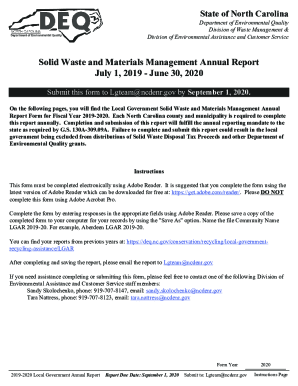

FL Claim to Receive Surplus Proceeds of a Tax Deed Sale 2014-2025 free printable template

Show details

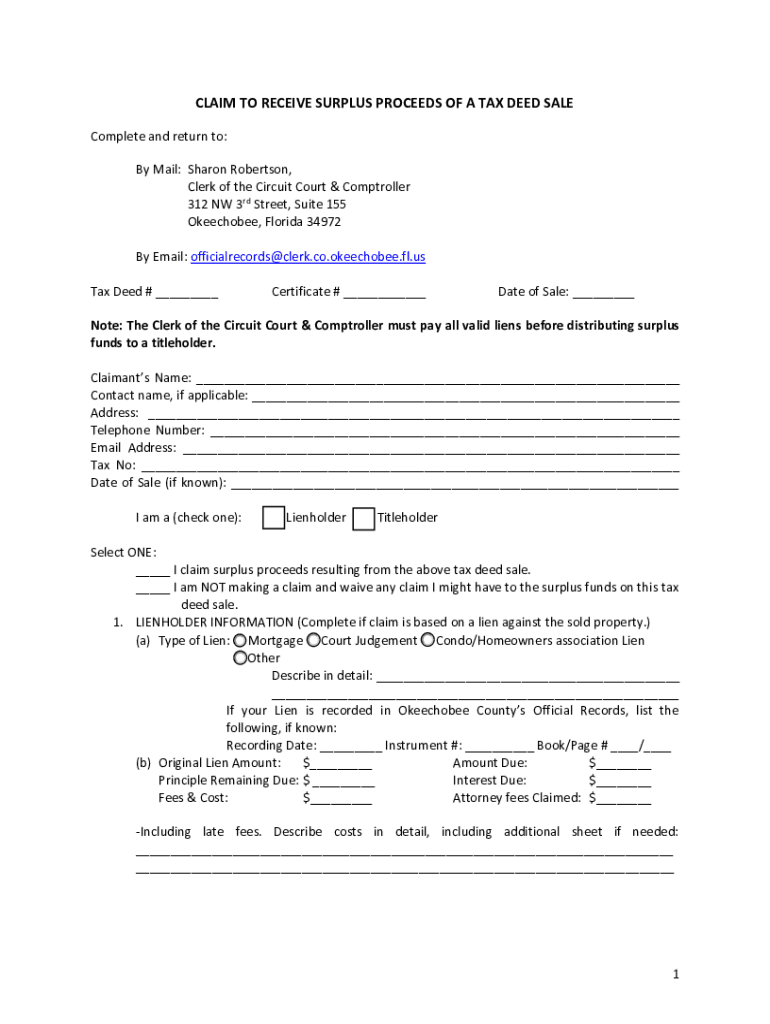

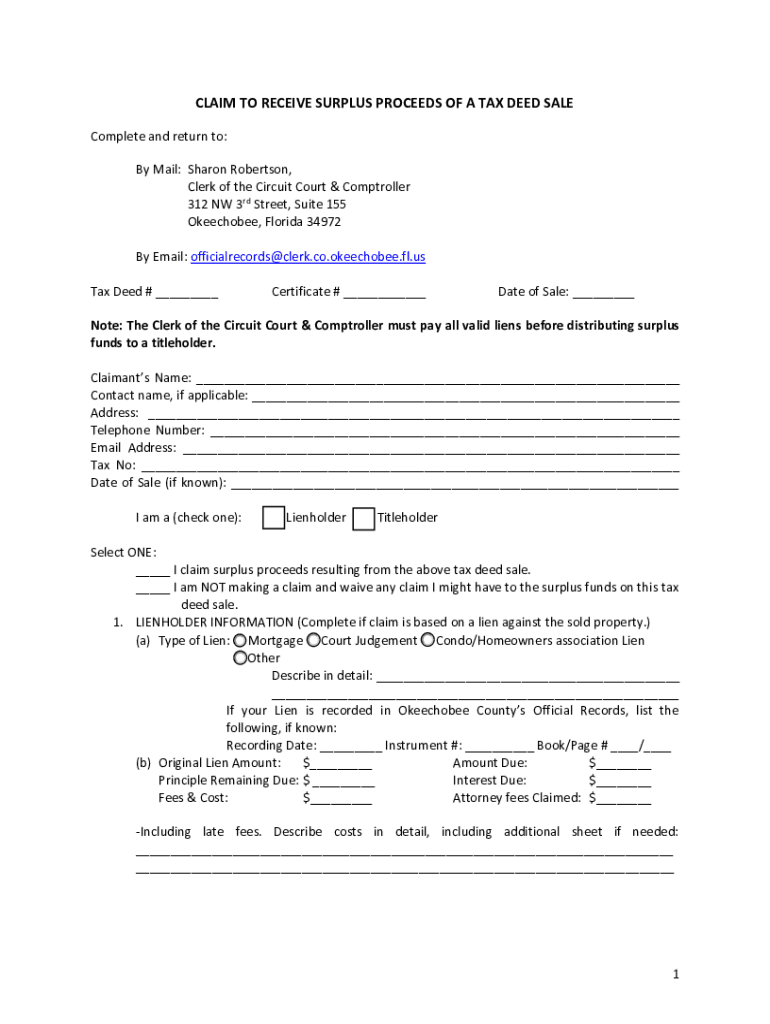

CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED SALE Complete and return to: By Mail: Sharon Robertson, Clerk of the Circuit Court & Comptroller 312 NW 3rd Street, Suite 155 Okeechobee, Florida 34972

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL Claim to Receive Surplus Proceeds of a Tax

Edit your FL Claim to Receive Surplus Proceeds of a Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL Claim to Receive Surplus Proceeds of a Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL Claim to Receive Surplus Proceeds of a Tax online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit FL Claim to Receive Surplus Proceeds of a Tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out FL Claim to Receive Surplus Proceeds of a Tax

How to fill out FL Claim to Receive Surplus Proceeds of a Tax Deed

01

Obtain the FL Claim to Receive Surplus Proceeds of a Tax Deed form from the local tax collector's office or online.

02

Fill out the claimant's name, address, and contact information accurately.

03

Provide details about the property, including the address, tax deed number, and the amount of surplus proceeds sought.

04

Include any supporting documentation that verifies your claim to the proceeds, such as proof of ownership or a valid identification.

05

Sign and date the form to confirm its accuracy and completeness.

06

Submit the completed form and any required documentation to the appropriate local authority, typically the tax collector's office, either in person or by mail.

07

Keep a copy of everything submitted for your records.

Who needs FL Claim to Receive Surplus Proceeds of a Tax Deed?

01

Individuals or entities that have ownership rights to the property which has been sold at a tax deed sale.

02

Previous property owners who may be entitled to receive surplus proceeds from the sale.

03

Heirs or beneficiaries of a deceased property owner who wish to claim the surplus funds.

04

Any interested parties who believe they have a legal right to the surplus proceeds from a tax deed sale.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send FL Claim to Receive Surplus Proceeds of a Tax for eSignature?

When your FL Claim to Receive Surplus Proceeds of a Tax is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I edit FL Claim to Receive Surplus Proceeds of a Tax on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing FL Claim to Receive Surplus Proceeds of a Tax.

How do I fill out the FL Claim to Receive Surplus Proceeds of a Tax form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign FL Claim to Receive Surplus Proceeds of a Tax and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is FL Claim to Receive Surplus Proceeds of a Tax Deed?

The FL Claim to Receive Surplus Proceeds of a Tax Deed is a legal form used to request surplus funds generated from the sale of a property following a tax deed sale. When a property is sold at auction due to unpaid taxes, any proceeds exceeding the tax debt may be claimed by the former property owner or other entitled parties.

Who is required to file FL Claim to Receive Surplus Proceeds of a Tax Deed?

Individuals or entities that have a legal interest in the property, such as the former property owner or lienholders, are required to file the FL Claim to Receive Surplus Proceeds of a Tax Deed.

How to fill out FL Claim to Receive Surplus Proceeds of a Tax Deed?

To fill out the FL Claim to Receive Surplus Proceeds of a Tax Deed, you need to complete the designated sections of the form, providing details such as the property identification information, claimant's personal information, and the amount of surplus funds being claimed. Ensure all required signatures and dates are included.

What is the purpose of FL Claim to Receive Surplus Proceeds of a Tax Deed?

The purpose of the FL Claim to Receive Surplus Proceeds of a Tax Deed is to allow eligible claimants to formally request and obtain any surplus money generated from the sale of their property after tax debts have been settled.

What information must be reported on FL Claim to Receive Surplus Proceeds of a Tax Deed?

The information that must be reported on the FL Claim to Receive Surplus Proceeds of a Tax Deed includes the claimant's name and contact information, the property address, details of the tax deed sale, and documentation supporting the claim for surplus proceeds.

Fill out your FL Claim to Receive Surplus Proceeds of a Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL Claim To Receive Surplus Proceeds Of A Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.