FL Local Business Tax Account Application Form - Polk County 2021 free printable template

Show details

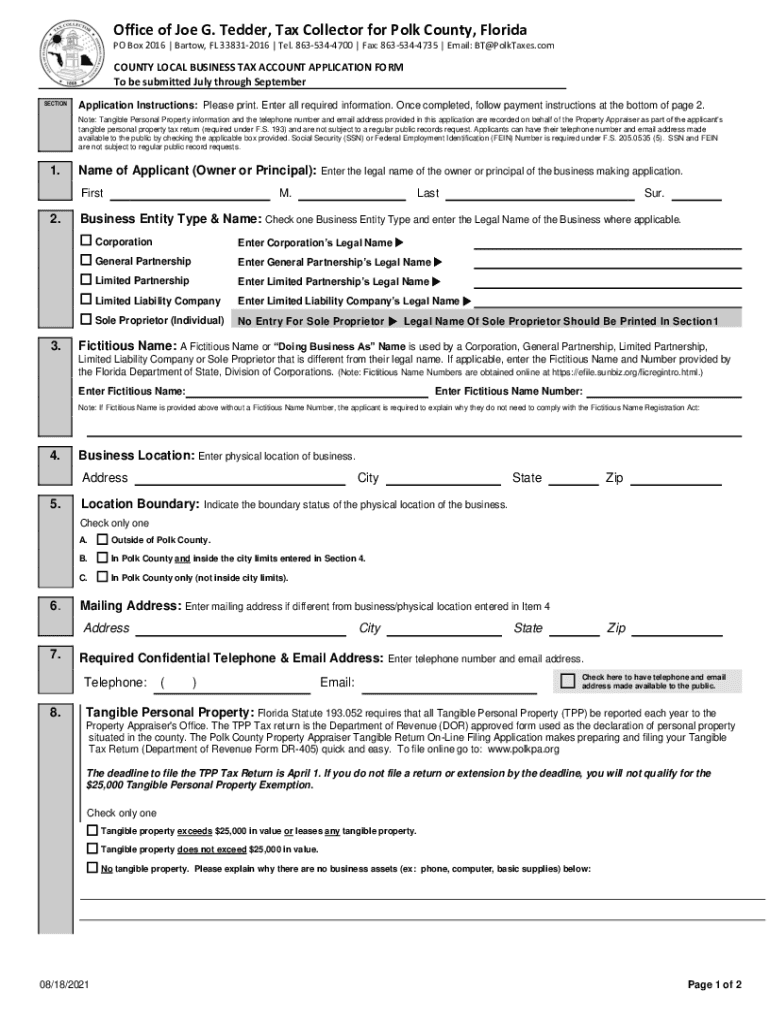

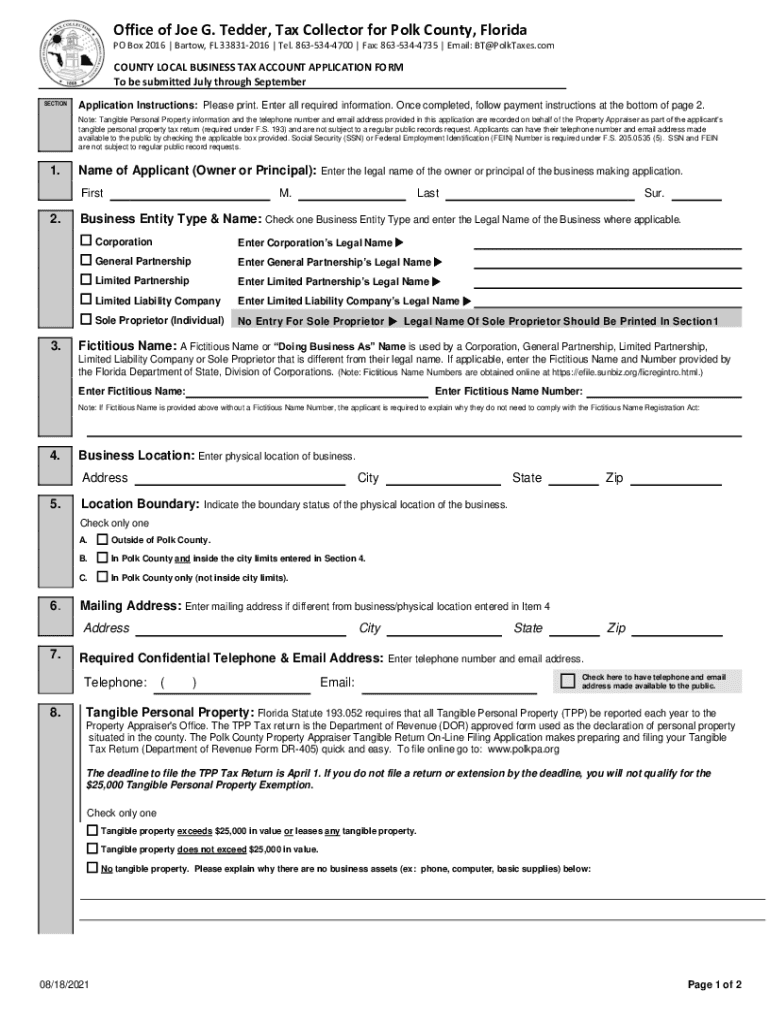

Office of Joe G. Tender, Tax Collector for Polk County, Florida PO Box 2016 | Barton, FL 338312016 | Tel. 8635344700 | Fax: 8635344735 | Email: BT×Folktales.community LOCAL BUSINESS TAX ACCOUNT APPLICATION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL Local Business Tax Account Application

Edit your FL Local Business Tax Account Application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL Local Business Tax Account Application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL Local Business Tax Account Application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FL Local Business Tax Account Application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL Local Business Tax Account Application Form - Polk County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL Local Business Tax Account Application

How to fill out FL Local Business Tax Account Application Form

01

Obtain the FL Local Business Tax Account Application Form from the local tax collector's office or their website.

02

Fill out the business information section, including the business name, address, and contact details.

03

Provide the owner's personal information, including name, address, and social security number or EIN.

04

Indicate the type of business and the nature of the services provided.

05

Specify the number of employees and the date the business commenced operations.

06

Review the local business tax rates and determine the applicable license fee.

07

Attach any required documentation, such as proof of identification or business registration.

08

Sign and date the application form.

09

Submit the completed application form along with the payment for the license fee to the local tax collector's office.

Who needs FL Local Business Tax Account Application Form?

01

Anyone planning to operate a business within a local jurisdiction in Florida needs the FL Local Business Tax Account Application Form.

02

New business owners, including sole proprietors, partnerships, and corporations, require this form to establish their business tax account.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to have a business license in Florida?

In Florida, you will need a general business license, called a business tax receipt, if you provide goods and/or services to the general public whether you are operating your new business at home or in a separate commercial location.

Are Polk County property taxes paid in advance or arrears?

The first installment is due in September, and the second installment is due the following March. Property taxes are collected on a fiscal year basis beginning July 1. The first installment is due in September, and the second installment is due the following March.

Can you run a business without a license in Florida?

Florida General Business License Some states have a general license requirement, which means all businesses operating in those states must have the license, regardless of what they do. But good news: Florida doesn't require a general license to do business in the state.

How do I pay my business taxes in Florida?

Electronically File and Pay with the Department File the Florida Corporate Short Form Income Tax Return (Form F-1120A) File Form F-7004. Pay the corporate income tax due on Forms F-1120 and F-1120A. Pay the tentative tax due on Form F-7004.

How do I get a Florida business tax receipt?

First-time applicants must use the online application system or fill out and print the Local Business Tax receipt application and submit it by mail or in person.

Is a local business tax receipt the same as a business license?

Note. Business tax receipts can sometimes work as a type of business permit, but not always. Some cities may require business licenses and business permits along with a business tax receipt in order for a business to operate.

How much is sales tax in Polk County?

The minimum combined 2023 sales tax rate for Polk County, Florida is 7%. This is the total of state and county sales tax rates. The Florida state sales tax rate is currently 6%.

How do I get a Florida business tax ID?

One of the fastest ways to get an EIN for your business is to call the Internal Revenue Service and apply by phone. Call 800-829-4933. You can call Monday through Friday, 7 a.m. to 7 p.m. If you're calling from outside of the U.S., use the non-toll-free international number: 267-941-1099.

Do I need a business license in Polk County?

In Polk County, most businesses must obtain a business license and report their gross receipts to the Department of Revenue on a yearly basis. After the first 30 days of operation, a new business has an additional 30 days to obtain a license. The fee for a business license is $15.00.

How much does my business have to make to file taxes?

Generally, you must pay SE tax and file Schedule SE (Form 1040 or 1040-SR) if either of the following applies. If your net earnings from self-employment were $400 or more.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my FL Local Business Tax Account Application directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your FL Local Business Tax Account Application and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I fill out FL Local Business Tax Account Application using my mobile device?

Use the pdfFiller mobile app to fill out and sign FL Local Business Tax Account Application on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit FL Local Business Tax Account Application on an Android device?

The pdfFiller app for Android allows you to edit PDF files like FL Local Business Tax Account Application. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is FL Local Business Tax Account Application Form?

The FL Local Business Tax Account Application Form is a document used by businesses in Florida to apply for a local business tax account, which is necessary for operating a business in a specific county or municipality.

Who is required to file FL Local Business Tax Account Application Form?

Any business operating in Florida, including sole proprietorships, partnerships, and corporations, is required to file the FL Local Business Tax Account Application Form to legally conduct business activities.

How to fill out FL Local Business Tax Account Application Form?

To fill out the FL Local Business Tax Account Application Form, applicants must provide information such as business name, owner details, business location, type of business, and any relevant identification numbers. It is important to follow the specific instructions outlined on the form.

What is the purpose of FL Local Business Tax Account Application Form?

The purpose of the FL Local Business Tax Account Application Form is to ensure that all businesses operating within a local jurisdiction comply with local tax regulations and are officially registered to collect local business taxes.

What information must be reported on FL Local Business Tax Account Application Form?

The information required on the FL Local Business Tax Account Application Form typically includes the business name, owner(s) information, business address, contact information, type of business activities, and any applicable state or federal identification numbers.

Fill out your FL Local Business Tax Account Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL Local Business Tax Account Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.