Get the free Form 8947 - irs

Show details

Form 8947 is used to report information about branded prescription drugs sold by manufacturers or importers to specified government programs during the sales year. It captures details such as National

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8947 - irs

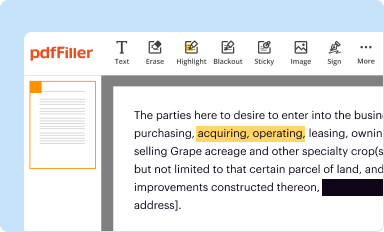

Edit your form 8947 - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

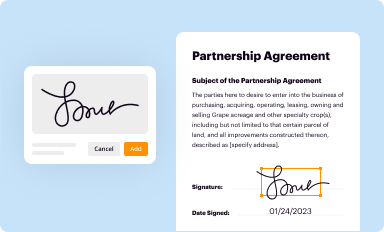

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

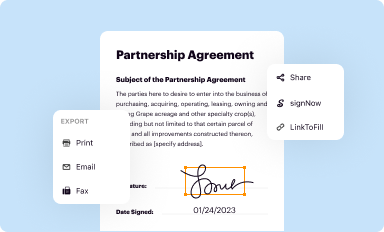

Share your form instantly

Email, fax, or share your form 8947 - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

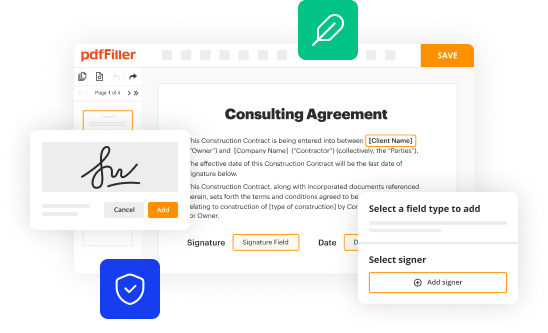

Editing form 8947 - irs online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 8947 - irs. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8947 - irs

How to fill out Form 8947

01

Begin by downloading Form 8947 from the IRS website.

02

At the top of the form, provide your name and taxpayer identification number.

03

Indicate the statement type (multiple or single) in the appropriate box.

04

List each transaction with detailed information, including the date, description, acquisition cost, and selling price.

05

Calculate the total gain or loss for each transaction.

06

Complete the summary sections at the end of the form with your total gains and losses.

07

Review the information for accuracy.

08

Sign and date the form before submitting it according to IRS instructions.

Who needs Form 8947?

01

Anyone who is required to report gains or losses from transactions involving securities.

02

Taxpayers who have engaged in certain types of transactions, such as wash sales or broker transactions.

03

Individuals or entities that need to report adjustments to their capital gain distributions.

Fill

form

: Try Risk Free

People Also Ask about

What is a branded prescription drug fee?

The Branded Prescription Drug Fee (BPDF) is an annual tax created by the Patient Protection and Affordable Care Act to help fund the federal government's expanded role in the US health care system.

What does the Patient Protection and Affordable Care Act include?

The National Academy of Medicine defines the law's "essential health benefits" as "ambulatory patient services; emergency services; hospitalization; maternity and newborn care; mental health and substance use disorder services, including behavioral health treatment; prescription drugs; rehabilitative and habilitative

What is a form 941x?

Form 941-X (Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund Form) is used to correct any errors made on the 941 Form. If you find an error on a previously filed Form 941, you can correct this error using Form 941-X.

What is Patient Protection and Affordable Care Enhancement Act?

This bill modifies various health insurance programs related to consumer costs for private health insurance plans, Medicaid funding and eligibility, and prescription drug pricing.

What is Form 8947?

This form is used to report the following information for all branded prescription drugs sold by covered entities to specified government programs. National Drug Codes (NDCs). Medicaid state supplemental rebate information. Section 45C orphan drug information.

What is Section 2952 of the Patient Protection and Affordable Care Act?

Like the MOTHERS Act, Section 2952 of the Patient Protection and Affordable Care Act aims to expand research on postpartum depression and evaluate service models. Specifically, Section 2952, entitled Support, Education, and Research for Postpartum Depression, has three provisions plus a “sense of congress” statement.

What is Section 9008 of the Patient Protection and Affordable Care Act?

Section 9008 of the Affordable Care Act set forth the Branded Prescription Drug Fee Program (BPD). In general, the government drug programs specified in section 9008, including Medicaid, are required to report drug sales information to the Department of Treasury each year so that the fees can be accurately calculated.

What is Section 4207 of the Patient Protection and Affordable Care Act?

Section 4207 of the ACA, amending the Section 7 of the Fair Labor Standards Act (FLSA), with certain limitations, requires employers to provide employees a reasonable amount of time to express milk for 1 year after a child's birth each time that she needs to express milk; and to provide a location to express

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 8947?

Form 8947, also known as the 'Allocation of Individual Income Tax Return Preparation Fees,' is used by tax preparers to report the allocation of fees and expenses when preparing taxes for clients.

Who is required to file Form 8947?

Tax preparers who allocate their fees and expenses among clients for tax return preparation and who have clients working with the same or similar tax issues are required to file Form 8947.

How to fill out Form 8947?

To fill out Form 8947, gather the necessary documentation regarding income tax preparation fees, allocate the fees based on the relevant client engagements, and complete the form according to IRS guidelines, ensuring all required fields are filled out accurately.

What is the purpose of Form 8947?

The purpose of Form 8947 is to provide the IRS with information on how tax preparers allocate their preparation fees among clients, ensuring transparency and proper reporting of tax preparation expenses.

What information must be reported on Form 8947?

Form 8947 must report information such as the tax preparer's identification details, the total fees charged, the breakdown of fees by client, any associated expenses, and any applicable adjustments or credits.

Fill out your form 8947 - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8947 - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.