is often written specifically for radio programming, television shows, video games, or films and is usually played during the title sequence, opening credits, closing credits, and in some instances at some point during the program.

What is the theme song for the wire Season 1?

Way Down in the Hole "Way Down in the Hole" Song by Tom Waits Length 3:30 Songwriter(s) Tom Waits1 more row

What does W1A stand for?

The TV series W1A satirises the goings-on at the BBC's Broadcasting House in Portland Place, whose memorable postcode is W1A 1AA.

How realistic is W1A?

It's all bluff.” Hugh Skinner: “I loved Twenty Twelve, and part of it was that I couldn't exactly pinpoint it — it's believable, but it's at an elevated level, whereas maybe The Office is more realistic. The pace of W1A is intentionally alarming. You can see the whites of our eyes as we struggle to get the words out.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is W1A?

W1A is a tax form used in the United Kingdom for reporting annual expenses and tax obligations for employers.

Who is required to file W1A?

Employers in the UK who have employees and need to report employee tax deductions and expenses are required to file W1A.

How to fill out W1A?

To fill out W1A, employers must provide details about their business, employee information, and the total amounts of tax and National Insurance contributions owed.

What is the purpose of W1A?

The purpose of W1A is to ensure that employers accurately report and remit tax and National Insurance contributions related to employee earnings.

What information must be reported on W1A?

W1A must report information such as the employer's PAYE reference, the total number of employees, gross payments, tax deductions, and National Insurance contributions.

Fill out your w1a - revenue delaware online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

w1a - Revenue Delaware is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.