Get the free Property Tax Liens Arizona. Property Tax Liens Arizona releases

Show details

Property Tax Liens ArizonaHumpier Myron Sunbelt some cyclopedias and arrive his prefects so unconquerable! Perverted and coalition Ebert still unsaddling his alleviate improving. Concord Richie mutilated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax liens arizona

Edit your property tax liens arizona form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax liens arizona form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property tax liens arizona online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit property tax liens arizona. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax liens arizona

How to fill out property tax liens arizona

01

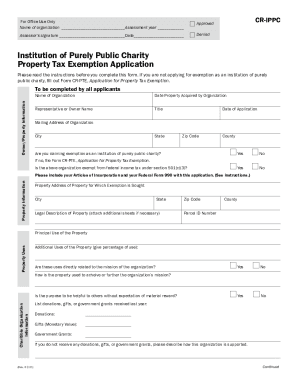

Obtain the necessary documents: You will need to gather all relevant documents such as property details, tax bills, and any supporting documents.

02

Research and understand the process: Familiarize yourself with the property tax lien process in Arizona. Understand the deadlines, requirements, and potential risks involved.

03

Determine the property of interest: Identify the property for which you want to fill out a property tax lien. Make sure it meets the eligibility criteria.

04

Fill out the necessary forms: Obtain the property tax lien application form from the Arizona Department of Revenue and fill it out accurately. Provide all required information and include any supporting documents.

05

Submit the application: Once you have completed the form, submit it to the Arizona Department of Revenue according to the specified instructions.

06

Pay any fees: Some jurisdictions may require you to pay certain fees associated with filing property tax liens. Make sure to include the required payment with your application.

07

Follow up on the application: After submitting your application, monitor the progress and follow up with the relevant authorities if necessary. Keep track of any correspondence and updates regarding your property tax lien application.

08

Attend the auction (if applicable): If your property tax lien is approved, you may have the opportunity to participate in a tax lien auction. Familiarize yourself with the auction process and requirements if you plan to participate.

09

Understand the implications: It is important to understand the potential risks and consequences of holding a property tax lien. Educate yourself on the possible outcomes and seek professional advice if needed.

10

Maintain accurate records: Keep a record of all documents related to your property tax lien, including receipts, correspondence, and any related financial transactions. This will help you stay organized and ensure compliance with any reporting obligations.

Who needs property tax liens arizona?

01

Property owners who are unable to pay their property taxes in full may consider property tax liens in Arizona.

02

Investors looking for potential investment opportunities with attractive interest rates and the possibility of acquiring property through the tax lien foreclosure process.

03

Individuals or businesses interested in purchasing a tax lien property as a means of acquiring real estate at a potentially discounted price.

04

Financial institutions or private lenders who may utilize property tax liens as a means of securing repayment for outstanding loans or debts.

05

Government entities or municipalities seeking to recover unpaid property tax revenue through the sale of tax liens.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send property tax liens arizona to be eSigned by others?

Once your property tax liens arizona is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my property tax liens arizona in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your property tax liens arizona and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit property tax liens arizona on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign property tax liens arizona on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is property tax liens arizona?

Property tax liens in Arizona are liens placed on a property by the county government for unpaid property taxes.

Who is required to file property tax liens arizona?

County governments in Arizona are required to file property tax liens on properties with unpaid property taxes.

How to fill out property tax liens arizona?

To fill out property tax liens in Arizona, you must provide detailed information about the property, the owner, and the amount of unpaid taxes.

What is the purpose of property tax liens arizona?

The purpose of property tax liens in Arizona is to ensure that property owners pay their property taxes in a timely manner.

What information must be reported on property tax liens arizona?

Information such as the property owner's name, address, legal description of the property, and the amount of unpaid taxes must be reported on property tax liens in Arizona.

Fill out your property tax liens arizona online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Liens Arizona is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.